Consumer staples’ valuations are extreme, even compared to bonds

This analysis is by Gina Martin Adams, Director of Equity Strategy, Chief Equity Strategist and Michael Casper, Equity Strategist. It appeared first on the Bloomberg Terminal.

Consumer staples companies’ high multiples appear vulnerable to volatile — but slow — earnings conditions amid inflation pressures. The sector is now pricey compared to bonds with a dividend yield 50 bps lower than the 10-year Treasury yield, and the group’s premium to the index and vs. the rest of its sectors is extreme.

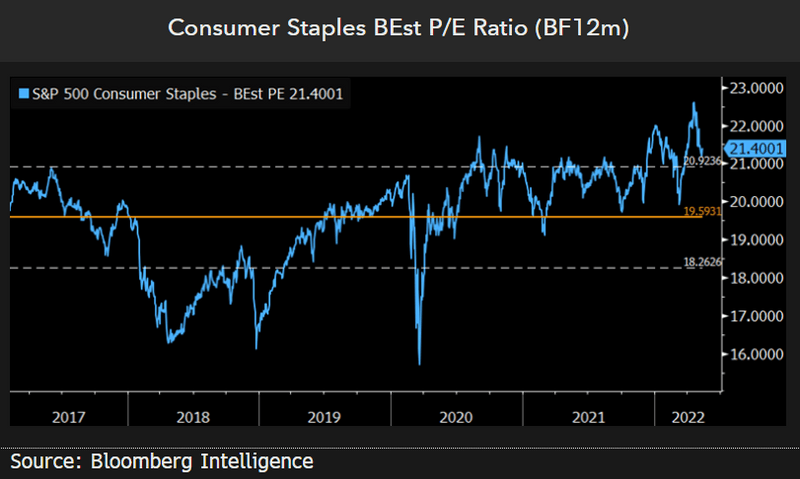

P/Es lofty as investors run to defensive staples

The forward P/E of the S&P 500’s consumer staples sector has gotten elevated since the market downturn began, though the group’s EPS growth prospects don’t show nearly as much resilience as most would hope. Staples trade at 21.4x forward earnings — 1.3 standard deviations above the five-year average but 1.2 turns below the group’s late-April peak multiple. Sector EPS growth is forecast to trail the benchmark by an average of 600 bps through the rest of 2022, including a 0.7% drop in 2Q, suggesting multiples could fall more in-line with the group’s 19.6x recent average as long as the defensive market sentiment wanes.

Costco, Brown-Forman, Church & Dwight, Clorox and McCormick have the highest forward P/Es in the sector. Walgreens Boots Alliance, Altria, Tyson Foods, Molson Coors and Kroger have the lowest.

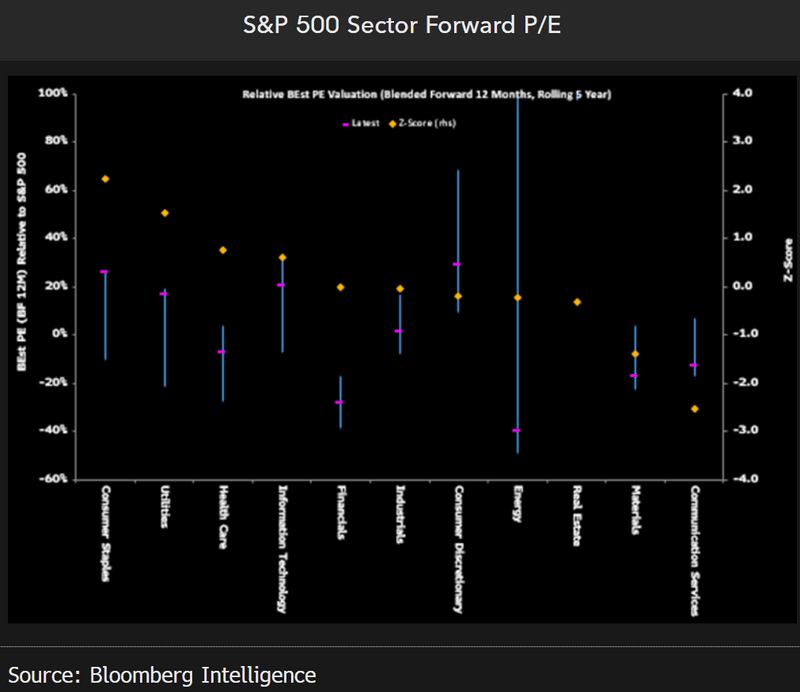

Staples is most expensive of all 11 GICS sectors

Relative to the S&P 500 and the other 11 GICS sectors, consumer staples is the most expensive and valuations seem unlikely to budge unless a more risk-on sentiment emerges. The sector carries a 25.8% premium to the S&P 500 on a forward P/E basis — 2.2 standard deviations above its five-year average 5.7% premium. Other defensive sectors like utilities and health care have joined staples atop the sector-valuation heap as investors sought the relative safety of their stocks amid the current correction.

Only 28% of stocks in the sector carry discounts to the five-year average, with the greatest discounting in Estee Lauder, Tyson Foods, Walgreens Boots Alliance, Altria and Monster Beverage.

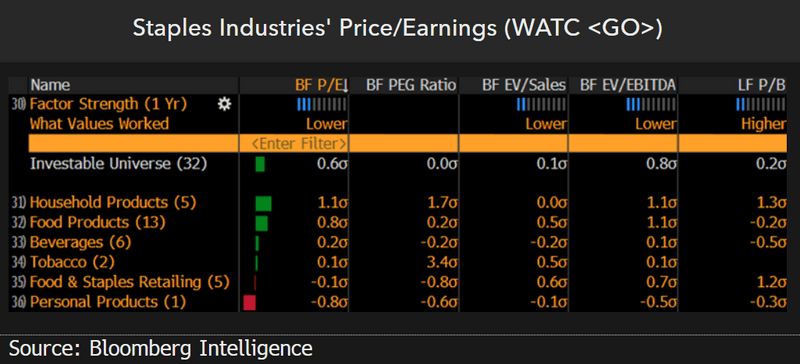

Household products, food driving sector premium

The household products and food products industries are driving consumer staples’ premium, while personal products and food & staples retailing are the cheapest. On a forward P/E basis, household products trade the most above the five-year average (1.1 standard deviations), followed by food products (0.8). Beverages (0.2 standard deviations) and tobacco (0.1) trade closer to average. Conversely, personal products (minus 0.8 standard deviations) is the cheapest relative to recent history, while food & staples retailing (0.1 below) also carries a discount.

On a price/book basis, only household products (1.3 standard deviations) and food & staples retailing (1.2) trade at a premium, though beverages (0.5 below), personal products (0.3 below) and food products (0.2 below) are within a stone’s throw of average.

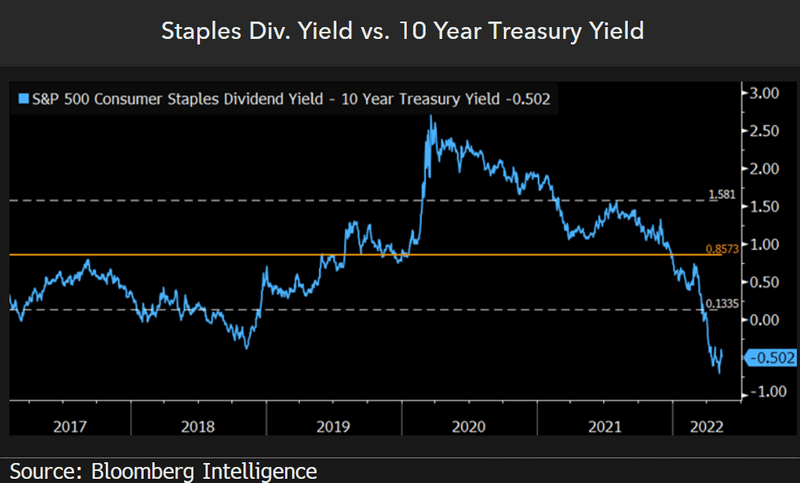

Even versus bonds, staples is expensive

More than 70% of constituents in the S&P 500’s consumer staples sector have dividend yields lower than the 10-year Treasury, suggesting the group is expensive to bonds. Staples carries a 2.43% dividend yield, 50 bps lower than the 10-year Treasury yield of 2.9%. This is 1.9 standard deviations above the five-year average of 89 bps, mainly due to the strong resurgence in the 10-year as staples companies held ground during the equity onslaught.

Only 29% of sector constituents carry dividend yields greater than the 10-year Treasury yield, including Altria, Philip Morris, Walgreens Boots Alliance, Kraft Heinz and Conagra. Costco, Estee Lauder, Church & Dwight, Brown-Forman and Constellation Brands have the lowest dividend yields.

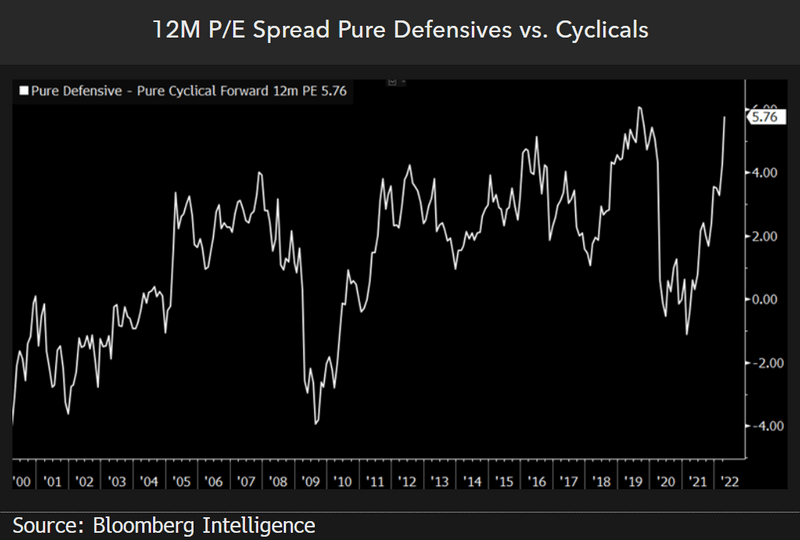

Defense is commanding near-record premium

Fear is prevalent in the equity market, with defensive sectors’ multiples starting to look extreme relative to cyclical-sector valuations. The spread between the median forward 12-month P/E for pure defensive sectors (utilities and staples) vs. pure cyclical sectors (financials and industrials) reached 5.7x this month — the third-highest level on record since 2000, surpassed only in August and September 2019. Utilities and staples are trading over two standard deviations above their 20-year average forward P/E multiples, while industrials and financials only slightly surpass average levels.

The forward P/E for stocks in the S&P 500 utilities sector is 20.7x and staples is 22x, while the median forward P/Es for financials and industrials are 13x and 18.2x, respectively.