This analysis is by Bloomberg Intelligence Senior Industry Analyst Kevin Tynan and Bloomberg Intelligence Senior Associate Analyst Andreas Krohn. It appeared first on the Bloomberg Terminal.

Catalysts for electric-vehicle makers to retrace $800 billion in market cap losses are in short supply, just as Tesla, Rivian and Lucid face economic challenges and rising materials costs for the first time in their short histories. This widens the opening for disruption by Ford and GM, which have the experience and flexibility to ride out down cycles, and the profitability to fund a measured drive to bring EVs to mass market.

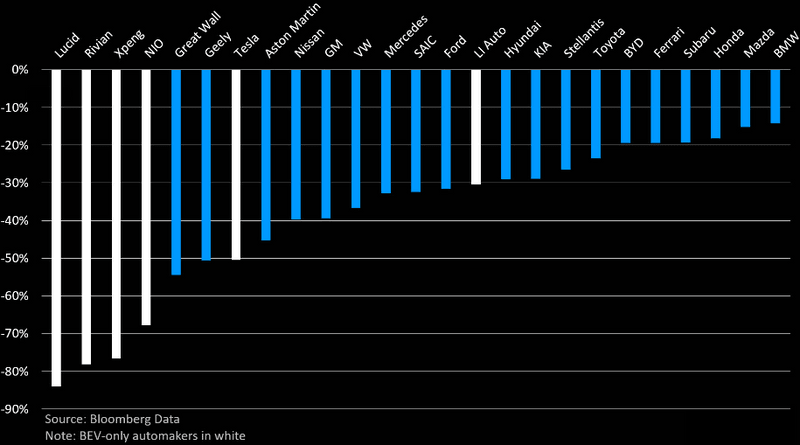

Pure-play EV builders carrying market cap hit in 2023

Market and economic conditions warrant an overdue look the financials, fundamentals and evolving competitive landscape for EVs. Pure-play EV builders — with US-based Tesla, Rivian and Lucid high on the list — are encountering tentative consumers and rising costs that will mute sales and profit in the coming year, delaying any market cap recovery until volume growth gets the tailwind of falling battery prices when new supply comes online after 2024. Legacy competitors are able to leverage their truck-heavy portfolios as well as their experience navigating the confluence of demand-eliminating economic factors to remain profitable while perpetuating their circumspect EV market share grab.

Five major pure plays have lost $800 billion, with the rest of the industry — 33 companies — down a collective $438 drop.

Market cap % change since November 2021

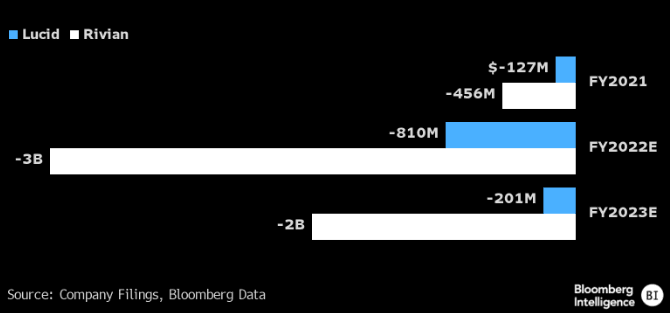

Lucid’s and Rivian’s road to gross profit stretches past 2024

Rising materials costs are catching Lucid and Rivian in ramp-up mode, lacking production and distribution scale, while running a loss at the gross profit line through at least 2023, with Ebitda losses through 2025. An important disadvantage of being a niche, premium priced, single drivetrain company is that product, technology and price flexibility is lacking during periods of soft demand. Ford is expected to earn $8.7 billion in pretax profit in 2023 with EV revenue at 4% of the US total, and GM $10.1 billion before tax with EVs accounting for 1% of US retail revenue.

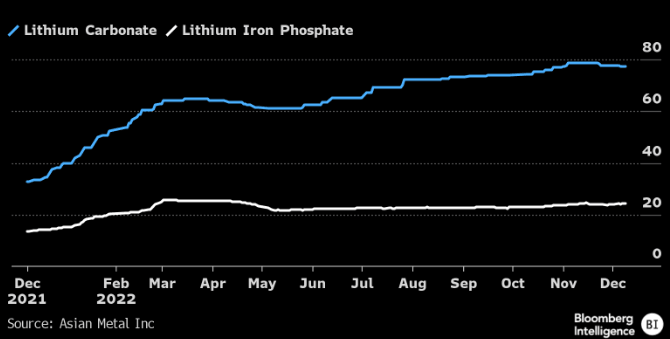

Lithium-ion battery costs increased 7% in 2022, according to Bloomberg NEF, and another jump is expected in 2023. This delays cost parity with internal combustion by two years to 2026, intensifying the challenge for Rivian and Lucid to become profitable.

Gross profit 2021-2023E

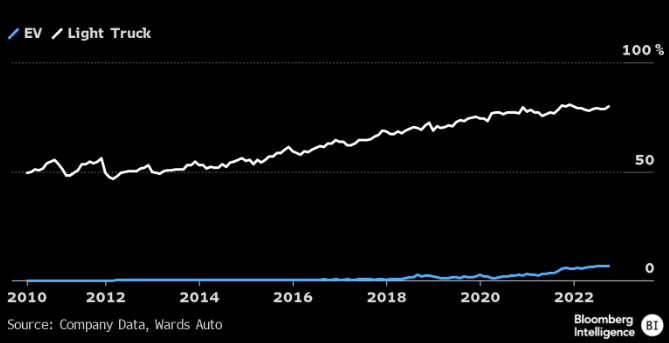

Legacy automakers shift to truck profits as EVs stew

Pickup and SUV adoption have pushed transaction prices up 11% for Ford in 2022 and 6% for GM, with all of Ford’s EV sales above the company’s US average price, while only 4% of GM’s EVs topped $50,000. Ford’s full-year EV volume pace of 52,000 units is 70% ahead of GM. Ford has disclosed that rising raw materials costs have absorbed all the Mustang Mach-E margin — at an average of $60,000 — a hint that supply will be slowed until profit dynamics improve.

South Korea’s Hyundai-Kia appears to have the biggest US retail revenue growth opportunity of 27% in 2023 vs. 2021 if it can maintain its market share, with $3 billion of the growth from EV sales and $9 billion from more and higher priced internal combustion light-truck volume. The automaker’s average price is up 13% by raising its SUV mix by 6 percentage points to 66%.

Light truck mix shift steeper than BEVs

Battery costs extend timeline for EV profit parity

A surge in lithium-ion battery prices in 2022 — the first rise ever — changes the comparative profit dynamics of EVs for both pure-play and legacy automakers. Lithium carbonate costs are 135% higher, while lithium iron phospate prices have risen 94% in the past year. For US EV-only companies Lucid and Rivian, the rising input costs delay profitability by years, not quarters. With battery-only vehicle penetration at less than 6% of the US market 10 years after Tesla began mass producing Model S, delayed profitability removes the motivation for legacy automakers to rush production to market and advance the EV narrative.

Plodding EV adoption is a small concern for Ford and GM, which will manage the interim period by selling high-margin full-size pickup trucks, which represent about 40% of their US retail revenue.

EV battery raw materials costs