This analysis is by Bloomberg Intelligence Industry Analyst Patricio Alvarez and Bloomberg Intelligence Associate Analyst Joao Martins. It appeared first on the Bloomberg Terminal.

Amid a structurally tighter gas-supply outlook, less volatile — but still elevated — 2023 prices could hold a silver lining for European gas utilities’ supply margins. With gas-shortage fears easing, the focus is now turning to looming recession headwinds. Below we have set out five charts summarizing the sector’s key drivers and risks in 2023.

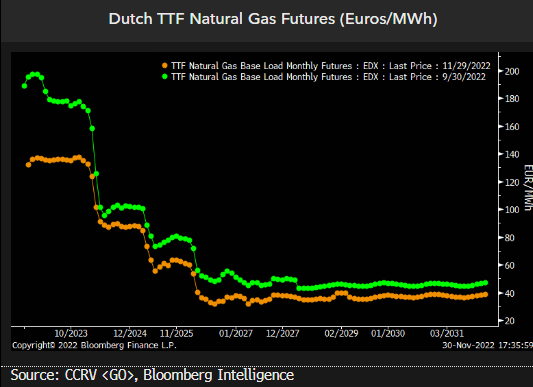

Margin rebound rests on easing gas, power prices

European gas prices could remain elevated vs. the 2017-21 average, with the halt of Nord Stream 1 marking a structurally tighter supply outlook and increased reliance on a competitive LNG market. Still, historically high but smoothing prices might be supportive for European gas and power utilities, easing pressure on the unhedged share of utilities’ (Enel, Iberdrola) supply margins and volaility-induced liquidity needs. This could unlock earnings potential for producers hedging their 2023-24 power sales at higher prices, excluding potential regulatory backlash.

Regulated gas (Snam) and power (National Grid) peers are largely insulated from commodity price and volume swings, meaning stable earnings growth may extend in 2023 amid tariff-indexation and sustained asset-base expansion.

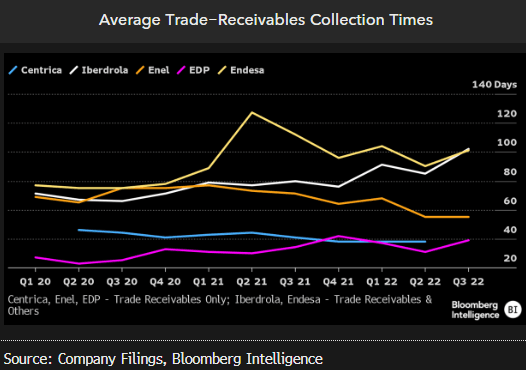

As retail-energy prices adjust, bad-debt risk looms

Following 2022’s surge in wholesale-energy prices, retail contracts are set to adjust to reflect suppliers’ higher procurement costs. This could ease utilities’ margin squeeze but simultaneously weaken affordability for customers, particularly if coupled with an economic downturn. This underscores bad-debt risk for utilities with an energy-retail bias and a focus on fewer markets (Centrica, Endesa) relative to their more integrated and diversified peers (Iberdrola). Geographical exposure could also be a differentiating factor as policymakers deploy national measures to shield customers vs. inflation.

Government-sponsored support for energy-bill affordability in the UK and Germany could provide a helpful backdrop, enabling headroom for a supply-margin recovery, tempering bad-debt risk.

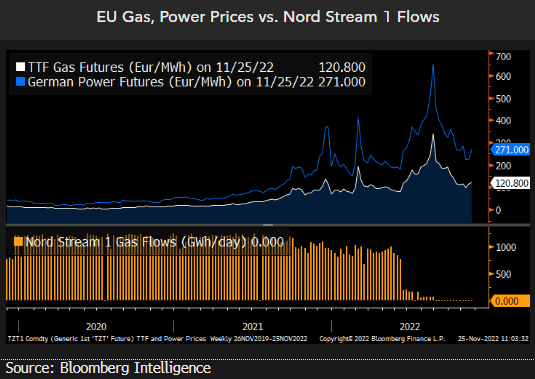

Nord stream 1 damage means higher prices for longer

European natural gas prices are set to remain elevated vs. their 2017-21 average, beyond the transient breather provided by near-full storage and softening demand. Unprecedented damage to Nord Stream 1 in 3Q dispels hopes for a near-term rebound in Russian piped flows, which remain at 20% of capacity, driving a structurally tighter supply outlook. Record LNG imports and higher piped flows from Norway have reduced Russian dominance in the region’s gas-supply mix, but curbing gas use is key to avoid depleting winter storage. The potential halt of Russian gas flows via remaining routes (Ukraine and Turkey) and a colder-than-average winter could be near-term price catalysts.

The latest Dutch TTF forward curve suggests prices may range from 100-130 euros a megawatt-hour in 2023 — 5-6x the five-year average.

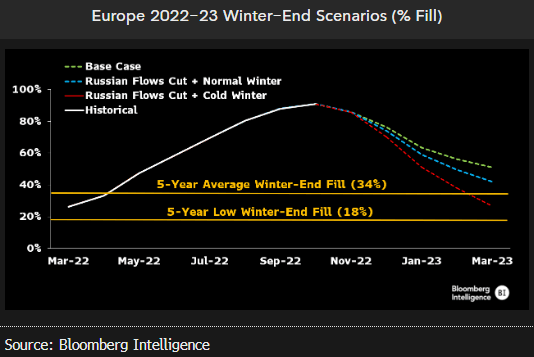

Winter buffer may thin on supply cuts, heating demand

With narrow supply prospects set to worsen if Russian flows via two of the five remaining routes stop, our baseline scenario is now meeting the EU’s 15% demand-reduction aim in August to March vs. the five-year average. In the event of sustained Russian supplies via TurkStream and Sudzha (via Ukraine) and normal weather, European storage levels could end winter ahead of their historical averages. A similar weather profile and a full halt of Gazprom’s piped imports from December would lead to lower but still manageable storage levels, as Russia’s deeply curbed flows now have a lower influence over the region’s supply mix.

Conversely, in a scenario of below-average winter temperatures and a full halt of Russian piped gas, an increased call on storage could see inventories exit 1Q below their five-year average.

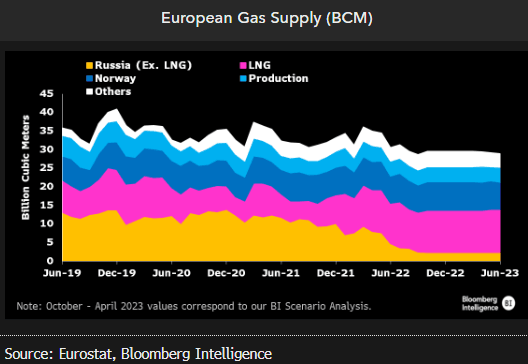

LNG, Norway displace Russian gas in the EU’s supply mix

The European energy crisis — triggered and exacerbated by Russia’s intensifying suppression of piped-gas flows — is driving a reconfiguration of the region’s supply mix. Incremental Norwegian flows and record LNG imports are likely to backfill about 80% of havled Russian piped-gas imports in 2022, based on our analysis, yet the region’s demand may need to adjust 12-15% to meet a structurally narrower supply base. Despite Europe’s supply-diversification push, Russian LNG imports are on track to climb year-over-year.

Norway is poised to contribute 25-30% of Europe’s 2022-23 gas supply, displacing Russia as the region’s largest piped-gas provider. Russian gas (excluding LNG) accounted for 35% of Europe’s supply in 2021, with that share set to fall below 16% in 2022 and 10% in 2023 amid reduced exports.