ESG isn’t just about doing good. More often, it’s good investing

This analysis is by Bloomberg Intelligence ESG Analyst Gail Glazerman. It appeared first on the Bloomberg Terminal.

Recent debate over ESG investing seems to have lost perspective. We believe calls for greater accountability are justified, but this requires quality and reliable data — and that’s a work in progress. ESG is not a monolith; not every investor is directly seeking to make an impact, though positive contributions are often a byproduct. Market debate ignores nuance; not all ESG issues are simple black and white, and there are often complexities and trade-offs to consider. The bottom line: ESG does not replace fundamental analysis.

ESG criticism: Putting the cart before the horse?

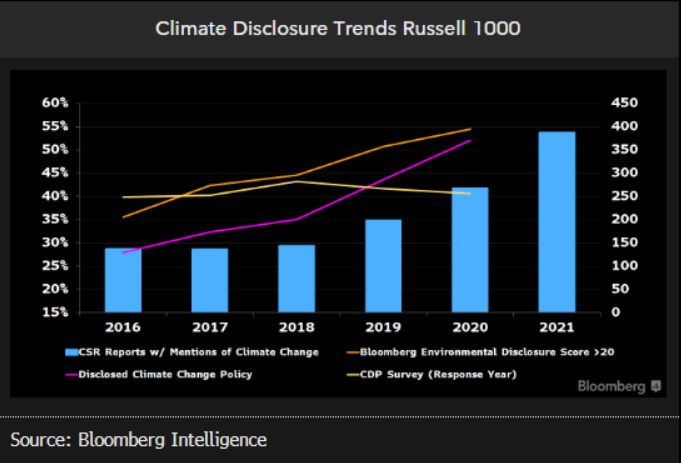

As evidenced by the recent market debate, there is a considerable need for accountability and transparency across the ESG space. But to conduct such analysis, markets need quality, comparable data — and that’s not yet available. ESG reporting is a rapidly evolving, but still a nascent discipline. In 2011, only 20% of the S&P 500 members issued a sustainability report, according to G&A Institute. By 2020 this had soared to 92%. Yet, these reports lack the consistency and rigor of traditional financial statements.

Large investors have called for better corporate ESG reporting. Governments are responding, with the US, EU, China and others starting to mandate corporate reporting. As companies give better data, investors can make more informed decisions, and both funds and corporations can be held accountable.

There is more to ESG than values, impact and exclusion

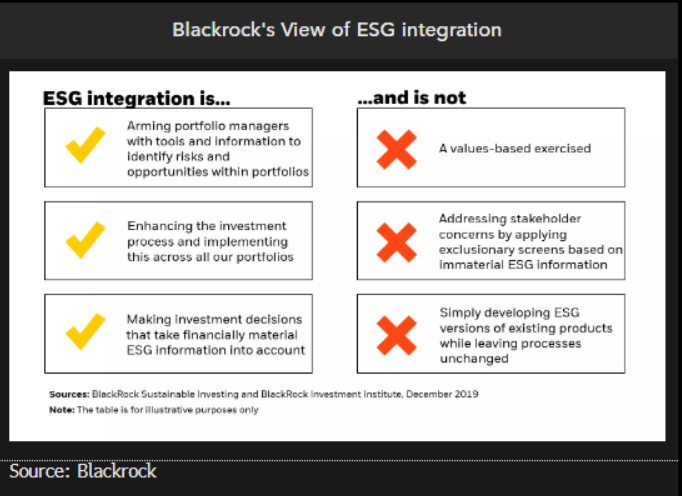

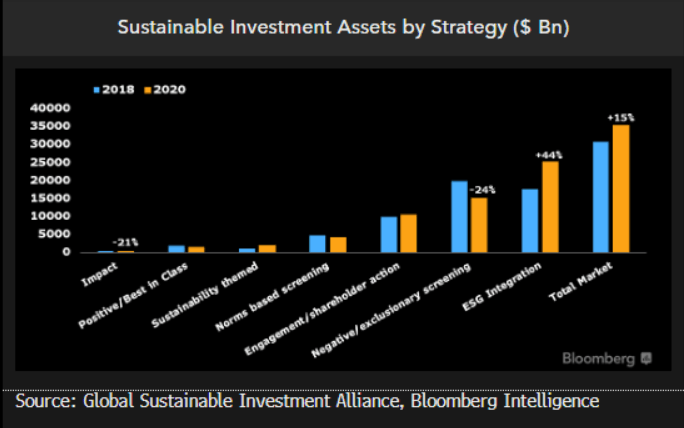

Much of the debate equates ESG with impact, but this is not the case. While some investors and funds seek to influence societal outcomes or exclude or divest from certain industries, a greater share of assets employ the lens of ESG analysis to help identify and manage investment risks and opportunities. The Global Sustainable Investment Alliance found that by 2020, the strategy of integrating ESG had more assets than exclusion and impact combined. Integration assets grew 44% in 2018-20, while impact and exclusion fell 20-25%. Integration has been increasing 3x faster than overall sustainable investing.

Governments recognize the potential for confusion and a need to clarify the objectives of investments marketed as having ESG attributes. Some are starting to introduce regulations such as the EU’s SFDR.

Is ESG doing good or good business?

Motivated by the prospect of improved investment returns, more ESG assets are focusing on integrating the strategy into their portfolios and not social impact — but that does not preclude yielding positive social and environmental outcomes.

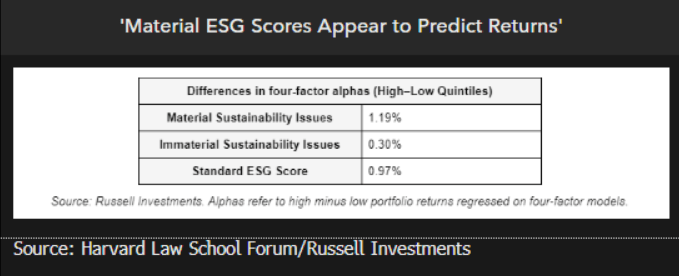

Integration strategy is supported by a body of academic work indicating companies that perform well on ESG issues financially material for their business tend to outperform the market. Funds investing in these companies also tend to outperform. While the focus is increasingly on economic returns, performing well on these industry or business-specific ESG issues may lead to more favorable societal outcomes as a byproduct, such as reduced exposure to fossil fuel-based energy is likely to result in lower emissions.

ESG isn’t black & white. There are many shades of gray

Given the moral and societal issues associated with ESG, it may be tempting to view it as a clear choice between right and wrong. In reality, these issues are often complex, entailing significant trade-offs and judgments — and influenced by investment strategy. Some investors may weigh certain E, S or G factors more heavily than others, or not at all.

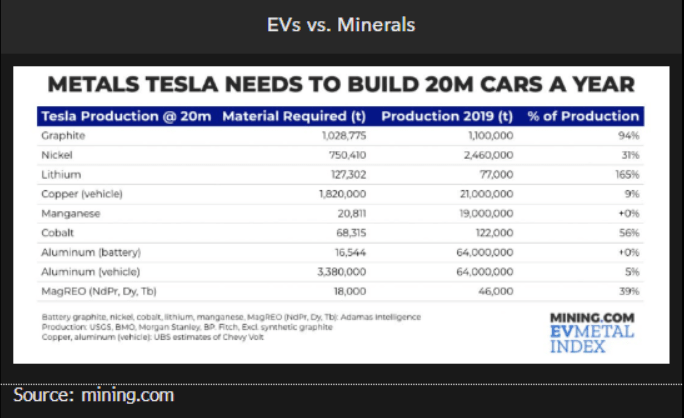

For example, electric vehicles are intended to reduce reliance on fossil fuels, but the current technology relies heavily on minerals like nickel and lithium. Locating and extracting incremental materials could raise environmental risks such as seabed mining. And there is a global effort to reduce reliance on single-use plastics, but some solutions could contribute to higher levels of food waste or emissions. ESG data and analysis can help investors evaluate these trade-offs.

ESG does not replace fundamentals

ESG can be a powerful tool to enhance investment returns but does not negate the need for fundamental analysis. A 2022 survey by Capital Group found that integration is the most-used ESG strategy (59%). Justifying this, studies have shown companies that perform well on the set of ESG factors most salient to their operations tend to perform better financially.

But investors should not ignore fundamentals. A food company that manages its supply chain well is unlikely to deliver strong financial performance if consumers dislike the taste of its products. On the other hand, understanding that the EU may need to regulate livestock in an effort to manage methane emissions might offer insights into potential demand dynamics for alternative proteins.