Six charts show Europe’s key stock drivers after summer holidays

This analysis is by Bloomberg Intelligence Strategist Tim Craighead and Equity Strategist Laurent Douillet. It appeared first on the Bloomberg Terminal.

With the Stoxx 600 retracing about 40% of its 1H plunge, it’s time to consider the future of post-holiday markets, and we see volatility with earnings risk or continued recovery. These six exhibits show a combination of interest rates, factors, margins and currency are set to be critical, which we believe may lead to a sloppier run to year-end.

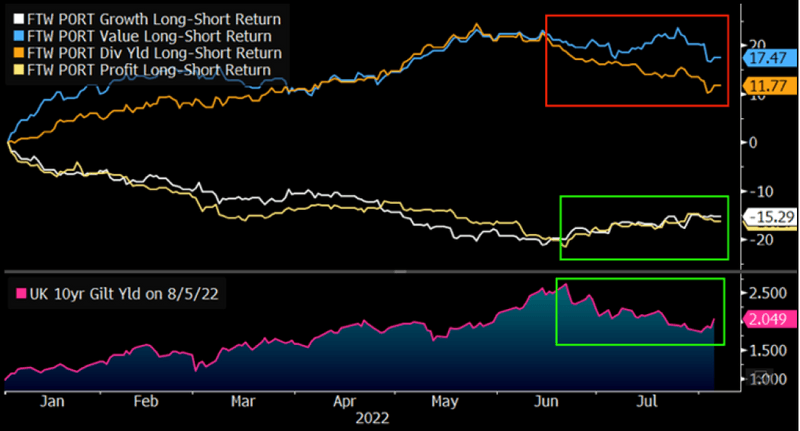

Factor reversal is all about interest rates

The move back toward growth and quality since midyear, and away from value and dividends, owes to the reversal in interest rates, and we’re hesitant to think this trend lasts. The 10-year yields for the UK and Europe retreated since late June’s peaks, as regional and global recession fears mounted. But we don’t believe elevated inflation and, in turn, central-bank policy and rate hikes are over. Our rates team expects bond yields to move back toward midyear levels.

There are also developing structural reasons to expect sustained higher inflation. Our US equity strategists have coined the three D’s — deglobalization, decarbonization and demographics — as key drivers. Against this backdrop, value factors may keep the upper hand over growth.

Growth regains lead over value: But for how long?

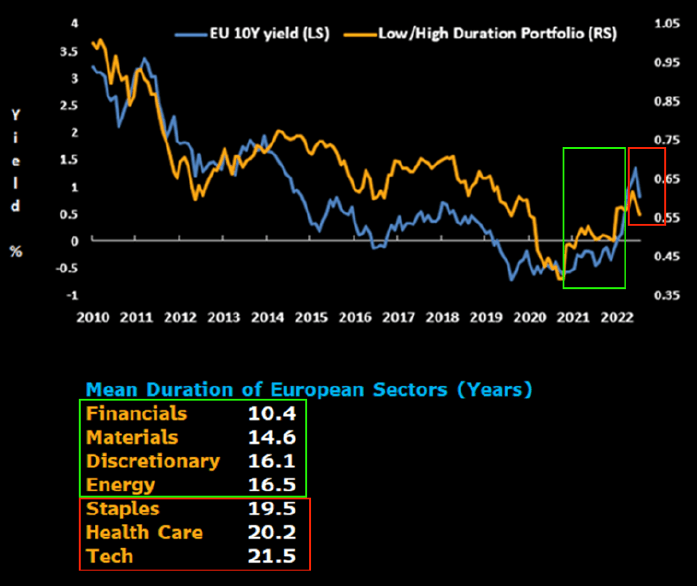

Think rates will rise? Low duration is your friend

Market implications from changes in interest rates are also evident in equity duration, where there’s a similar reversal that we believe may be fleeting. Low-duration stocks had enjoyed an extended run relative to high-duration peers, outperforming from the pandemic lows of early 2020 through this June. With the 10-year yield’s recent retreat, higher-duration shares have regained the lead so far in 3Q. If, however, interest rates start moving higher again into 4Q, as mentioned above, low-duration groups could be fundamentally advantaged once more.

Looking across sectors, banks, commodities and autos tend to have lower duration, while staples, pharma and tech are higher.

Low duration vs. 10-year interest rates

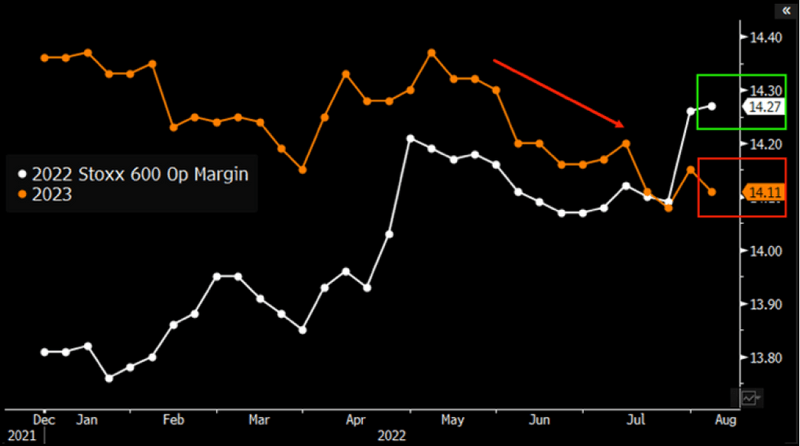

Look past 2022 margin surprise; 2023 is slipping

Though 2022 European profit margins are defying concerns about inflating costs and slowing revenue, we focus more on 2023, where estimates are slipping. This year’s positive surprise has several drivers, with the energy sector being the biggest. Without it, the Stoxx 600’s 2022 margin estimate would be stable, not up. Currency translation benefits are also a support (see more below). Beyond these factors, European companies’ ability to mitigate rising costs is surprising, especially in staples and discretionary.

We believe the trend in 2023 margin expectations is more important looking ahead, with the 30-bp decline since early 2Q the start of pressure to come. Next year is now projected to be lower than this year’s record profitability levels.

A diverging trend: 2022 vs. 2023 Operating margins

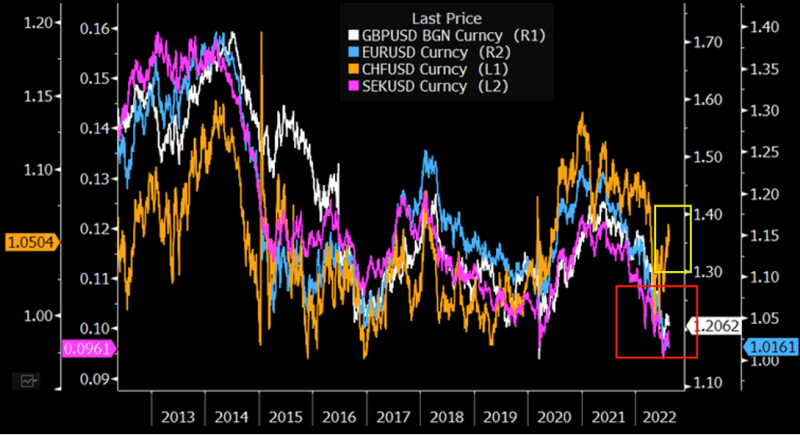

European currencies on knees, except Franc

The sharp erosion in European currencies this year is one reason why the region’s earnings appear more resilient than US peers, and with them trading at or near decade lows, this positive offset may be close to ending. The pound, euro and krona are down 15-23% from 2021 highs vs. the dollar and significantly against other currencies, too. All three geographies have substantial international revenue on an index-weighted basis (think UK energy, pharma and consumer brands; Swedish industrials; European autos and luxury goods). The euro’s year-over-year decline has bolstered Stoxx 600 earnings by several percentage points.

However, unless the currencies continue their slides to unprecedented levels, this translation benefit may be largely over. The Swiss franc is unique in its 2022 strength, which has already created a drag.

Euro, Pound, Krona and Franc vs. the Dollar

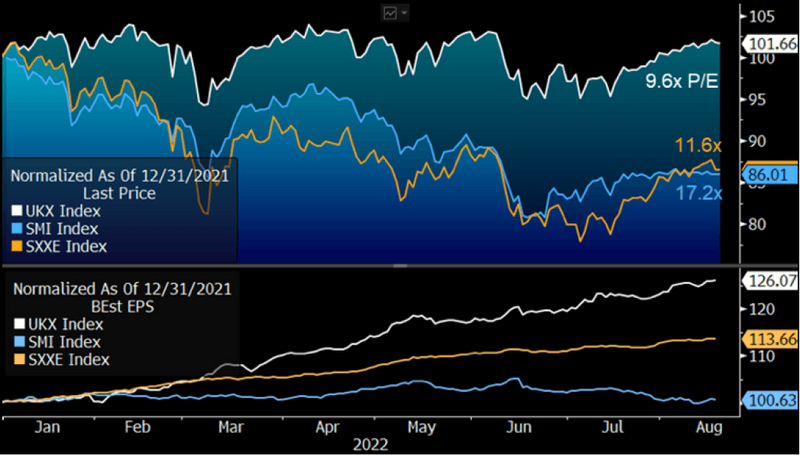

2022’s European haven isn’t Switzerland

The go-to poster child for safety amid market turmoil in Europe is usually the Swiss SMI, but this year is different, with the UK’s FTSE 100 the only stable index. As we’ve discussed several times, the differentiating factor is composition. The FTSE is a barbell with two parts. The first is cyclical, with financials and energy earnings benefiting from rising rates and oil prices. The second is defensive, with global consumer and health care aided by the falling pound. Together, these groups aggregate to 62% of the index, are propelling positive earnings revisions and help the index trade at 9.6x forward P/E.

In contrast, about 61% of the SMI is pharma and staples. These are defensive, but the strong franc is a translation-negative for revenue and earnings. What’s more, revisions are flat and the index sits at 17.2x.

FTSE 100 vs. SMI: Which is in 2022’s storm?