This analysis is by Bloomberg Intelligence Senior Industry Analyst Henik Fung. It appeared first on the Bloomberg Terminal.

Saudi Aramco’s revenue swing during the pandemic suggests the importance of the company’s diversification into Asia’s downstream business, the driver of global petrochemical demand, to sustain its long-term growth outlook and enhance earnings visibility. The company could reinforce cooperation with China and South Korea’s refineries.

Downstream strategy starts to deliver results

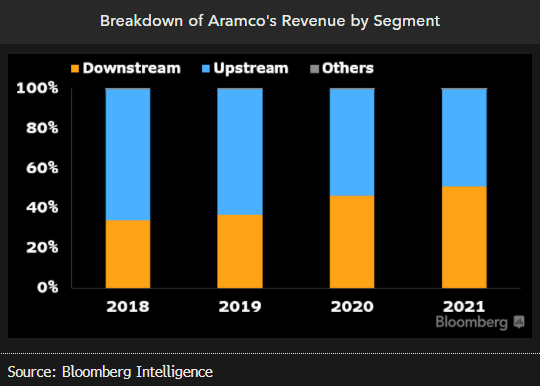

Fuel-efficiency improvements and faster-than-expected adoption of electric vehicles (EVs) cloud the long-term oil-price outlook, with falling energy intensity and the EV threat set to drag on global oil demand from 2025. As Aramco is an upstream-heavy company, over 90% of its earnings are contributed by exploration and production. Management has consequently adjusted the company’s strategy to reduce overreliance on oil revenue, attempting to ramp up its presence in Asia’s downstream sector. Recent oil-price volatility in the Covid-19 era and as the virus has become more manageable underscores the importance of diversification: upstream’s share of total sales fell from 66% in 2018 to 48.7% in 2021. Upstream’s share could keep falling in 2022, we believe. S-Oil and Sinopec are Aramco’s key partners in Asia.

Aramco may look east for growth engines

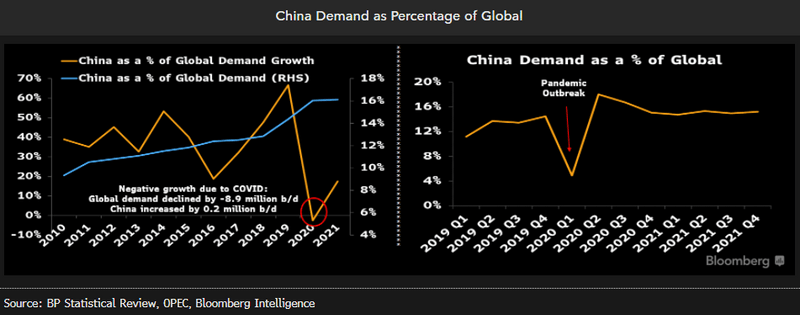

Asia consumed 36.6% of global oil production in 2021 and drove global demand growth while developed markets faltered during the peak of the pandemic in 2020. Global oil-demand growth looks set to slow from 2025, mainly because of sluggish developed-market demand and electrification of vehicles, and crude consumption by Asia’s petrochemical sector will become key to supporting oil-demand growth. Saudi Arabia exported 70% of its total oil production in 2020 with 25% of the exports going to China, and 27% in 2021. It may want to direct more sales there as China could generate more than 50% of global demand growth after 2022. Petrochemicals are the bright spot, and will drive the bulk of China’s oil demand after 2022, when most of the country’s major petrochemical projects are fully utilized.

Asia capacity additions stress light products

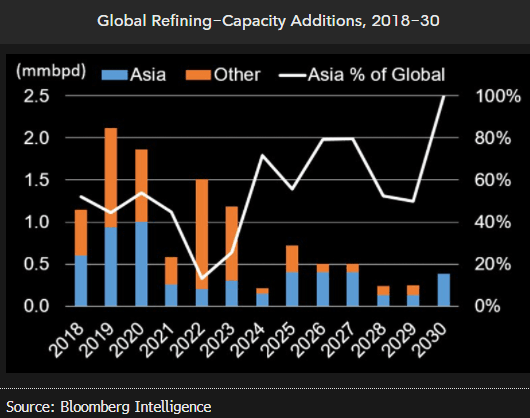

Global refining capacity will increase by more than 11 million barrels a day by 2030, a compound annual growth rate of slightly more than 1%, our analysis suggests. Although demand destruction induced by Covid-19 could delay capacity additions from 2020 to 2023, China’s refining-capacity additions remain on schedule while those of major global refiners look uncertain. Refining capex pulled back by corporates in 2020 may return in 2H22, however. Half of planned additions are greenfield projects in Asia, and are likely highly complex in order to meet the region’s continuing growth in demand for naphtha, a major chemical feedstock. A number of complex crude-to-chemical operations have been announced in China and Southeast Asia.

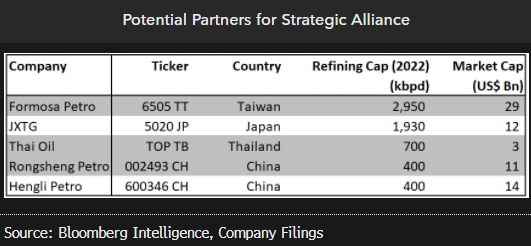

Allying with customers best way to secure demand

Buying equity stakes in downstream refiners is a logical step for Aramco to secure long-term demand for its oil, and the company has already taken stakes in an integrated petrochemical complex in China’s Zhejiang and in India’s Reliance to broaden its crude distribution channels and maximize marginal return. Given its low earnings exposure downstream, Aramco may need to build more positions in its petrochemical portfolio in Asia, and it’s a good match for countries with oil deficits. We see a number of candidates for a strategic alliance in Japan, Taiwan, Thailand and mainland China. Apart from securing demand, Aramco can increase its exposure to Asian chemicals through such partners.