This analysis is by Bloomberg Intelligence Senior Industry Analyst Anurag Rana and Bloomberg Intelligence Associate Analyst Andrew Girard. It appeared first on the Bloomberg Terminal.

Enterprise resource planning (ERP) may be the next big growth driver in the Software-as-a-Service (SaaS) market, as corporations upgrade finance applications after years of ignoring this key functional area. We expect enterprises to choose a mix of public- and private-cloud products, unlike some of the other markets, where public cloud would be the dominant delivery model.

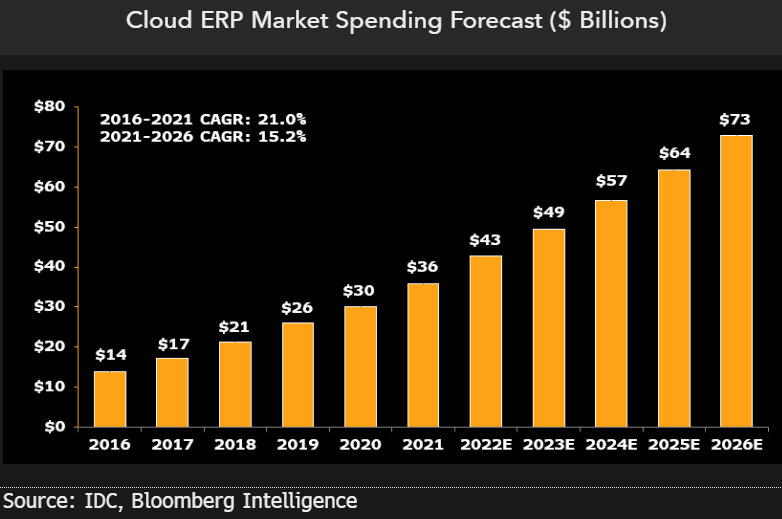

Market Could Reach $73 Billion by 2026

The public-cloud ERP market, which includes areas such as finance, planning, procurement and asset-management applications, could reach $73 billion by 2026 from $36 billion in 2021, or annual growth of 15%, based on IDC data. ERP has trailed other application-software areas in its cloud migration, with 48% still on-premise. These applications, which help clients manage finances and day-to-day business processes, are prime for a shift to the cloud as large corporations seek more insight into their operations and look to improve scalability.

We expect spending on larger-scale back-office projects for finance-related ERP products to moderate modestly with elevated macroeconomic uncertainty, but lead the recovery toward the end of 2023, driven by a modest rebound in IT spending that fuels more deal activity.

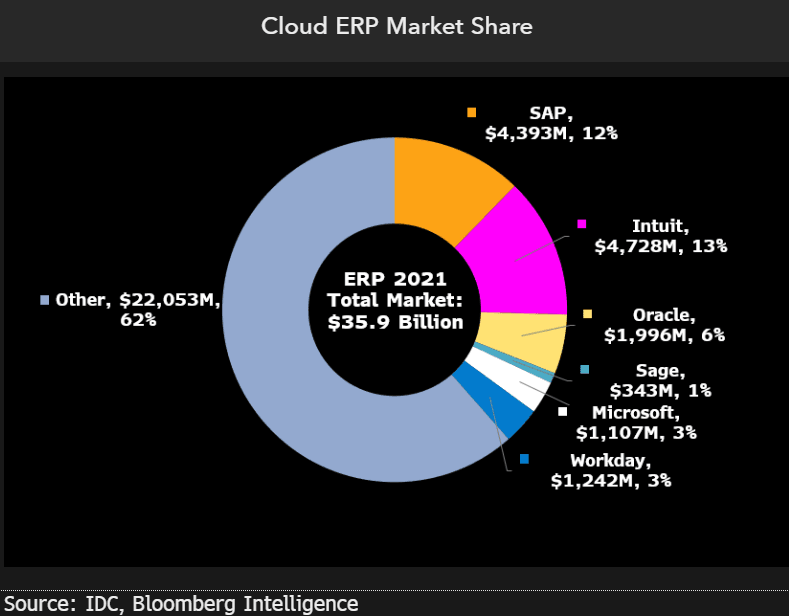

Workday, Oracle can take share on cloud shift

Despite Intuit’s lead in the cloud ERP market with a 13% share, we believe Workday and Oracle are better positioned to make gains over the next few years as cloud adoption rises. Workday, with a 3% share, could be the key beneficiary of an increase in spending, given its wide portfolio of ERP products, boosted by acquisitions of ScoutRFP in 2019 and Adaptive Insights (2018). Workday’s leadership in cloud HR apps and largely unpenetrated customer base may also aid its ERP efforts as clients seek to standardize back-office processes. Upselling existing users alone could add $10 billion in sales, 6x the opportunity above their core products.

Oracle’s application unit may also benefit from higher ERP spending, fueled by its positioning in the small-to-midsize segment, strengthened by its acquisition of NetSuite in 2016.

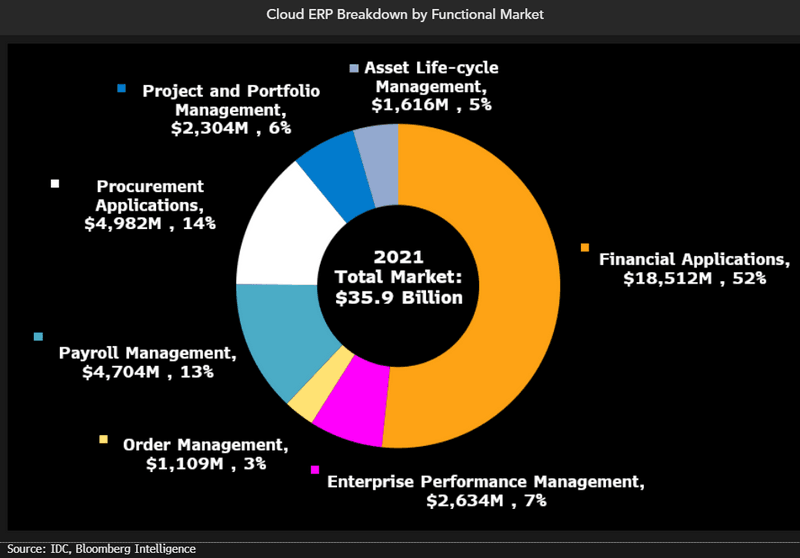

Financial dominates cloud ERP at 52% of spending

Financial applications, which include accounting, point-of-sale and billing software, represent the largest portion of the cloud ERP market at 52%. This part of the market is expected to reach $38 billion by 2026 from $19 billion in 2021, or annual growth of 15%, based on IDC data. Higher spending on finance products could be a key driver for the broader cloud ERP market over the medium term, where overall cloud penetration is only 52%, though this segment may be more exposed to economic slowdown. Intuit leads due to its accounting product, QuickBooks, which has seen firm adoption by small and midsize businesses.

SAP and Oracle are right behind, especially as they lead the second-largest segment, procurement. Other areas include management of assets, performance, payroll, orders and projects and portfolios.

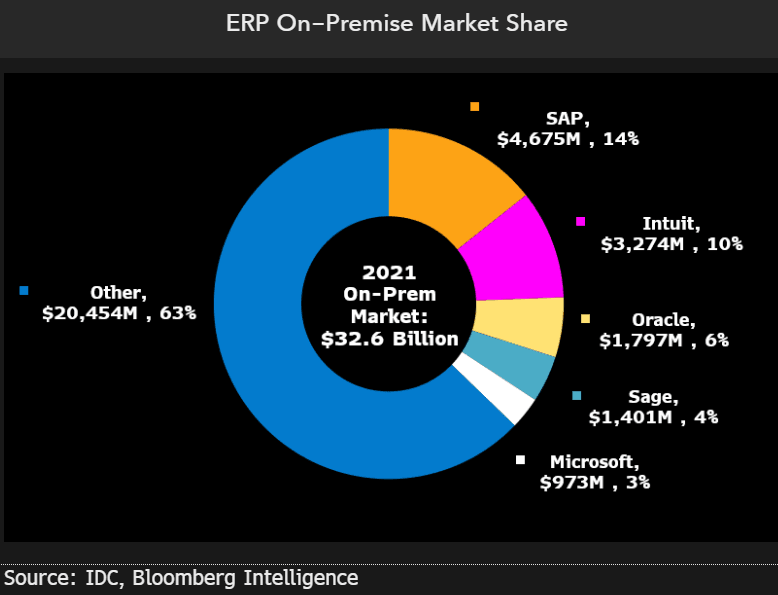

SAP leads on-premise ERP market with 14% share

SAP dominates the on-premise ERP market with a 14% share and has seen steady revenue expansion over the past couple of years, driven in part by clients upgrading to the latest S/4HANA suite. Larger customers still favor either a private- or hybrid-cloud model, which bodes well for SAP’s market position, given that its public-cloud offering is relatively new. However, SAP could gain share in the cloud portion of the ERP market as S/4HANA in public cloud in addition to its cloud migration solution, RISE with SAP, matures, helping the company fight off rising competition from SaaS peers.