This analysis is by Bloomberg Intelligence Senior Credit Analyst Robert Schiffman. It appeared first on the Bloomberg Terminal.

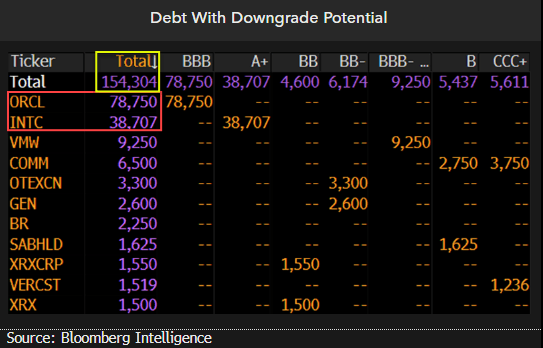

As recession risks rise, demand slows and margin pressure grows, the technology sector’s excess financial flexibility supports lower ratings volatility than industrial peers, with very limited downgrade exposure. Massive cash piles and robust cash-flow may continue to be effective defensive characteristics, while event risk-driven M&A remains muted. High grade’s $129 billion of downgrade risk is issuer-specific, with Oracle and Intel making up 90% of all at-risk securities.

$154 billion of downgrade risk may be misleading

Elevated recession fears and a souring economy provide the backdrop for $154 billion of high yield and high grade tech debt with near-term downgrade potential, yet just two issuers — Oracle and Intel — account for more than 75% of that, indicating risk is more issuer-specific than sector-wide. Oracle, with its highest ever debt load, may have limited rating risk, we believe, as growing Ebitda and a less aggressive financial-policy stance could reduce leverage over the next year. Further buffering the broad sector’s downside risk is $1 trillion of aggregate balance-sheet cash. At-risk debt includes issuers on review for downgrade, or with at least one negative outlook from Moody’s, S&P or Fitch.

Intel’s outlook is negative at all three raters, reflecting weaker operating results and high capital spending.

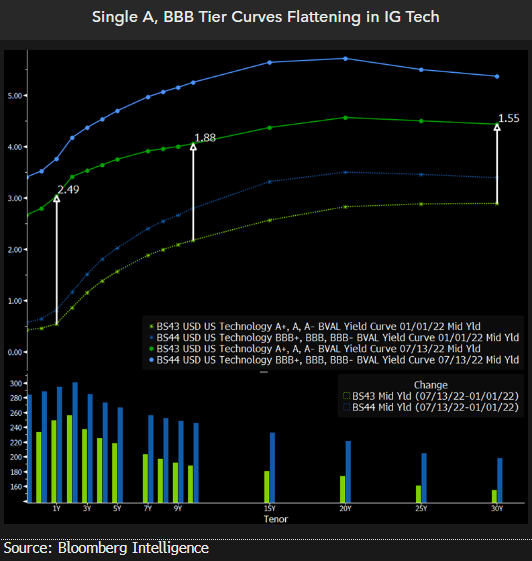

Curve flattening driven by front-end moves

Yield curves for investment-grade tech bonds have moved higher and flattened considerably year-to-date, driven by Federal Reserve rate moves and inflationary pressures. Issuers rated A saw 2-10-year spreads narrow by 91 bps and BBB issuers by 97 bps. Spread-compression potential remains limited, despite $81 billion of debt with a positive outlook from at least one rater. This suggests improving credit fundamentals may help to buffer spread volatility rather than driving positive total returns.

Though debt levels will increase, Broadcom may look to aggressively deleverage after its acquisition of VMware, enabling potential spread outperformance over the next year. High-quality issuers including Apple and Amazon.com may continue their upward ratings climb over the next 2-4 years, we believe.

Oracle is transitioning from out-of-favor to tech-credit darling

Oracle’s precipitous credit plunge may have finally bottomed as ratings begin to stabilize after debt rose to an all-time peak of $91 billion to fund M&A and shareholder returns. We anticipate leverage will decline over the next 12-24 months as Ebitda grows, financial policy shifts toward a less-aggressive stance, and free cash flow remains abundant.

HP credit monitor: Credit outlook

HP can maintain its commitment to investment grade ratings over the intermediate term, despite a challenging macro environment and historically high shareholder returns. Robust free cash flow and a $5.3 billion cash pile continue to support a capital-allocation policy under which HP will soon exceed its $16 billion return-of-capital target.

Though credit-default swaps are near five-year highs, we see limited risk to its stable Baa2/BBB/BBB+ credit profile, with leverage remaining below 2x. Wide to peers, outperformance potential exists via spread carry, not relative tightening.