This analysis is by Bloomberg Intelligence Senior Market Structure Analyst Sean Savage. It appeared first on the Bloomberg Terminal.

There’s a need for more intermediation in the repo market, given high demand for collateral and growth in Treasuries outstanding as the Federal Reserve tightens policy. The Fixed Income Clearing Corp.’s (FICC) delivery vs. payment (DVP) repo should scale, aiding liquidity and market resiliency, given it’s centrally cleared.

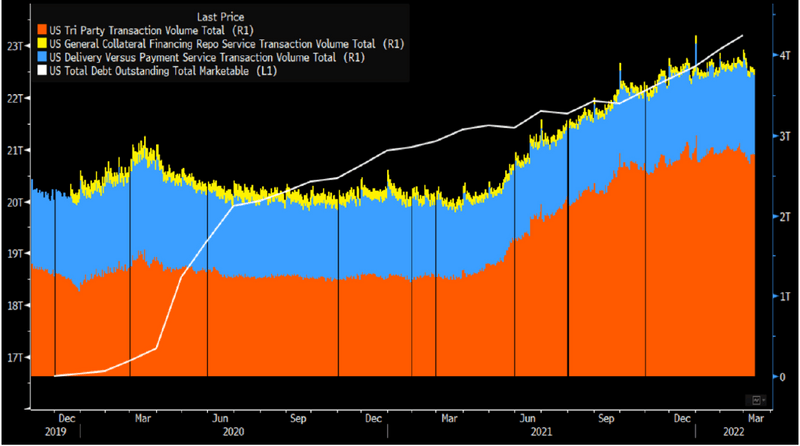

Treasury market growth outstrips repo; more funding needed

Growth in Treasury-backed repo has long lagged that of the outstanding collateral. This imbalance was exacerbated by the pandemic, which necessitated massive growth in the latter — given fiscal stimulus to fight the pandemic — and comparatively less expansion of the former. We think this mismatch, combined with the gradual reduction in the Fed’s balance sheet, should boost private sector intermediation in repo markets. While we expect some of this to come via dealers, regulatory constraints may limit their ability to fully flex their repo books in response to increased demand. Thus, other sources — such as FICC’s DVP — stand to see increased use.

The Fed’s RRP will remain large well after balance sheet runoff begins, though.

Repo market volume, treasuries outstanding

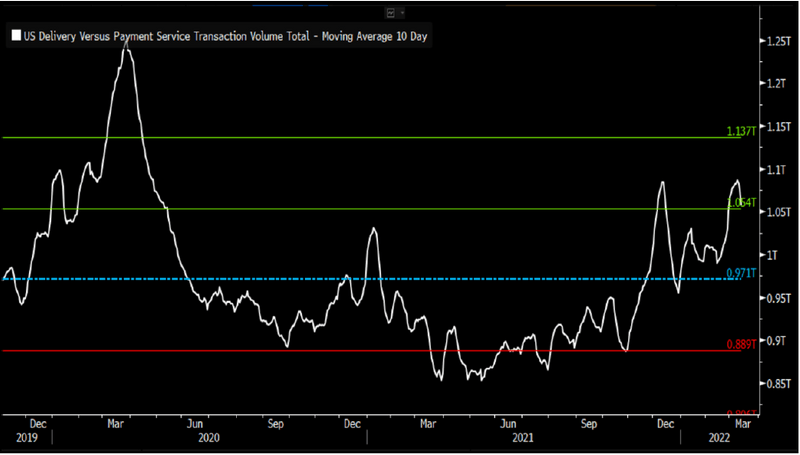

Cleared repo growing as Fed steps back

We’ve long argued that FICC’s DVP repo service, which typically serves as an additional source of repo market liquidity when some banks shrink balance sheets around month and quarter ends — was poised for more growth as the Fed tapered its asset purchases and prepares for balance sheet runoff. Recent months have borne this out: volume has grown substantially, though it remains below its early-Covid-19 peak.

Still, we expect further growth as the need for more intermediation in funding markets grows. DVP is also a key venue for sourcing specific securities, so each time there’s a scramble for collateral, whether Fed-induced or stemming from geopolitical or other factors, FICC’s DVP should get additional business. As it scales, this will support broader repo market resiliency as this activity is centrally cleared.

FICC DVP repo

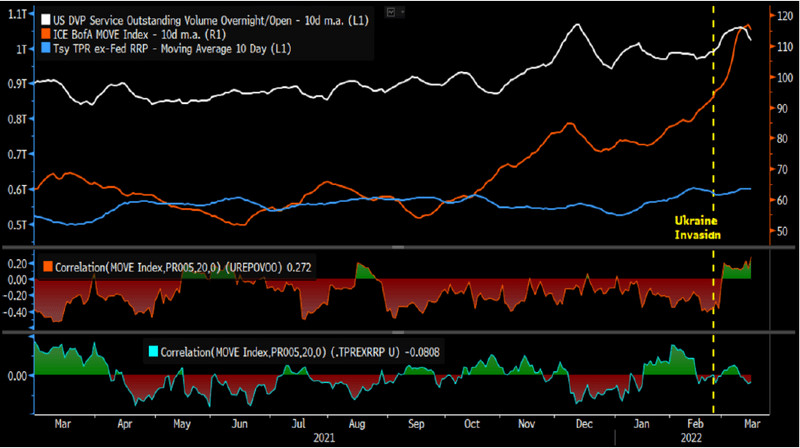

Centrally cleared repo boosted amid recent volatility

Centrally cleared repo not only benefits broader repo (and cash) market resiliency, but can be an additional source of repo market liquidity amid volatility. Consistent with this, FICC DVP repo rose notably after the invasion of Ukraine, while dealers’ triparty repo — where they fund their Treasury inventories — was little changed (top panel). This led to the correlation between changes in DVP and in volatility shifting sharply positive (middle panel). While not necessarily causal, this is consistent with FICC DVP being an increasingly important source of liquidity for repo market participants amid volatility.

To the extent that markets remain in a higher volatility regime — not unlikely given Fed tightening, high geopolitical risk and increased uncertainty over the macroeconomic outlook — DVP repo should grow further.

FICC DVP repo, dealer triparty & rate volatility