Software cloud shift still early, with 54% of apps on-premise

This analysis is by Bloomberg Intelligence Senior Industry Analyst Anurag Rana and Bloomberg Intelligence Associate Analyst Lucas Ramadan. It appeared first on the Bloomberg Terminal.

Application software’s shift to the cloud is still in early stages, with less than half of the market on a public-cloud model. The cloud’s superior functionality should continue driving high-single to low-double digit growth as the need for digital change remains a priority even with economic uncertainty. Finance offerings may be the next area to expand due to lower existing cloud penetration.

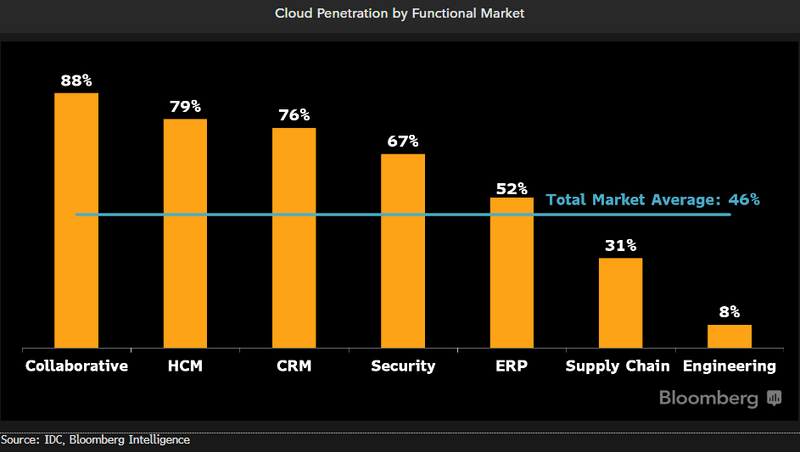

CRM apps in cloud at 76% vs. 8% in engineering

Certain functional areas such as collaboration applications, customer relationship management (CRM) and human resources have much higher cloud penetration, given the common nature of these functions across industries, compared with areas such as financial services and engineering. For example, 87% of collaborative applications use the cloud-delivery model vs. just 8% for engineering, according to IDC data. The high demand for cloud-based applications in customer service is fueling double-digit sales gains for Salesforce, while the need for cloud-based HR applications is driving growth for Workday.

Despite macroeconomic and geopolitical pressures, we expect spending for these categories to remain steady over the next 12 months as conditions ease and enterprises continue upgrades to their legacy infrastructures.

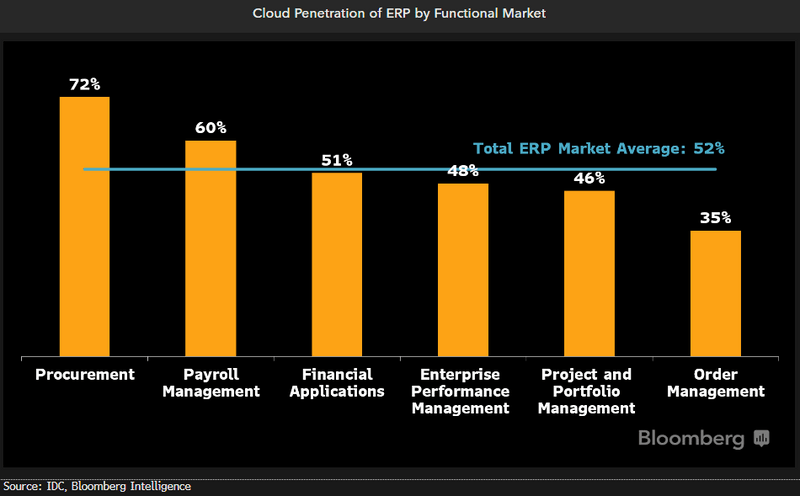

ERP might be next area for cloud shift

Enterprise Resource Planning (ERP) applications could be the next big functional area in software to see a rapid shift to the cloud from on-premise, we believe, as spending for the category improves but weakening economic conditions could delay these tailwinds. ERP includes areas such as core finance applications, planning and procurement, with a total market size of $66 billion and just 52% cloud penetration. SAP, Intuit, Oracle and Microsoft are leaders in on-premise and cloud-based applications. Workday is a pure-play cloud provider and is banking on its success in the HR market to become a credible participant in this segment.

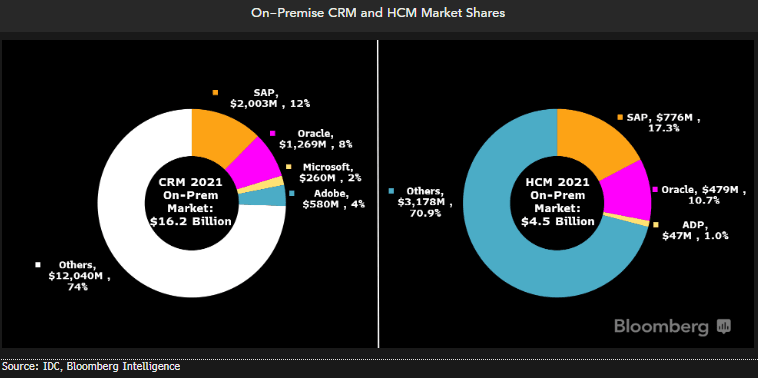

SAP leads in on-premise HR, customer services

Salesforce and Workday are the top two providers in cloud CRM and HR software, but SAP has the largest on-premise delivery model for both of these markets. This position gives SAP a good opportunity to expand its own cloud presence, which so far has been built largely through acquisitions.

Oracle is also a credible participant in this market and has shown consistent growth in its cloud-based products by persuading its on-premise clients to shift to the cloud.