What’s next for China property in five BI charts

This analysis is by Bloomberg Intelligence Regional Market Analyst John Lee. It appeared first on the Bloomberg Terminal.

We ask some of the major questions facing China’s beleaguered property sector — are there signs of a turnaround? What’s the impact of mortgage boycotts? What are the potential policy options? These charts were created by analysts from Bloomberg Intelligence and Bloomberg Economics in Asia.

Any signs of a property turnaround?

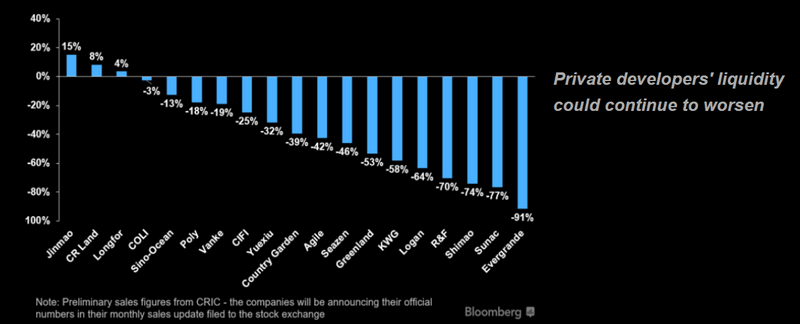

Private developer sales continue to paint a dim picture, despite a relaxation of home-purchase quotas and lower mortgage rates. BI real estate analyst Kristy Hung writes about how contracted sales at private developers such as Sunac, Shimao, R&F, Logan, KWG and Agile, were down 42-77% in August, ahead of the peak season for the China housing market. However, state-owned developers like Jinmao, Yuexiu and COLI appear to be turning the corner.

Contracted-sales growth in August (year-on-year)

Should we be worried about mortgage boycotts?

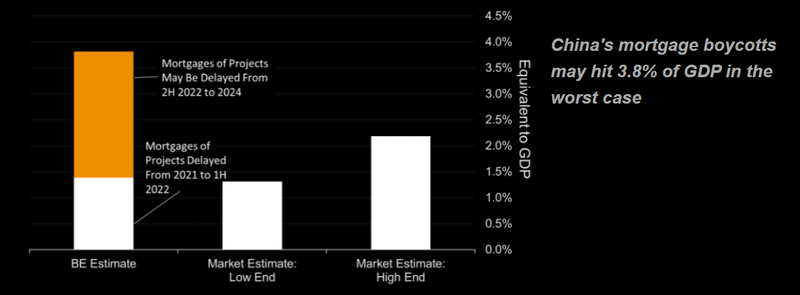

Concerns over the financial health of developers has led to a number of home buyers refusing to make mortgage payments for presold, unfinished homes. These mortgage boycotts are not big now, but could snowball. Bloomberg Economist David Qu notes property developers have yet to hand over the keys on 884 million square meters (or 48%) of homes they committed to deliver in 2021 and the first half of 2022. That’s equivalent to 1.6 trillion yuan of mortgage loans at risk, or 0.7% of bank lending and 1.4% of 2021 GDP. If the situation continues, this figure to swell to 4.4 trillion yuan of mortgage loans by 2024, equivalent to 2.1% of bank lending and 3.8% of GDP.

Mortgages at risk — BE versus market estimates

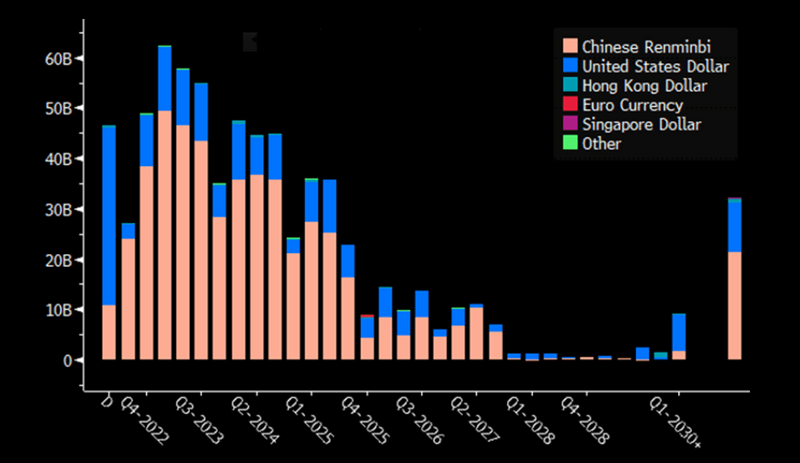

What’s the next policy response?

China property sector debt maturity profile ($ Bn)

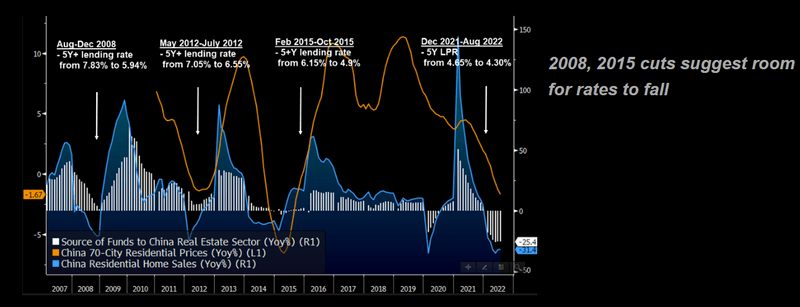

How low can lending rates go?

China’s mortgage rates have a lot more room to fall, if history is any guide. The PBOC cut the five-year loan prime-rate by 15 basis points in August to 4.30%. As Kristy Hung notes, the LPR has declined by 35 bps since the beginning of the year, compared with cuts of 189 bps and 125 bps in 2008 and 2015.

Rate cuts in past downcycles

V or L-shaped property loan recovery?

The PBOC’s easing efforts have so far failed to revive demand for property loans. Bank lending to the real estate sector fell to $7.8 trillion in 2Q, the first drop since the time series was created in 2011. During the height of the property boom in 2013-19, real estate loans grew 20% on average and at the peak comprised 40%-45% of new bank lending compare with just 4.9% in the first half.

Net increase in bank loans to real estate