Italy vote could leave ECB between devil and the deep blue sea

This analysis is by Bloomberg Intelligence Rates Strategist Huw Worthington. It appeared first on the Bloomberg Terminal.

Foreign flight in Italian debt since last summer was offset by QE, but that’s ended and Target2 data indicate that the selling hasn’t. Flows like today’s after the 2018 election would overwhelm the ECB plan of using pandemic QE bond redemptions from “core Europe” — possibly leaving a new euroskeptic government reliant on the ECB’s spread tool.

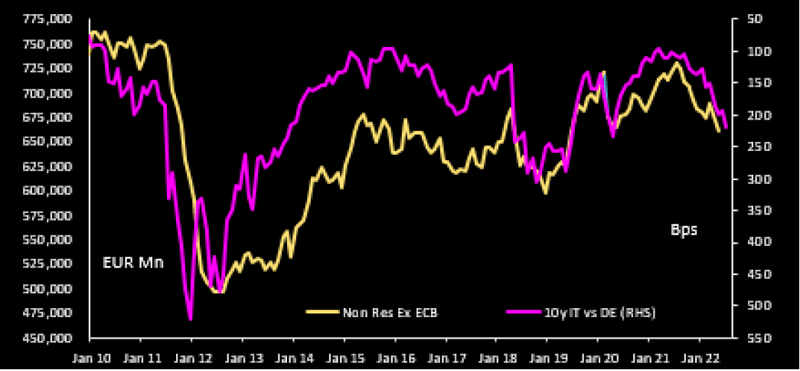

Foreign BTP exit could overwhelm ECB Italy support

Italian spreads widened despite QE support during 2018, and the political shenanigans after that year’s election proved unappetizing for nonresident investors, with foreign holdings of Italian government debt falling by 74 billion euros between March and December 2018 — completely overwhelming the 25 billion euros of BTP purchasing by the Bank of Italy.

That may be happening again, with foreign holdings dropping by 70 billion euros between July 2021 and May this year. That was offset by 75 billion euros of buying by the Bank of Italy, but switching pandemic QE bond redemptions from Germany and others to the periphery — the ECB’s first line of defense — will fall well short of that, leaving Italy exposed and possibly reliant on an untested “anti-fragmentation” tool to support what may be a recalcitrant government.

Italian foreign debt holders & BTP spreads

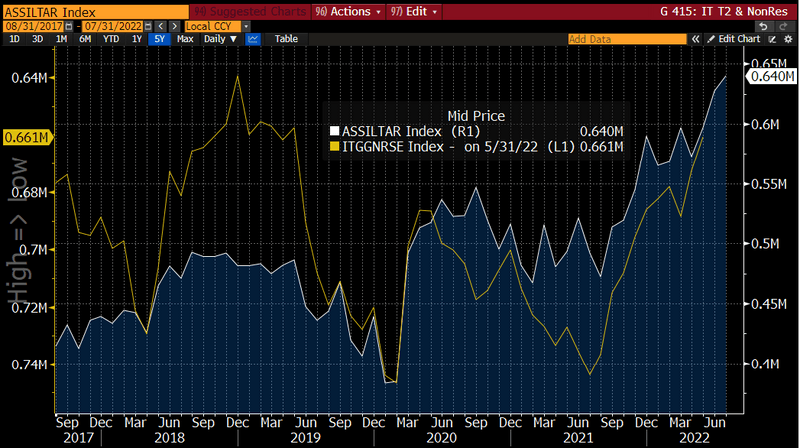

Italian Target 2 balance back at record highs

There may be signs that foreign flight is stepping up again, from more timely ECB data in the shape of Target 2 balances tracking the Bank of Italy’s liabilities to other central banks in the Eurosystem. In the past this measure has been well correlated with inflows and outflows of nonresident holdings of Italian government debt, and acted as a measure of capital flight in Italy in the 2008 and 2011-12 crises.

That yardstick is back at all-time highs of 640 billion euros and is up just under 70 billion euros since April. Data due this week for August target balances may indicate whether Italian election risk is back on investors’ radar.

Italy Target 2 and foreign debt holders

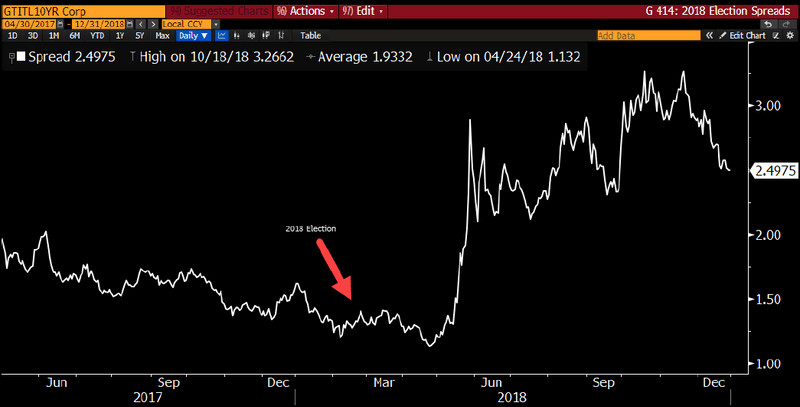

Spreads didn’t widen until after last election

Yield spreads around the last Italian elections held on 4 March 2018 didn’t show any signs of nervousness ahead of the poll itself, with 10-year spreads only widening marginally to 1.4% from 1.2% in the month before. However, any composure swiftly vanished when it became apparent that a surprise coalition between the 5 Star Movement and Lega could result, doubling spreads from just over 1% in less than a month propelling them as high as 3.3% in the latter part of 2018.

Markets this time around may be showing some nervousness ahead of elections, but they don’t seem to be fully discounting a coalition with the likes of Giorgia Meloni, Matteo Salvini and Silvio Berlusconi to the fore and committed to tearing up Mario Draghi’s EU-agreed spending plans for post-pandemic grants and loans.

Italy yield spreads around last election

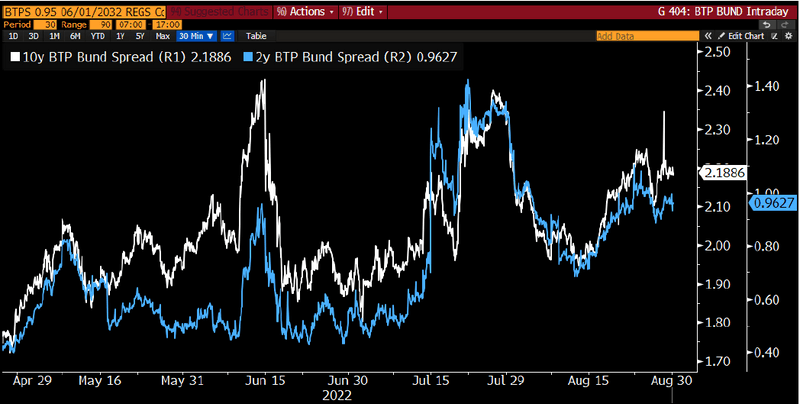

Italian spreads just 0.2-0.3% below ECB reaction area

Mario Draghi’s appointment as Prime Minister in early 2021, coupled with QE buying, brought 10-year Italian bond spreads vs. Germany to under 1% during most of that year. But as it became clear that QE was ending with no clear plan from the ECB in place to support Italian debt, spreads ballooned — hitting 2.5% in June. An ECB U-turn in June coupled with a pledge to stop “fragmentation” in the euro area followed, taking spreads back under 2%, but news that Italy would face an early general election saw them widen again, to 2.4% from 2% in a week.

That reversed again by mid-August but since then they’ve edged wider to sit at a current 2.2%. That’s just 20-30 bps from levels which the ECB clearly finds disconcerting.

2y, 10y Italy yield spreads vs Bunds

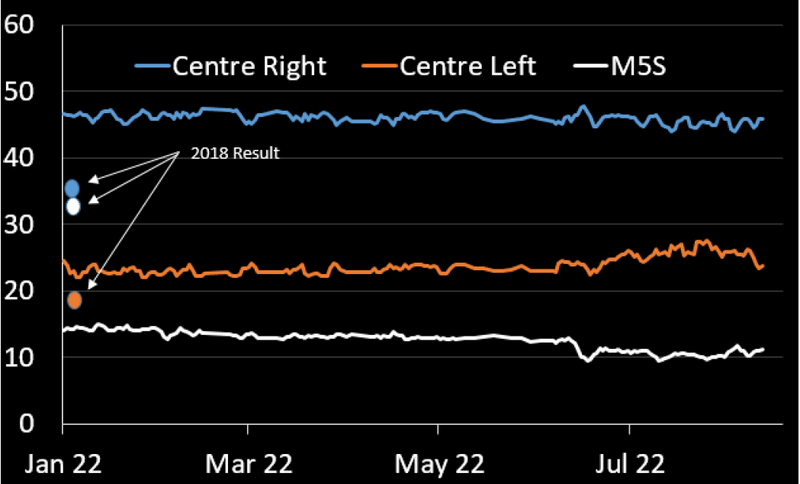

Euroskeptic parties set to win Italian elections

On Sept. 25 Italians go to the polls to elect a new government to replace Mario Draghi’s cross-party coalition, which collapsed in August. Opinion polling points to a swing in favor of a euroskeptic center-right coalition comprising the Brothers of Italy, Lega and Forza Italia, which have been consistently polling 45 to 47% in vote share — up around 10 points from the 2018 result.

That leaves them well positioned to form the next government, with the center-left group trailing as much as 20 points behind, while the 5 Star movement, which won the most votes of any single party in 2018, has seen its vote collapse by 20 points to just over 10%.

Opinion polling: 25 Sept. Italian election -%