This article was written by Jacqueline Poh. It appeared first on the Bloomberg Terminal.

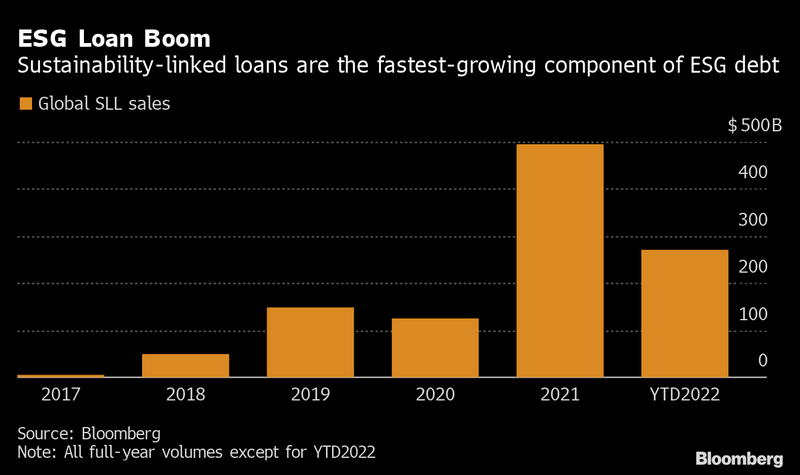

Virtue can bring rewards, as more companies are discovering when they reach out for a loan. Some banks offer borrowers discounts if they meet targets for cutting pollution, reducing food waste or even assisting job seekers. To give incentives teeth, there are penalties for missing goals. Global issuance of loans linked to borrowers’ environmental, social and governance performance surged to almost $500 billion in 2021 from $4.9 billion in 2017 when the first such deal was created, as companies sought options that let them promote themselves as socially responsible.

1. How do the loans work?

The deals are set up like normal loans or revolving credit facilities, often with a group of banks providing funds for the borrower. Traditional loans are priced versus a benchmark rate used in lending between banks, such as Euribor or Secured Overnight Financing Rate (SOFR), and borrowers pay a premium, or spread, on top of the benchmark, based on factors such as credit ratings and deal length. A sustainability-linked loan has an extra twist, a spread discount or penalty that depends on the borrower meeting specific ESG targets. For example, a loan’s interest rate may be 100 basis points over Euribor and that can be adjusted based on the borrower’s ESG performance.

2. What sort of targets?

A loan can be either tied to an overall ESG rating or specific sustainability goals called key performance indicators. The KPIs can be quite varied, as long as both sides agree on the goals. Turkish lender Akbank TAS got a $660 million loan in April 2022 with pricing tied to the amount of energy sourced from renewable resources and progress in renewing expiring plastic credit cards with recycled ones. An infrastructure loan for Rubis Terminal Infra SAS that was in syndication in August included reduction of its carbon intensity, waste and work accidents as targets. Telefonica SA amended its core facility in January 2022 to commit to lower carbon emissions and more women in executive roles. If a borrower is looking to link its performance to an overall ESG rating, it can achieve scores or grades from a company that independently assesses ESG standards.

3. Is the idea catching on?

Since their inception in 2017, sustainability-linked loans, or SLLs, have become the second-largest and fastest-growing segment of ESG debt instruments, and the idea has spread to other parts of the credit market including bonds and Schuldschein. The sustainability-linked structure has been adopted by the bonds and Schuldschein market widely, posting record sales in 2021.

ESG loan boom

Sustainability-linked loans are the fastest-growing component of ESG debt

4. How big are ESG incentives?

It’s hard to know for sure since the market is still developing and borrowers don’t always reveal details of their loans. Still, it’s possible to get an idea. Turkish bank Yapi ve Kredi Bankasi AS can potentially shave as much as 3 basis points off a 240 basis-point spread for dollar borrowings, while pulp and paper producer Asia Pacific Resources International Ltd. negotiated a discount of up to 5 basis points on a 200 basis-point interest rate.

5. What other forms can they take?

In the US, where most corporate revolving facilities are not drawn, borrowers such as HP Inc. have agreed to impose the sustainability-pricing adjustment on commitment fees paid on undrawn amounts. In recent years, there have been cases where borrowers give up the discounts and will only be penalized if targets are not met. And some borrowers have pledged to use any savings from the discounts for ESG projects. Similarly, some lenders also contributed any profits from the ESG pricing adjustment to sustainable causes.

6. What’s in it for lenders?

The main advantage for banks may be customer loyalty and a clearer idea of companies’ non-financial performance, such as diversity and workplace safety. Many ESG-indexed loans have been negotiated as replacements for older facilities nearing maturity, meaning borrowers could have shopped around for a deal elsewhere. The loans may also help lower banks’ exposure risks because companies with strong ESG policies tend to have good track records for profitability and debt repayment.

7. What about regulation?

Regulators and policy makers are pushing banks to pay more attention to the environmental and social impact of transactions. That’s led to more than 270 banks representing over 45% of banking assets worldwide adopting responsible banking principles developed with the United Nations. Europe has led the way in this area, helping make it the biggest region by far for ESG-linked loans.

8. What challenges does the market face?

As with other efforts to link environmental and social goals to financing, such as green bonds, a big challenge for ESG-linked loans is ensuring that deals truly have a positive impact, and proving it. To try to prevent the sector becoming just a marketing tool for lenders and borrowers, the three main global loan associations have drawn up a framework for deals. The main criteria are for borrowers to be transparent in their corporate social responsibility strategy; to set targets that are more ambitious than what they have already achieved; and for their actions to be evaluated by independent assessors. Even then, there’s a lack of agreement on how to objectively gauge a company’s social responsibility. The European Commission adopted technical standards in April 2022 to be used by financial market participants when disclosing sustainability information.

9. How do the loans fit in the wider ESG finance market?

There’s a plethora of green and socially responsible financing options, and the variety keeps growing. Green bonds are the largest part of the sustainable finance market at more than $600 billion for the whole of 2021, according to BloombergNEF. ESG-linked loans were the fastest growing part of the whole ESG finance sector, albeit from a much lower starting point. Major differences between the two products include how the money can be used and the pricing. Green bond funds must be spent on projects that are designed to be environmentally friendly. Pricing is also fixed at sale, with no potential discounts or penalties. Sustainability-linked loans offer much more flexibility because there is no requirement to use the funds solely for investments directly tied to meeting the ESG goal. Any pricing incentive is purely based on whether the borrower hits or misses the target.

10. What are the latest developments?

The SLL market is still evolving, with innovations emerging such as ‘sleeping’ transactions where ESG targets or metrics are not disclosed until a later date during a loan agreement. This ‘sleeping’ SLL has raised questions about eligibility to be classified as an ESG debt. Meanwhile, the German Schuldschein market has come up with a so-called ESG bridge giving companies time to build up their ESG reporting, which can eventually be included in financing agreements. Borrowers will be penalized if ESG reporting deadlines aren’t met, and the instrument is designed for companies that want to commit to a sustainability framework but aren’t yet ready to have targets tied to their debt.