Credit Suisse $17 billion AT1s face writedown, coupon, call risk

This analysis is by Bloomberg Intelligence Senior Credit Analyst Jereon Julius and Bloomberg Intelligence Associate Analyst Vincent Georg Brand. It appeared first on the Bloomberg Terminal.

Credit Suisse’s Additional Tier 1 bonds may remain pressured while the bank’s capital and earnings outlook stays uncertain. Buffer analysis suggests that the bonds’ principal write-down and coupon-cancellation risks appear manageable at this stage, but FINMA discretion looms large. The bonds are no longer priced to the call.

High-Trigger writedown requires double 2008 loss

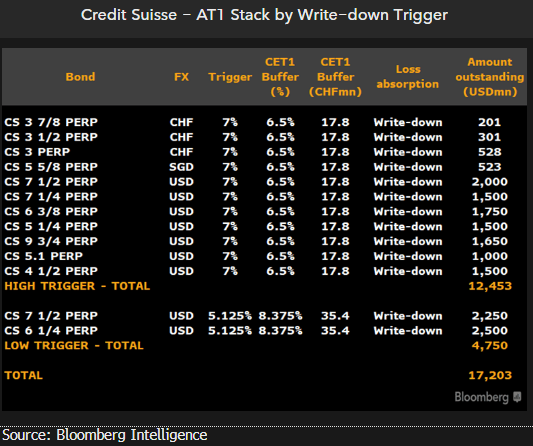

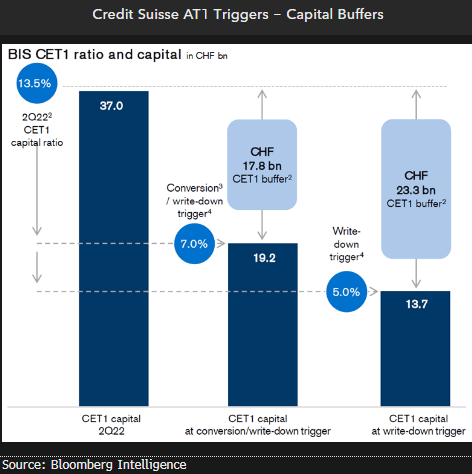

Most of Credit Suisse’s AT1s have a 7% CET1 ratio trigger for principal loss absorption. The bank’s CET1 ratio buffer above this “high” trigger was 6.5% (17.8 billion francs) as of 2Q. For these bonds, the principal amount of the instrument would be written down to zero and canceled if a trigger event were to occur: either the lender’s reported CET1 ratio falls below 7%, or FINMA determines that cancellation of the instrument and other similar contingent capital instruments is necessary or that the bank requires public sector capital support, “in either case to prevent it from becoming insolvent or otherwise failing”.

For context, the lender’s largest loss year was in 2008 (8.2 billion francs). So a write-down scenario for those high trigger AT1s would require at least double that amount of losses.

Two low-trigger AT1s are legacy but may stay

Credit Suisse also has two “low-trigger” AT1s outstanding: the dollar 7.5% perp-2023 and dollar 6.25% perp-2024. The “first order” CET1 buffer above their 5.125% trigger was 8.375% (23 billion francs) as of 2Q. In theory, their buffer is larger because the bank’s high-trigger AT1s would be written off (and another 12 billion francs added to the buffer) before the low trigger was activated. In practice, FINMA may not differentiate between the bank’s high- and low-trigger AT1s (if an insolvency or bank-failure scenario threatens) and force losses on all AT1s simultaneously.

These two low-trigger AT1s will count as gone-concern capital after their first call dates, given their lower loss-absorption characteristics. By then, it may be cheaper for CS to call and replace them with senior holdco bonds. But FINMA may not allow this.

Coupon risks come in many guises

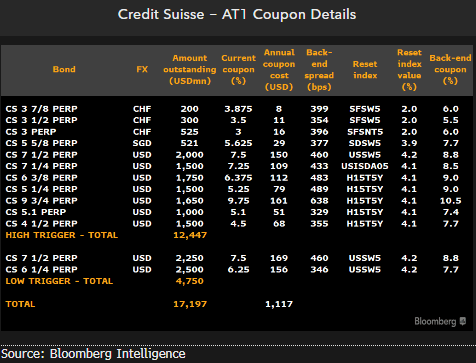

A more immediate risk to AT1 holders than principal writedown is that of of prohibited interest. The bank’s CET1 buffer was 3.2% (8.8 billion francs) as of 2Q — below the sector average (4.2%) and UBS (4.2%). If CS were to breach this buffer, it wouldn’t be able to pay its AT1 coupons. A second mandatory coupon constraint relates to distributable profits: these were 14.3 billion francs as of 4Q, well above the $1.1 billion annual cost of AT1 coupons. Lastly, FINMA can require the bank not to pay its AT1 coupons at any time.

Apart from mandatory AT1 coupon skip risks, the issuer has complete discretion over AT1 coupons (a feature inherent in all AT1 bonds). But Swiss bank AT1s come with dividend stoppers, unlike EU bank AT1s. So an AT1 coupon skip would prevent it from paying a dividend.

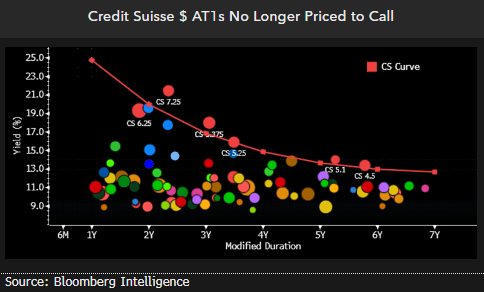

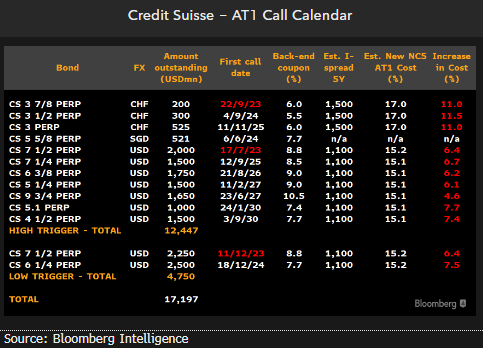

Non-call Risk May manifest itself in 2023

Credit Suisse has three AT1 bonds up for first call in 2023: the high-trigger dollar 7.5% in July, the low-trigger dollar 7.5% in December and the franc 3.875% in September. None of these bonds is pricing in a call. Replacement issuance in coming months could be prohibitively expensive (assuming AT1 primary markets will even reopen): for all three, AT1 replacement issuance today would result in a much higher coupon (using interpolated five-year I-spread as a proxy for new-issue spread) than the back-end coupon of the existing AT1. However, these calculations may have shifted nearer the call dates.

We also note that CS’ call of its dollar 7.125% AT1 in July was clearly uneconomic — the replacement bond came with a much higher coupon (9.75%) than the 8.2% back-end coupon. So FINMA may still allow uneconomic calls.

AT1 holders seek answer to three questions

Credit Suisse’s dollar AT1 bonds’ cash prices have plunged by 29-39 points year-to-date and now trade wide of all other European banks. AT1 holders are awaiting answers to three key questions: First, what will be the size of cutbacks in the investment bank. Put bluntly, the more radical the cutbacks, the better. Second, what will be the size of any losses due to restructuring charges, leveraged loan exposures, etc. Third, to what extend can capital raising efforts (rights issue, capital gains on sale of certain assets) mitigate or even offset these losses? The answers to these questions may depend on the state of financial markets. So CS is partially dependent on the external environment over which it has no control.

The bank will announce “details of the progress of the strategic review” on Oct. 27 with its 3Q results.