This article was written by Lee Klaskow.

Normalizing freight markets and moderating economic activity will weigh on truckload performance in 2023. Rate discipline will be key to mitigate the impact from inflation, especially for equipment, labor, maintenance and insurance. Carriers that have diversified away from traditional truckload markets will be better insulated from rate and demand weakness.

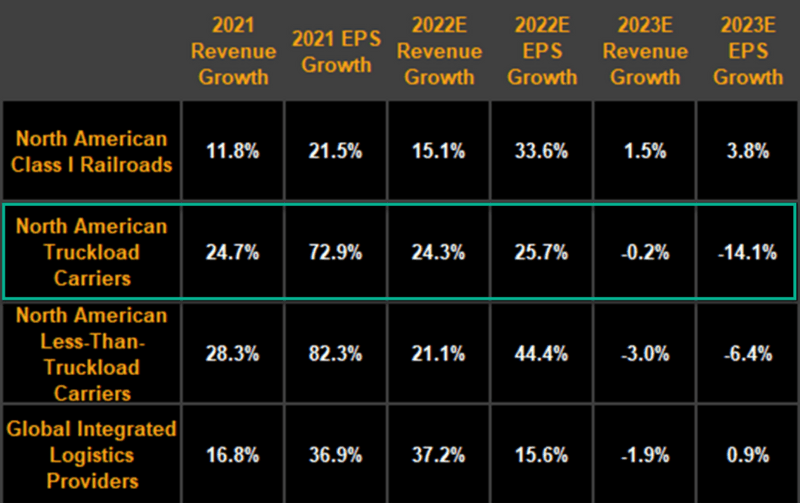

Earnings to decline after two strong years

Contractual-rate declines in the mid-single digits and moderating economic activity will weigh on truckload carriers’ revenue and earnings in 2023. Earnings and margins will also be hurt by rising labor, insurance and equipment prices, along with higher maintenance costs. Truckload carriers are being forced to hold equipment longer due to the lack of supply of new trucks, which will push up maintenance costs. Equipment sales have been a tailwind for carriers this year but will likely become a headwind in 2023 as comparisons become challenging and demand for used tractors wanes. Knight-Swift’s sales of equipment contributed 34 cents to its 2022 EPS through 3Q of $4.03 — about 59% higher than last year. Earnings may fall 14% in 2023 on mostly flat revenue, based on consensus.

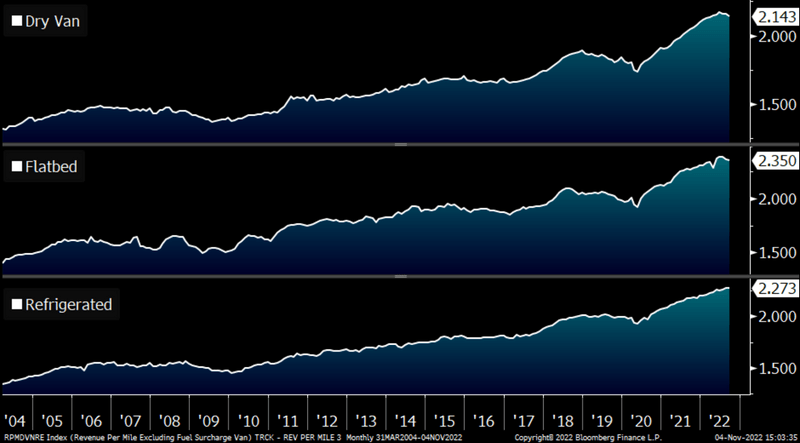

Rates may move lower by mid-single digits

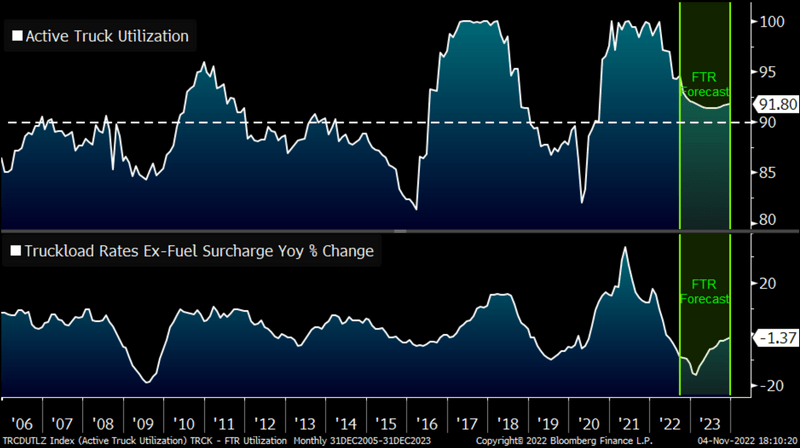

Contractual truckload rates will likely give back some gains made over the past two years as demand moderates, coupled with an oversupplied spot market. We believe contractual rates will be down mid-single digits in 2023, which is slightly less bearish than FTR’s 7.7% lower outlook. Our scenario calls for weakness in 1H, followed by firming condition in 2H. Dry-van contractual rates rose 7.4% on average in 2022 through September, following last year’s 10% increase. Spot dry-van rates, excluding fuel surcharges, have declined 19% on average in 2022 after surging 30% in 2021. The spot market is rebalancing as higher-cost capacity is forced out.

Truckers need strong rates to offset rising expenses to attract and retain drivers, as well as higher insurance, fuel and equipment costs.

Diversification key to beat rate cycle

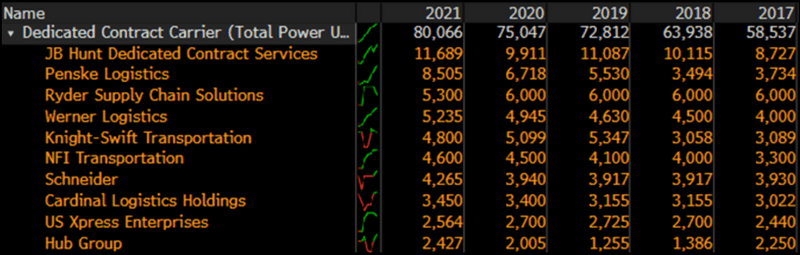

Carriers have been diversifying away their exposure from the irregular route truckload market, organically and through acquisitions, making them more resilient to rate cycles. Areas of interest have been dedicated, intermodal and brokerage businesses. Knight-Swift made a splash when it bought two regional less-than-truckload carriers with aspirations of building a national network. LTLs’ consolidated market makes for more disciplined pricing, which we believe could rise by mid-single digits next year.

Dedicated businesses, with long-term contracts and more stable earnings, have strong pipelines heading into 2023 and should outpace the over-the-road, irregular-route, contractual market over the next 12 months. J.B. Hunt, Ryder, Werner and Schneider operate some of the largest dedicated fleets.

Utilization rates hover above historical norms

Truck utilization rates should remain above historical levels in 2023 despite falling from 2021’s peak, fueled by long-term structural supply constraints. Utilization rates have been normalizing since peaking at 99.8% in 2Q21, and they’ll likely continue to come off these unsustainable levels as the market rebalances through 2023. FTR forecasts utilization rates will average 95.8% this year and 91.6% in 2023 — still above the 20-year average of 91.2%. During the last freight recession in 2019, utilization rates were much weaker, at 88%.

Large carriers have been slow to boost tractor counts outside of their dedicated fleets and prefer to leverage owner-operators for flex capacity. Supply-chain constraints also limited the number of new trucks delivered to carriers by OEMs.

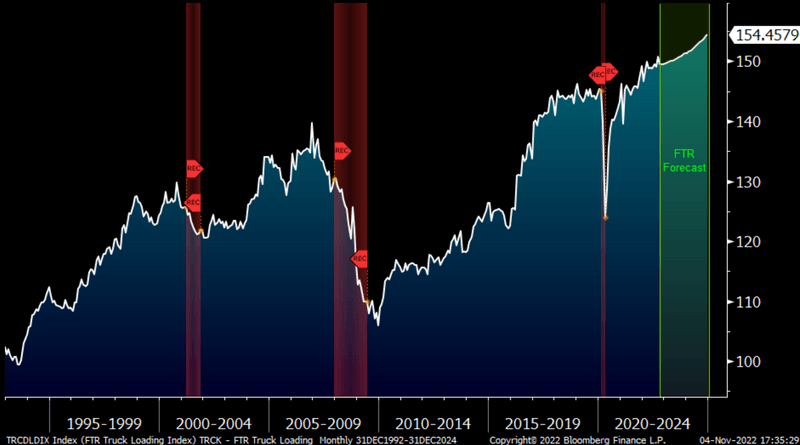

Fed may pump the brakes on demand

Trucking volume may increase 0.9% in 2023 and 2.5% in 2022, according to FTR’s forecast, after climbing 5.4% last year. Next year’s growth expectation is well below the 10-year annual average of 2.4%. Demand forecasts will likely moderate as the Fed continues to raise rates. However, our most likely scenario still calls for total load expansion next year, even after the probability of a recession increased to 60% from 30% in June. Any recession would likely be short and shallow, limiting the impact on trucking demand.

Rising mortgage rates may cool the housing market and demand for building materials, which are key end markets for flatbed equipment. FTR expects flatbed loads to decline 1.4% in 2023. The flatbed market is $19 billion, according to SJ Consulting, and its largest carriers are Daseke and Landstar.