This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Jamie Douglas Coutts. It appeared first on the Bloomberg Terminal.

Bitcoin is navigating its toughest test yet as a monetary alternative, enduring an environment the polar opposite of its formative years when price inflation was benign, and monetary policy excessively loose. While fundamental adoption continues and on-chain metrics place it in the value zone, we take heed of rates and liquidity for a macro signal.

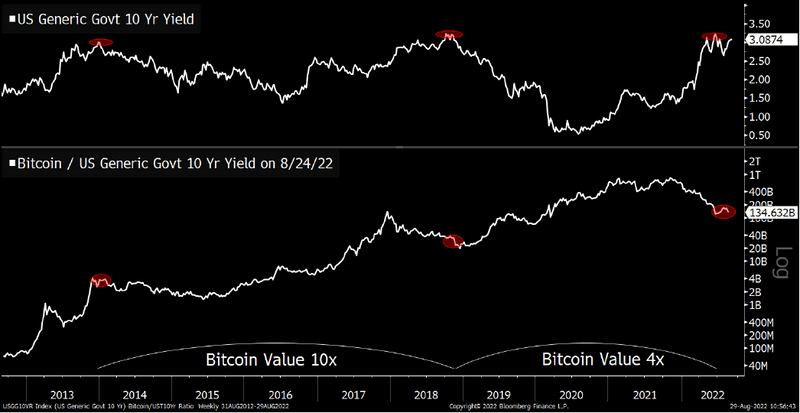

Bitcoin relative to rates quadruples since last tightening

Bitcoin cycles are increasingly correlated with rates, as its institutional adoption frames it as a macro trading instrument with hedging power against monetary inflation. While rate peaks coincide with crypto bear market lows, the ratio of the two shows Bitcoin has made higher lows on every increased breach of the 3% yield threshold, a sign of resilience in the face of rising rates. However, appreciation through successive cycles has shown flagging vigor.

Underperformance during the last cycle was due to slowing adoption, and upside inflation surprises 12 months after the 2020 halving decapitating the bull market. Bitcoin’s performance is likely to stay collared until inflation falters and rates ease, allowing liquidity to flow back into risk assets.

Bitcoin relative performance adjusts to rate cycle

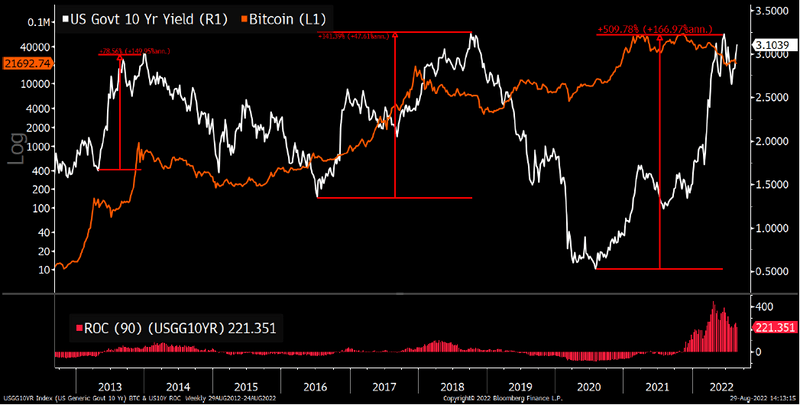

Prevailing rate cycle has been crypto’s biggest test

The sharpest increase in interest rates Bitcoin has witnessed — while detrimental to pricing — could be the crucible it must withstand to solidify its status as a monetary alternative. Since inception, Bitcoin has prospered from low inflation coupled with accommodative monetary policy, interrupted only by short bursts of tightening, nurturing inherent biases in modeling the asset. The 500% increase in yields since 2020 (4x last cycle), has provided a new and vastly different in-sample period. While the max drawdown during this cycle fares favorably vs. previous cycles, there is a non-zero chance that yields have more upside, and before they peak.

Despite the unprecedented adversity in macro conditions, Bitcoin adoption continues, albeit slower, boding well for its longevity and proliferation.

10-Year yields tightening 4x previous cycles

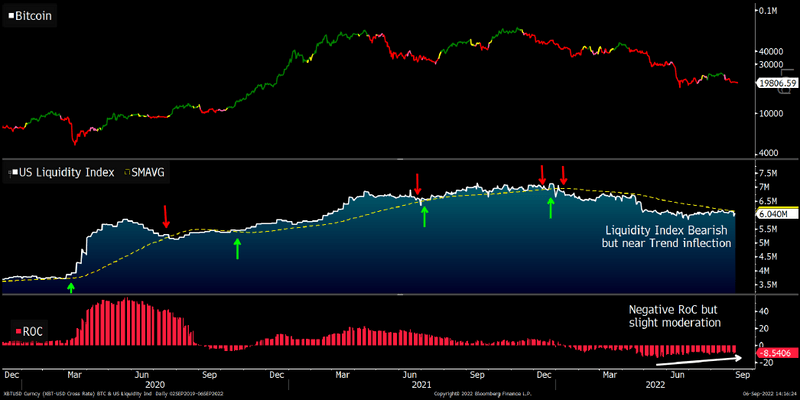

Liquidity conditions stay on bearish footing

Both the price of money and systemic liquidity have significant impacts on Bitcoin’s proposition as a monetary alternative. The US liquidity index, an aggregate of central bank assets, Treasury and reverse repo balances at the Fed, quantifies this and the liquidity conditions’ velocity.

The liquidity regime has been bearish since December 2021. Current stability has been due to the US Treasury almost entirely cancelling out the tightening coming through from the Fed and private sector — via reverse repos — over the past four months. The nuclear scenario for Bitcoin and, by extension, most risk assets would be a situation in which the liquidity index resumed its decline following several months of stability as rates take out the 3.5% high.

Current liquidity regime remains bearish