This analysis is by Bloomberg Intelligence Litigation Analyst Matthew Schettenhelm and Industry Analyst Paula Penkal. It appeared first on the Bloomberg Terminal.

The America Competes Act’s $52 billion for semiconductors favors Intel, with TSMC and Samsung also poised to benefit, and with the war in Ukraine adding urgency, we give the legislation about a 60% chance of becoming law. Bipartisan passage in the Senate and President Joe Biden’s support are clear signs that this sharply divided Congress will come together to enact a compromise measure that includes the funding this year.

Intel well-positioned in U.S. bid to keep semiconductors at home

The America Competes Act, which aims to onshore chipmaking and reduce U.S. dependence on Asia’s manufacturers, is more pressing in light of Russia’s war in Ukraine. The act’s $52 billion for semiconductors targets the leading edge and likely favors U.S.-based Intel, though TSMC and Samsung may also benefit given their dominance in advanced technology.

Russia-Ukraine conflict an impetus to act fast

The Russia-Ukraine war heightens the sense of urgency for the U.S. to strengthen its semiconductor supply chain through the America Competes Act. Russia consumes only 0.1% of global semiconductor revenue, so the direct impact of U.S. sanctions on chip makers may not be immediate. A protracted war, however, may intensify an already-strained supply chain since Russia and Ukraine are big exporters of palladium and high-grade neon gases used in chip manufacturing.

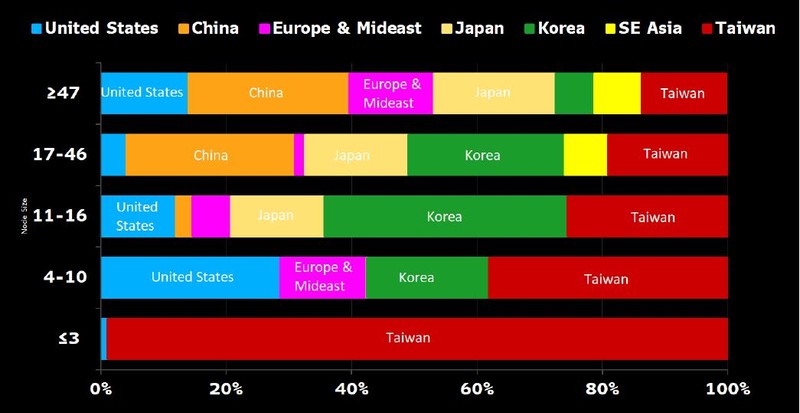

Attention on the war could slow the act’s passage. But we believe the crisis heightens awareness of global geopolitical risk, especially in Taiwan, where TSMC makes 80% of leading chip nodes, and could encourage swift approval.

Node capacity by region: Taiwan in focus

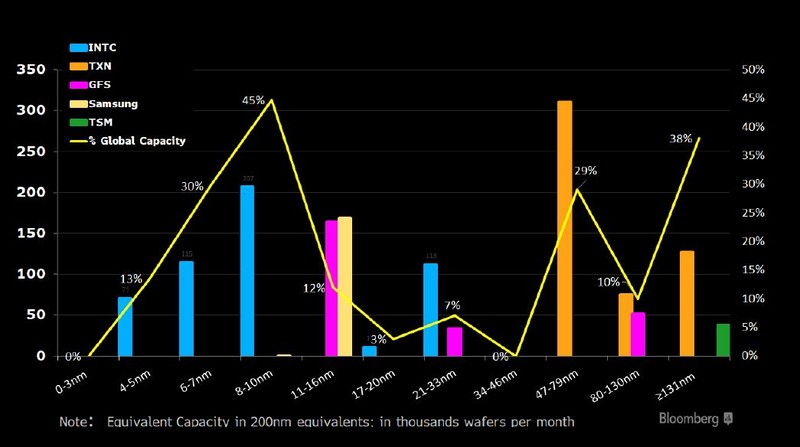

Manufacturers on cutting edge to benefit most

Intel, Taiwan Semiconductor (TSMC) and Samsung could be the big winners in the America Competes Act, as the measure targets advanced tech used in highly sensitive applications for aerospace-defense, data centers and telecommunications. TSMC and Samsung, leaders in making cutting-edge process nodes, have plans to build U.S. capacity for 10-nanometer or smaller chips. But that pales next to Intel’s $20 billion-plus mega-fab investment, which may qualify for a larger allocation. The aid could fast-track Intel’s development of 5-nanometer nodes, which have strategic importance to U.S. national security.

Texas Instruments and GlobalFoundries may also benefit from the act, which reserves $2 billion for mature technologies used in autos, industrials and Internet of Things applications, where the most acute shortages are found.

U.S. process node capacity vs. % Global capacity

$52 Billion would boost U.S. cost competitiveness

Even as prospective new funding for semiconductor manufacturers is a solid first step to making the U.S. more competitive, it may not be enough to close the gap with rivals in Asia. Constructing chip factories — or fabs — in the U.S. costs 25-50% more than in Asia, largely due to fewer government incentives. Taiwan, South Korea and Singapore subsidize 33% of upfront construction costs on average vs. only 10% in the U.S. Intel said new subsidies could cover 10-30% of new construction costs, and while 30% is a reach, it still wouldn’t close the cost gap.

Higher operational expenses and stringent regulations could counteract some of the act’s benefits as well, and we believe longer-term government policy may be needed to drive the new capacity commitments intended by the bill.

Estimated government incentives across locations

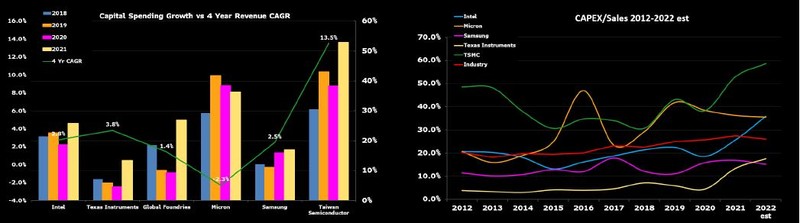

Competes act supports spending-led revenue gains

Revenue growth could increase substantially over the next decade for TSMC, Intel and Samsung on the back of capital spending gains that are slated to outpace the broader semiconductor industry. Heavy demand for advanced logic chips, along with supply shortages, has led to rising capex to build new fabs. TSMC and Intel will spend upward of $70 billion in 2022, a 37% annual increase over already-high 2021 levels and outpacing the 14% growth estimated for the industry. Capex largely concentrated among TSMC, Intel and Samsung positions them for a greater share of market growth than counterparts in the memory and analog space, which are taking a more cautious approach to building factories.

The America Competes Act may drive some of the new capital investment in foundries to the U.S.

Capital spending 2007-21