Asia technology hardware & semis: 2023 outlook in six charts

This analysis is by Bloomberg Intelligence Senior Industry Analyst Steven Tseng and Bloomberg Intelligence Industry Analyst Charles Shum. It appeared first on the Bloomberg Terminal.

A shifting supply chain will be the overarching theme for the global technology industry in 2023 and bring a lot uncertainties to the profit margin and capex of electronics manufacturers, from TSMC to Hon Hai. We’ve set out six key charts and data-sets that we believe best outline the key drivers and unknowns for the sector next year.

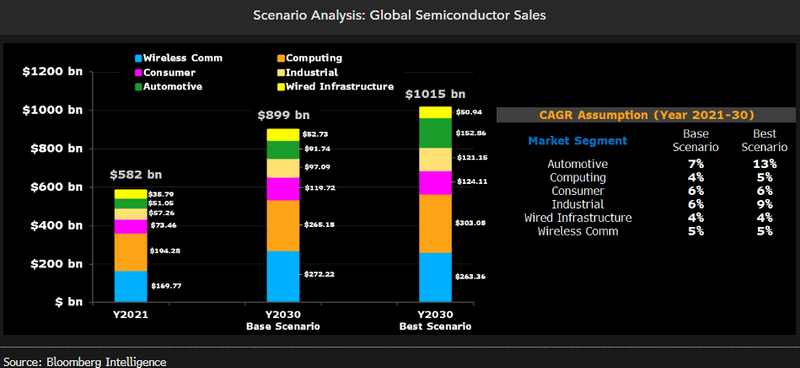

Auto, industrial chips to drive IC sales growth this decade

Semiconductor sales growth in the coming decade will be driven by new markets created by vehicle electrification, industrial automation and smart home applications, while sales for PCs and smartphones will likely stagnate as their markets mature. Our scenario analysis suggests that global semiconductor demand may grow to about $900 billion to $1.65 trillion in 2030, led by a 7-13% compound average growth rate for automotive chips and 6-9% for industrial chips.

The average semiconductor content in each vehicle may double to more than $1,440 in 2023, from $665 in 2021, according to Gartner.

A challenging plan for advanced chip diversity

Hurdles to moving manufacturing capacity of advanced chips outside of Asia include high requirements for utility infrastructure, slow deliveries of extreme ultraviolet lithography systems and the lack of local supply-chain support from photomasks and wafer materials to experienced engineers. The mismatch of downstream market demand is also a key issue. PCs and handsets, the two largest end-markets for chips, are still largely produced in China and Southeast Asia.

Instead of governments, Apple and other chipmakers that don’t have their own foundries may have to consider offering more incentives to push faster expansion outside Asia. In addition to direct financial subsidies and partial shareholdings, multiple-year supply agreements can also be good measures for fabless chipmakers to consider.

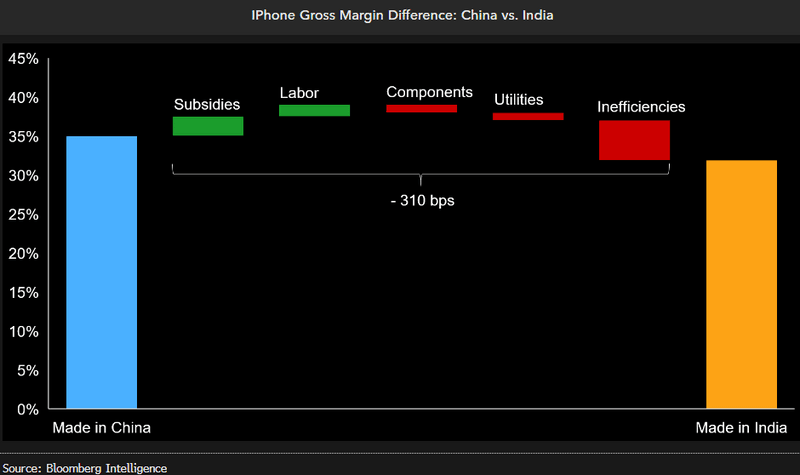

India’s efficiency handicap a risk to iPhone margin

Apple’s iPhone production challenges in India could arise more from operating inefficiency rather than direct costs. As Apple shifts some production from China to less-developed India, its iPhones’ gross margin could shrink to 31.9% from around 35%, in our scenario. India’s government subsidies and lower labor costs could offer a nearly 400 basis-point gross margin tailwind, but extra costs for imported components, utilities, and operating inefficiency could kick up a 700 basis-point gross margin headwind. Lack of scale at the outset could deliver an even bigger blow.

India’s steep learning curve for handling premium iPhones and its less-developed infrastructure frame the broader risks to Apple as it pares its production dependence on China.

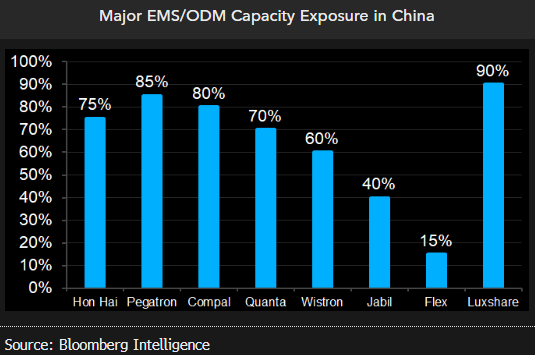

Capacity reliance on China may not change much in 2-3 years

China could remain the largest manufacturing base for EMS/ODM sector in two to three years. About 70% of the sector’s capacity was located in China in 2021, we estimate. The exposure might have declined from 2018 when the US-China trade war triggered an exodus of some capacity in the tech sector. While capital spending outside the mainland could continue to increase, exposure may not drop much in the next few years, we believe, as it takes years for new capacities and related ecosystems to scale up. Chinese players such as Luxshare are also expanding rapidly.

US-listed Jabil and Flex have notably lower exposures in China — 40% and 15%, respectively, of capacity in 2021 — due partially to the trade war impacts. For instance, Flex sold two factories in China as it ended its relationship with Huawei.