Clean, versatile hydrogen emerges as key decarbonization vector

This analysis is by Bloomberg Intelligence Senior Industry Analyst Will Hares. It appeared first on the Bloomberg Terminal.

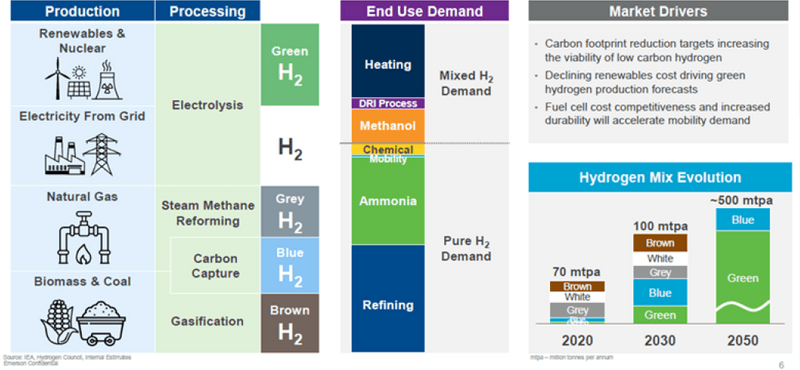

Clean hydrogen looks increasingly likely to represent one of the primary long-term decarbonization vectors as both countries and companies target net-zero emissions. This is reinforced by strengthening policy support and greater investment. Diverse end-market development underscores hydrogen’s versatility, with its application favored in heavy industries with high temperatures and hard-to-abate emissions-intensive processes (such as refining, chemicals, fertilizers, cement and steel) and, to a lesser extent, energy storage and mobility. The latter is largely driven by battery competition. Blue hydrogen may act as a bridge until lower-cost renewable power and electrolysis capacity can be deployed for green hydrogen production, which looks unlikely before the 2030s.

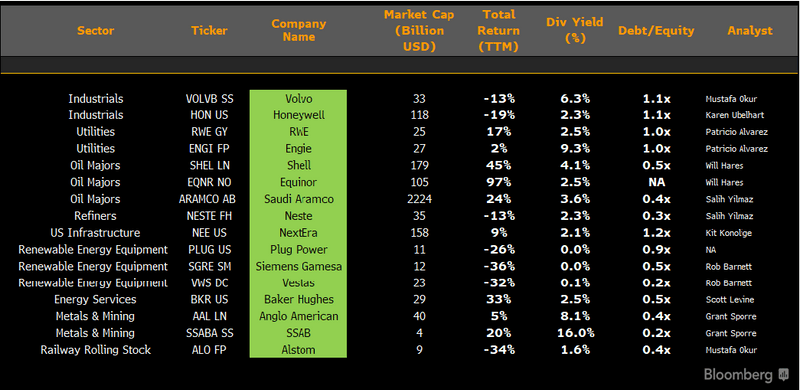

Hydrogen: Key companies to watch

Companies with hydrogen exposure

Industrial companies raising investments in hydrogen’s advance

Industrial investments in hydrogen fuels as a path to decarbonization look set to keep growing. Zero-carbon “green hydrogen” faces costs 2-3x those of “blue hydrogen”, requiring renewable energy and electrolyzer capacity to expand rapidly. The power sector will play a central role and natural gas/hydrogen-blend turbines are the most likely outcome.

Industrial-sector interest in hydrogen evolving

As interest in hydrogen as a cleaner fuel source grows, industrial companies are raising investments. Blue-hydrogen projects, requiring post-combustion carbon capture, are moving forward. Zero-carbon green hydrogen is some distance from being competitive, with its current cost 2-3x that of blue hydrogen. Declines in renewable energy costs and much higher electrolyzer production are critical; these will be achieved through technology development and building scale. In a best-case scenario, which assumes low-cost renewable electricity at $20 per megawatt hour and scaled-up electrolyzer production, the International Renewable Energy Agency (IRENA) projects green hydrogen could be competitive by 2030.

Green hydrogen could help hard-to-decarbonize sectors such as steel, chemicals and transport to approach net-zero CO2 emissions.

Snapshot of hydrogen landscape

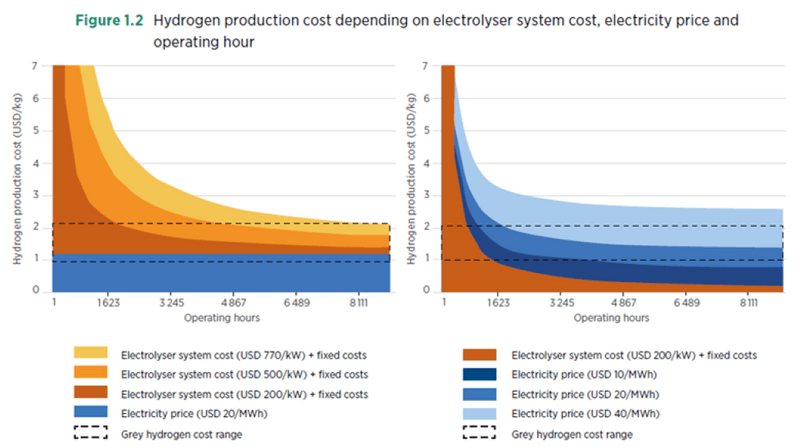

Clean hydrogen needs lower costs

Green hydrogen, 100% carbon-free, would go a long way toward achieving decarbonization in hard-to-abate sectors, yet production costs are a sizable barrier to adoption. Current production cost, about $4-$6 per kilogram, is 3-4x above “gray hydrogen”, which is derived from fossil fuels, according to IRENA. The economic case for green hydrogen via electrolyzers rests first on lower costs for renewable energy, the largest input. Wind-power costs are down 40% in the last decade and are expected to go lower. Electrolyzers, the next largest expense, may be reduced through performance enhancements, manufacturing scale and other actions, which IRENA projects could cut costs by 40% in the near term and 80% in the long term. If achieved, green hydrogen could fall below $2 per kilogram by 2030 vs. $1-$2 for gray hydrogen.

Hydrogen production costs

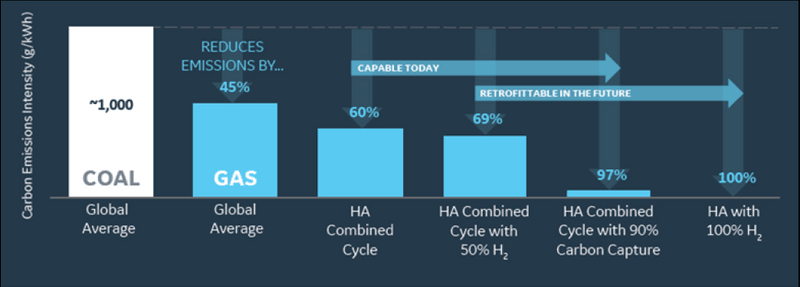

Addressing power sector is central

As the largest carbon-emissions source, 41% of global emissions according to the International Energy Agency, the power sector may be a prime user of low-carbon hydrogen (H2) fuel. Gas-turbine makers have committed to 100% hydrogen-fueled turbines by 2030, which should be attainable technologically. But the quantities of fuel needed raise worries about having adequate supply. Existing turbines can be retrofitted for hydrogen, avoiding locking in CO2 for the 25-30 year lives of power plants and eliminating big new equipment costs.

Turbines fueled by a hydrogen and natural-gas blend have been commercially demonstrated. Green hydrogen, generated by electrolysis of renewable energy and water, is a preferred option. But even with wind capacity projected to triple by 2040, fuel blends are most likely in the near to medium terms.

Gas-turbine pathway to low or near-zero carbon