Volkswagen poised to swipe Tesla’s BEV crown in race to the top

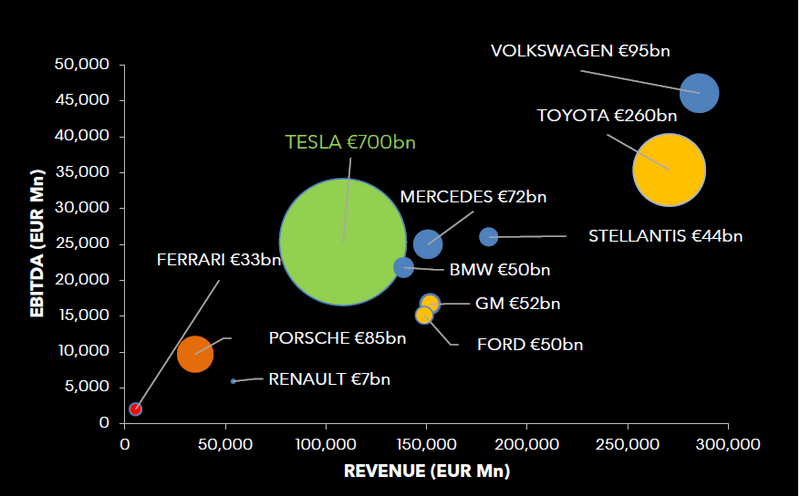

Global battery-electric vehicle (BEV) demand is likely to move at a varying pace regionally, with Tesla set to retain its global sales crown for at least another year, aided by a new EU factory. However, Volkswagen is poised to overtake the US company in 2024 and already leads in Europe. Execution will be key to encroaching on Tesla’s $700 billion market capitalization.

Global automakers will challenge Tesla via an impending wave of competing models, though profit incentives are limited amid rising battery costs and a lack of scale. That may change in 2025-26, as more legacy brands achieve critical mass on new-generation models with proprietary software. Yet such bold BEV ambitions have done little to prevent crisis-level multiples, stoked by recession fears, rising interest rates, supply-chain constraints and inflation.

Legacy automaker BEV execution lacking; uptake varies by region

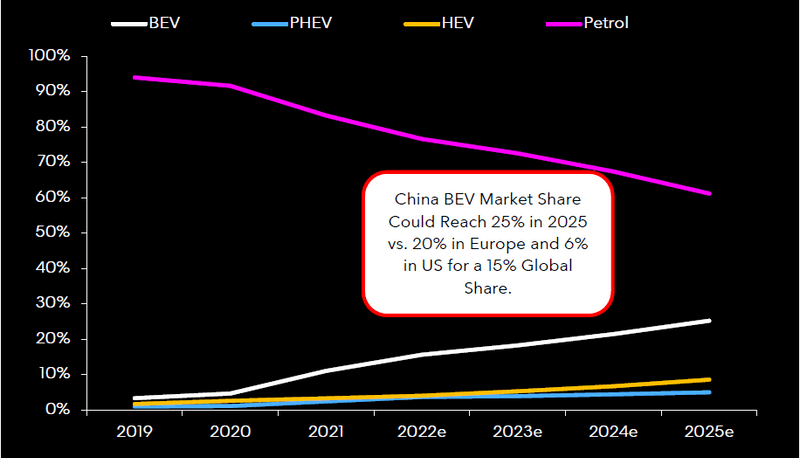

Tesla’s valuation and battery-electric vehicle sales crown are yet to be challenged by incumbent automakers, whose disappointing 1Q BEV sales mix highlights the difficulty in executing bold ambitions amid shortages, rising costs and a scramble to add battery capacity. Our scenario analysis suggests a 15% global battery electric-vehicle market share in 2025 vs. 6% in 2021.

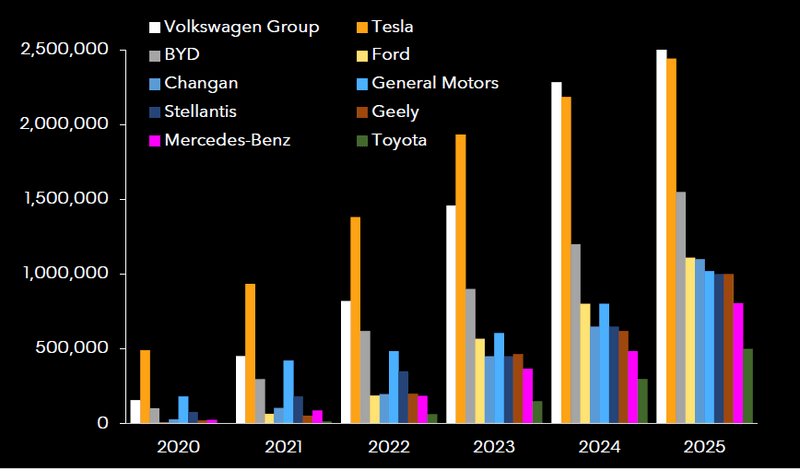

Tesla, VW Jostle for BEV leadership as peers lag behind

Tesla’s new EU capacity and buoyant global demand should enable it to retain its sales crown for at least another year, though Volkswagen is hot on its heels and could overtake in 2024. The latter already enjoys a leading market share in Europe, but this dominance needs to be replicated in other regions, particularly China, where its BEV share through April was only 3.5% vs. 15% for the overall market. China’s BYD is set to become the third-largest BEV player in 2022 and may exceed 1 million units annually in 2024.

Despite angling to be regarded as one of the leading legacy BEV brands, Mercedes’ ambitious plan to have a 50% electric vehicle (xEV) sales mix by 2025 — with BEVs comprising the majority — far outstrips its lackluster 4% mix in 2021 and 1Q. The company aims to double this figure by year-end.

BEV volume by automaker (Units)

Porsche IPO offers VW a solution to BEV spinoff issue

Legacy automakers vying to reduce the valuation gap vs. Tesla’s $750 billion market cap are unlikely to succeed in divesting BEV-related assets that are intertwined with their combustion operations, while the execution of bold 2025 plans to boost their multiples may be back-end loaded. Volkswagen is the exception: The company is on track to launch an IPO of its Porsche brand in 4Q, worth 85 billion euros using our scenario analysis employing a luxury-based multiple. Its potential 30% BEV sales mix in 2023 and more than 45% in 2025 is significantly ahead of peers and may attract a higher, more tech-oriented multiple.

German automakers — which are still jostling to be seen as the leaders of the legacy transition – only averaged a BEV sales mix of 5% in 1Q, partly explaining their low multiples despite record margin. This comes alongside recession fears, rising rates, supply-chain constraints and inflation.

2023 Sales estimates vs. Ebitda; market cap (relative circle size)

15% Global BEV sales mix by 2025; China and Europe lead

Despite the hyperbole, our scenario analysis indicates the global battery electric-vehicle sales mix will only reach 15% in 2025 vs. about 6% in 2021, with China remaining the dominant region (25% vs. 11% in 2021). Though evolving European emission legislation will enforce the accelerated uptake of electrified vehicles, the region is only likely to retain the No. 2 position globally, with a 20% market share in 2025 (or about 3 million units) vs. 9% in 2021.

The US and other areas will lag behind, with the former’s BEV share expected to hit 6% in 2025 vs. 3% in 2021. Our scenario assumes that ambitious battery-production-capacity plans are achieved amid supply constraints and inflationary pressure.

China’s sales mix by Powertrain