Bank of Japan boxed in as wagers rise on end to curve control

Bloomberg Market Specialists Yasumasa Nakagomi, Ken Yamaji and Shio Kinoshita contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

Japanese government bonds are becoming an outlier this year in a global market that has seen yields fall on hopes for monetary easing. Japan’s new benchmark 10-year government note traded at the BOJ’s new 0.5% ceiling, and Tokyo’s inflation hit 4% for the first time. This led governor Haruhiko Kuroda and his board’s decision to widen the bank’s 10-year yield target band in December 2022, describing the move as a way of improving market function.

<span style="font-size: 29px; line-height:25px!important;">In today's fast-paced and digitized economies, successful Treasury teams are accessing accurate real-time data and automating accounting processes so that they can perform at peak efficiency.</span>

Subscribe to corporate treasury newsletter to learn more

The issue

The Bank of Japan’s yield-curve control policy is under a renewed challenge that may mean 2023’s yen bond losses have further to run. Leveraged investors returned to a popular trade, going short on underlying cash JGBs and long futures as 10-year yields are lower than future expectations. The BOJ may end its negative rate policy this quarter and the benchmark yield could trade around 0.75% in a year, swaps and forwards signal.

Tracking

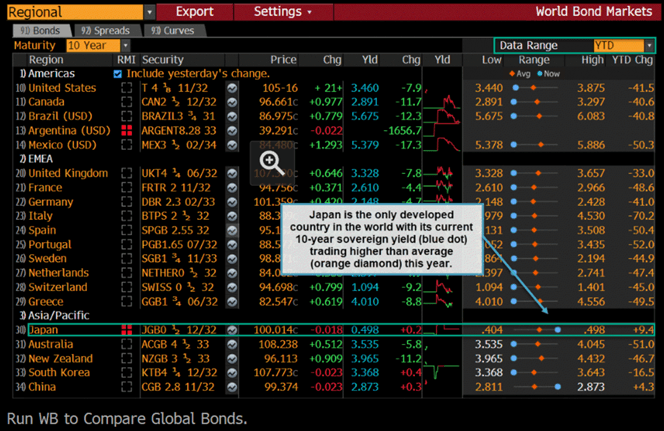

To compare Japanese sovereign debt with global peers, run WB <GO>. Japan is the only developed country in the world with its current 10-year sovereign yield (blue dot) trading higher than average (orange diamond) this year.

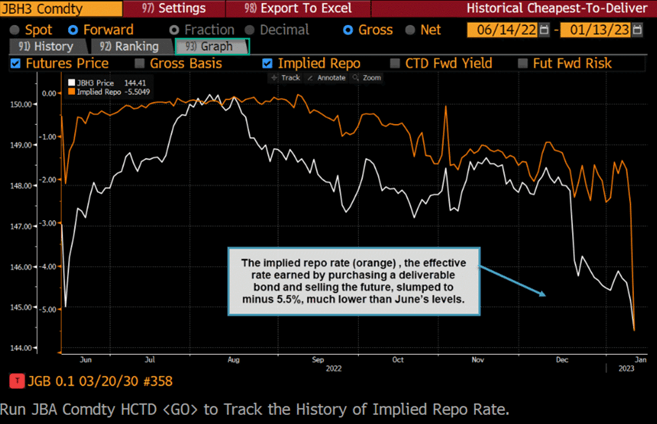

To track the history of implied repo rate, run JBA Comdty HCTD <GO>. On home turf, the so-called short basis trade, which blew up in mid June after the BOJ’s historic intervention, returned.