Fundamental Review of the Trading Book (FRTB): Where do we stand?

This article was written by Joe McHale and Christian Benson, Regulatory Affairs Specialists at Bloomberg.

Complex and large-scale regulatory changes famously take time and it is never too early to begin preparations. In this context, with regulators preparing to draw up final rules for implementation, Bloomberg Regulatory Affairs Specialists run through what is known so far on the current state-of-play when it comes to the Fundamental Review of the Trading Book (FRTB).

What is FRTB?

First introduced in the aftermath of the 2008 global financial crisis, the FRTB is a global set of rules specifying the minimum regulatory capital requirements that apply to banks’ wholesale trading activities. The rules are designed to prevent the kind of systemic losses that were seen on trading books in the wake of the financial crisis.

A central theme – and indeed challenge – of FRTB is the boundary between the trading book and the banking book. The rules aim to distinguish between assets intended for active trading as opposed to assets expected to be held to maturity, usually customer loans. It will also tackle the risk of market illiquidity and the use of expected shortfall – as opposed to value at risk – as a measure of risk under stress, ensuring banks capture tail risk events. As a result, banks will be required to calculate a significantly more complex and risk-sensitive Standardised Approach (SA) than in the past.

Background

The Basel Committee on Banking Supervision (BCBS) introduced a set of revisions to the market risk framework in July 2009. This was an immediate response to the global financial crisis that had exposed the framework’s weaknesses in ensuring that banks can survive unexpected losses arising from their trading activities. These reforms were designed to increase capital for trading book activities and became known as ‘Basel 2.5’, but they were only a quick-fix, and they soon led to a more fundamental review of the trading book regime. The first FRTB proposals were published for consultation in May 2012.

The FRTB rules were finalized in January 2016 and implementation was originally set for January 2019. However, this date was pushed back until 2022 once it became clear that the industry needed more time to implement the changes and to absorb much higher capital requirements. Then in early 2020, the Basel III implementation date was delayed again until January 2023 because of the onset of the global pandemic.

What will the impact of FRTB be?

Given the technical complexity of the requirements FRTB will impose, the market has seen a sustained period of anticipation and preparation, as banks develop their processes and systems. Once adopted, the FRTB rules are expected to significantly drive up the capital that large banks must hold against trading many products, in particular products that are illiquid or have risk profiles that are difficult to benchmark, such as derivatives. Risks that are not backed by enough data will be considered “non-modellable” and this will create added costs.

The treatment of fund and index exposures under FRTB remains a particular concern for banks. FRTB will require funds to make frequent holdings data available to measure fund risk via the ‘Look Through’ (LT) approach, which assesses positions based on their underlying constituents. If a desk does not apply the LT approach, FRTB allows for other approaches such as the Index Benchmark approach, Mandate approach, or bucketing the sensitivity arising from exposure to a fund into the “other sector” bucket. While these alternative approaches might seem simpler, according to a Bloomberg survey, banks tend to prefer an LT approach, and this requires accurate and robust fund data.

Compliance costs associated with FRTB reporting are substantial, as regulators have been clear that they want metrics to be reported desk by desk, versus in aggregate across the entire institution. While the Basel guidelines are neutral between the use of the internal model approach (IMA) versus the standardized approach (SA), the implementation of FRTB is expected to result in a shift from a system of banks using the IMA to a SA where the regulators give the banks the relevant parameters. As such, policymakers are keen to ensure that the SA becomes more granular and more sensitive.

Implementation challenges

As with all Basel agreements, FRTB is a non-binding international agreement, with individual jurisdictions left to transpose the agreement into domestic law. Part of the complexity for banks is that the process to implement the international standards takes place according to different timelines depending on the jurisdiction, and the supervisory dialogue with the industry will vary. For example, it takes the EU considerably longer to agree to legislation than it does for the Federal Reserve to finalize a rulemaking.

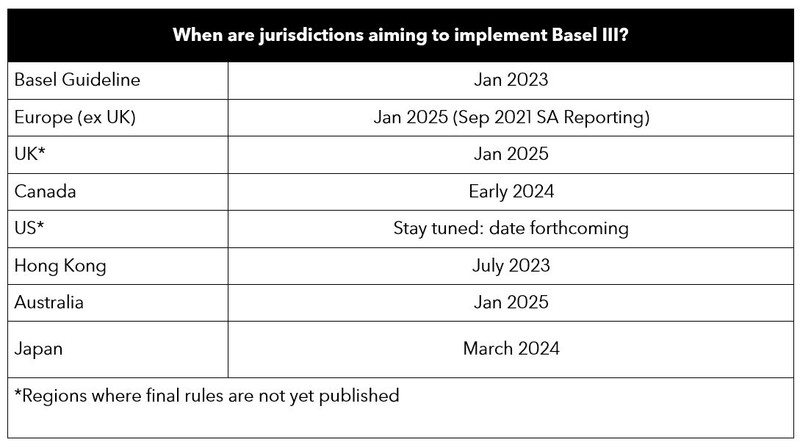

Although the agreed international implementation date is January 2023, the EU and Australia have both confirmed that they are aiming for a 1 January 2025 go-live date. The Japanese FSA has also decided to push back their implementation of Basel III until March 2025 for regional banks. More jurisdictions are expected to issue their proposals later this year.

Implementing FRTB: Where is the EU?

The EU was one of the first jurisdictions to release draft legislative proposals to complete the full implementation of Basel III. It announced the Commission’s ‘banking package’ in October 2021, which amends the existing Capital Requirements Regulation (CRR) and the Capital Requirements Directive (CRD). As with several priority policy initiatives, such as sustainable finance and digital issues, the EU wants to be seen as the global standard-setter and this partially explains why it has been so quick to outline its proposals, relative to other jurisdictions. The other reason is that the legislative process within the EU takes much longer to complete than other jurisdictions, as the proposal needs to be agreed upon by both the EU Parliament and Council.

While the EU’s proposal is in many respects “faithful” to the original Basel III accord, there are areas in which it is proposing to diverge to account for the specifics of the EU banking sector. Examples of this divergence include a lower risk weight for carbon trading, detailed governance and control requirements for the alternative standardized approach, and the ability for the EU Commission to amend market risk requirements to ensure a level playing field internationally. Moreover, the EU’s proposed January 2025 implementation represents a two-year delay to the Basel go-live of January 2023.

As part of its work to implement FRTB, the EU has already implemented reporting requirements for the standardized approach (SA) under CRR II, and draft rules drawn up by the European Banking Authority (EBA) on the internal models approach (IMA) are currently awaiting adoption – triggering a three-year waiting period before application. As such, it is unlikely to be until early 2025 before institutions can calculate their own funds requirements for market risk using their internal models. This will be around the same time that CRR III will begin to apply.

Implementing FRTB: Where are the UK & US?

Given the dominance of New York and London for wholesale trading book activity, the US Federal Reserve and the UK’s Bank of England (BoE) are both key players in the technical development of FRTB policy. Considering the depth of the UK-US relationship on financial markets, with London and New York two highly sophisticated global financial centers, and the close working relations between the BoE and the Federal Reserve, market participants can expect tight alignment between the two jurisdictions on their FRTB policies that reflect the original Basel standards.

In the US, proposals to implement the remaining elements of Basel III, including provisions on market risk, are expected to be released in the first half of 2022. While the Fed may be taking the lead, implementation on the project requires a coordinated effort with the other US bank regulators (the OCC and FDIC). Joint rulemaking activities, particularly regarding one of such importance, can take time and requires the support of three separate agencies acting in concert. While the agencies expect to put out a proposal that is generally consistent with the BCBS standards, the timing is still somewhat uncertain. And while additional delays can be brought about by the turnover in personnel flowing from the recent change in administration, banks should not delay their own preparation as there will be a period for industry feedback and the Fed will require hypothetical portfolio exercises to build a picture of industry readiness prior to implementation.

In the UK, proposals to implement the remaining elements of Basel III, including provisions on market risk, are expected to be released for consultation in the second half of 2022. As such, the Basel go-live of January 2023 is unlikely to be met by the UK and the current implementation date for Basel III in the UK is “post-March 2023”, according to the latest version of the UK’s Regulatory Initiative Grid. Senior UK regulators expect that the FRTB rules will come into force around the same 1 Jan 2025 deadline that the EU is working toward.

In terms of what we know so far about differences between the UK’s implementation of FRTB and the EU’s approach, HM Treasury confirmed last year that the UK would implement both the reporting and the capital elements of FRTB simultaneously, in contrast to the EU’s staggered approach.

Conclusion

If Basel II is anything to go by, banks should start their preparation as early as possible. The requirements around reporting, data management, and ensuring the necessary flows of information through the organization are highly complex and will require the deployment of sophisticated technical processes. Sufficient time and resources will be needed to develop and test models that will sufficiently incorporate various new methodologies and substantial data requirements to satisfy the upcoming FRTB rules.