How to analyze, create, and risk-manage ESG-linked structured products

This article was written by Nitin Ananda, Global Product Manager for Structured Products at Bloomberg.

Environmental, social and governance (ESG)-linked structured products issuance has surged in recent years, going from zero to around $10-15 billion, partly driven by investors looking to customize their exposure to ESG factors. This sharp increase reflects a wider trend: there were over $35 trillion ESG assets under administration in 2020, a number estimated by Bloomberg Intelligence to exceed $50 trillion by 2025.

While none would doubt that ESG going mainstream is great for the planet, an overarching anxiety hangs over this period of dizzying growth. ESG investments, be they structured products or more vanilla instruments, are only as sound as the data that feeds them. Without reliable and comparable data sets, investors are sailing blind, vulnerable to greenwashing and dependent on divergent standards and anecdotal evidence to orientate their investments. Fund managers may also struggle to explain why they have taken certain decisions from an ESG perspective, which can lead to investor criticism.

Many jurisdictions are already making concerted efforts to improve data quality, consistency and availability. In the EU, for example, regulations such as the Sustainable Finance Disclosures Regulation (SFDR), the Corporate Sustainability Reporting Directive (CSRD), and the EU Taxonomy tighten disclosure requirements and help standardize definitions of what constitutes green. Other areas of the globe, like APAC, are working on their own taxonomies. Until there is more clarity on what constitutes green finance, ESG-focused investors will still have to contend with greenwashing complications.

ESG considerations aside, investors also face the usual difficulty that accompanies structured products: firms that lack the appropriate analytic tools to price structured products satisfactorily may struggle to fit them into a portfolio. Moreover, in the post-trade space, non-tier one, sell-side market makers have typically struggled to build effective risk management tools. Most vendor solutions contain significant gaps and building a system internally can often take years and be prohibitively expensive.

Data availability and quality: Positive evolution

Thankfully for ESG-focused investors, financial markets are in a green data revolution, spearheaded by companies such as Bloomberg, which has made transparent ESG data a priority for over a decade.

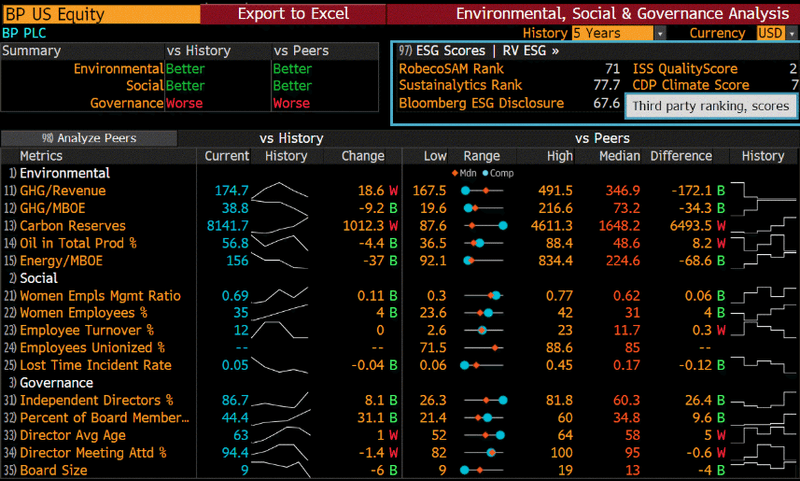

Bloomberg provides ESG data for almost 12,000 firms and over 410,000 securities in more than 100 countries with more than 15 years of historical data. Bloomberg’s ESG data can be consumed on the Terminal through the same screens and tools that investors use every day, creating a streamlined workflow to better incorporate ESG considerations. For example, some of the Terminal’s popular tools for equity screening, like EQS, now have customized ESG searches to filter companies based on their score.

In addition to company-reported, proprietary and third-party data, Bloomberg’s sustainable finance offering includes carbon estimates, scores, indices, research and news to help investment companies and corporations better evaluate their assets under management, capital allocation, lending and reporting on sustainability disclosure requirements and performance.

Pre-trade analytics and structured products creation

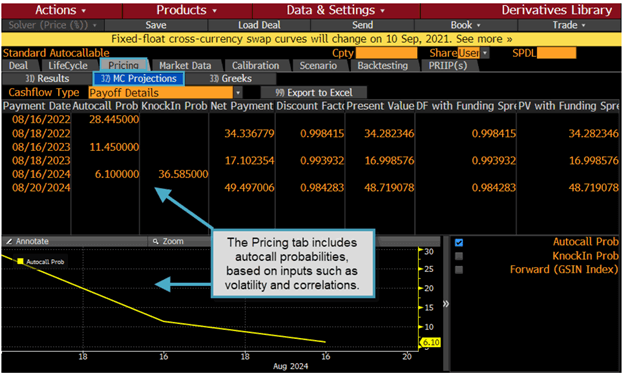

Once investors have pinpointed their ESG interest areas using reliable data, the next step is to run the appropriate pre-trade analytics to capture the full range of market risks. This can be accomplished via Bloomberg’s Derivatives Library (DLIB) platform, which handles valuations, back testing, and Monte Carlo projections, as well as other functions.

Since Bloomberg data is available over API and Excel, investors can combine ESG data with other variables on DLIB to gain a broader understanding of a given company’s ESG profile and create powerful pre-trade and post-trade tools. For example, Bloomberg’s Governance scores look at Board Composition and Executive Compensation for over 4,500 companies – two factors that can have a material impact on a company’s performance. Investors can integrate these Governance scores into structured notes analytics.

Investors could also start with the S&P Index and filter companies based on benchmark scores or ESG indicators. They could then use the smaller subset of filtered underlyings in DLIB’s Excel Autocallable basket optimizer tool to find the best combination of companies that match their appetite for high coupon or reduce downside risk.

Post-trade analytics

Investors may also wish to obtain and aggregate individual ESG factors to assess their portfolio performance with respect to their own ESG metrics. This final step in the ESG-linked structured products journey can be especially daunting for firms without the appropriate suite of post-trade analytic tools.

On this front, Bloomberg’s Multi-Asset Risk System (MARS) enables portfolio managers to understand the net exposure of ESG factors on their portfolio, and monitor the value of their portfolios on demand with live real-time data, analyze their term-structure risk and investment decisions, and perform intraday lifecycle and cash flow management. All on a single and integrated platform.

As the ESG revolution continues to gather momentum, structured products investors need three components to stay on top of the wave: good data, good pre-trade analytics and good post-trade analytics. Bloomberg helps firms not only to manage these new imperatives, but also to integrate sustainable finance considerations into their strategic decision making with its unique and comprehensive suite of ESG data and solutions.