WFH crushes London office needs as 45% of respondents downsize

This analysis is by Bloomberg Intelligence Associate Analyst Sirine Bouzid and Senior Industry Analyst Susan Munden. It appeared first on the Bloomberg Terminal.

A Bloomberg Intelligence survey of 500 London office workers suggests space requirements may shrink if the search for talent forces employers to comply with desired working patterns. It’s the young that overwhelmingly prefer working from home, so the pressure looks likely to intensify over time. London office commuters are more enticed by bars and shops near their workplace.

Reduced office usage may crunch demand for space

London office space usage may see a radical change as the flexibility to work from home becomes entrenched, crushing demand. Employees of businesses planning to downsize comprised 48% of our survey respondents. Yet amenities influence employees’ willingness to work from the office. Within our sample, 53% of respondents either agree or strongly agree that gyms, terraces or free meals increase office allure, while 28.5% were neutral.

GPE, Derwent London and Landsec could see stronger demand for their flexible prime sites, pushing prices well above conventionally let space in a limited supply market. In particular, GPE’s fitted and fully managed office offers generate 35% and 64% higher net rents than longer-let office space and 18% and 30% more cash flow.

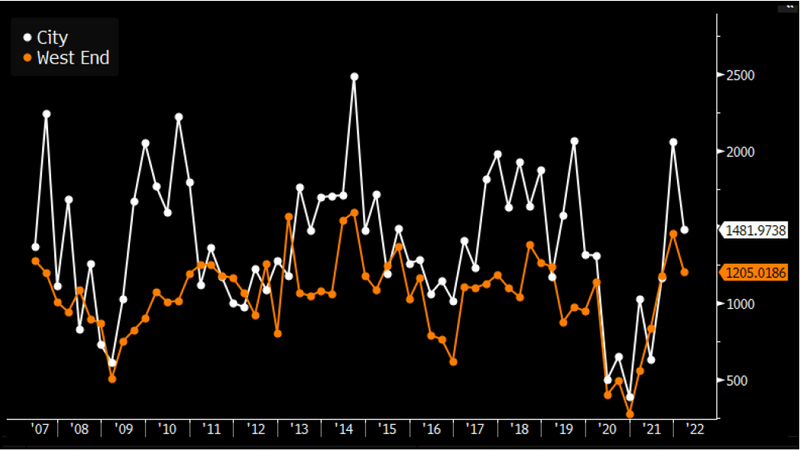

Central London office take-up, gross (000 sq.ft)

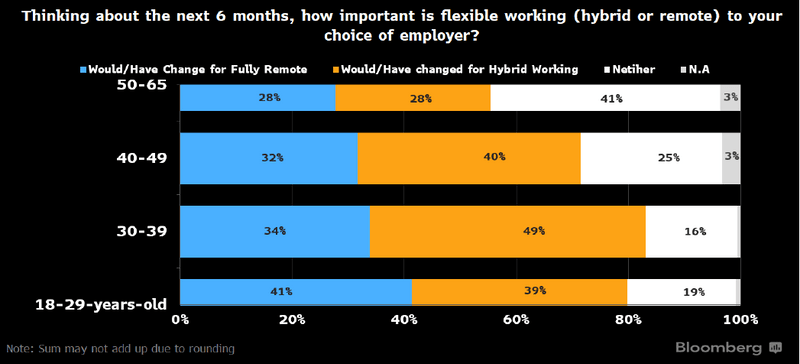

Flexible working could attract and retain London talent

London employers may need to provide flexible work arrangements in order to recruit and retain talent, our survey of 500 respondents working in London offices suggests. Most people seek flexibility in work patterns and 76% of respondents have or would change employers in the next six months to secure hybrid or fully remote work arrangements. Millennials and Gen Z may be the hardest to retain as 82% of respondents aged 18-35 would change employers. Of more experienced employees, aged 50-65, 55% of respondents are willing to do so.

As hybrid working becomes a key feature for attracting talent, it may convince employers that are providing temporary hybrid working arrangements (40% of respondents) to convert to permanent plans.

Working arrangement preferences per age group

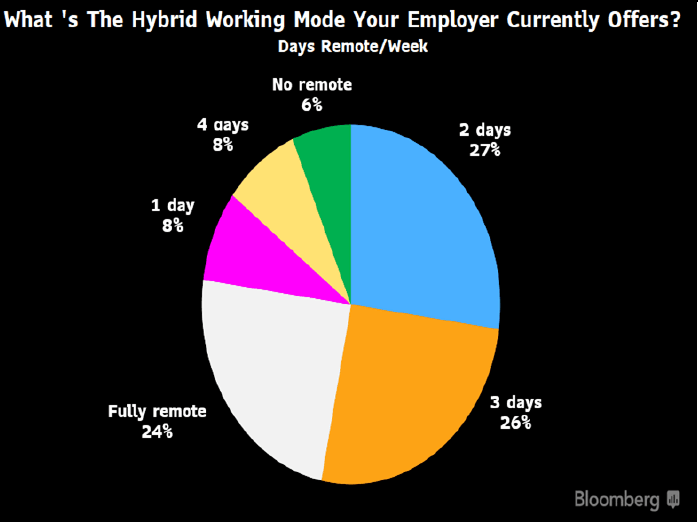

Work from home: The `new normal’?

London employers may need to rethink office spaces as hybrid working becomes the new norm, rather than a cyclical disruption, based on our survey of 500 London office employees. Working from home is widely spread in London, with 53% of respondents working remotely either two or three days a week, while fully remote amounts to 24%. Only 6.4% of employers offer no flexible working mode. A radical change in work patterns started as a result of the pandemic restrictions, yet the duration of such flexibility remains uncertain. Of the 500 respondents, 46% state hybrid working is a permanent offer; yet 18% of them expect the allowed number of days of remote work to decline.

While employers encourage a return to office, productivity may argue against, with 67% respondents feeling more productive with flexible working.

Current hybrid working mode in London

London employees aren’t rushing back to shops

London shops’ footfall may take longer to recover to pre-pandemic levels as commuters prefer hybrid working. Yet the full impact of new working practices is unclear as our survey shows conflicting results about the use of shops while at work. Respondents indicate they use shops, gyms, restaurants and bars less either due to inflation (27%), preference for online shopping (23%) or fewer commutes to London (24%). When asked about retail specifically, 49% of respondents report visiting shops near the workplace more than before the pandemic.

The flight to quality in retail space in London may boost occupancy for the best-located spaces. British Land’s retail, food and beverage offers in London are supported by their campus concepts. Landsec’s London shops began to recover in 2H21, yet remain less vibrant than 2019.

Use of shops current vs. Pre-pandemic

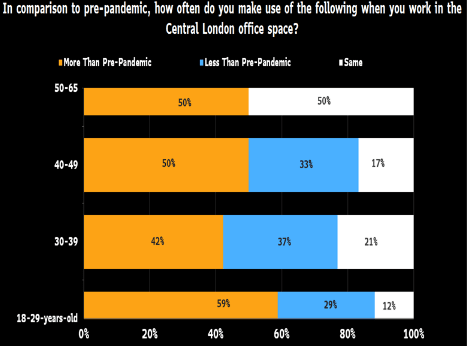

Bars and restaurants have renewed appeal

London REITs with food and beverage portfolios may see more demand for such space as London employees return to the office. In comparison with the pre-pandemic period, 62% of respondents claim they make use more of bars and restaurants when working from a central London office. Here, the driver is the older demographic, with 70% of commuters 44-65-years-old dining out more vs. 60% of people under 44. This may not last as inflation and spiking energy prices tighten purchasing power, though this may have less effect on the older demographic of London professional commuters. Inflation and economic conditions are deterring 27% of respondents.

Shaftesbury and Capital & Counties’ estates may be supported by return of international travel and tourists to London if the number of domestic visitors falls due to economic headwinds.

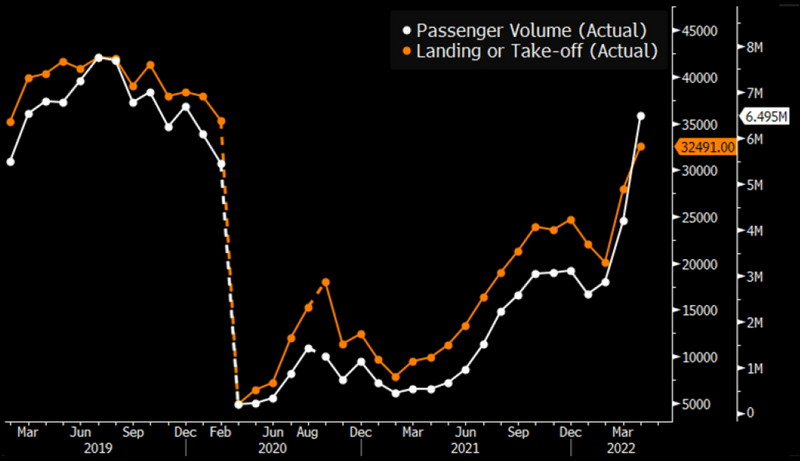

London Heathrow air traffic