Russia-Ukraine war rattles oil markets

This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

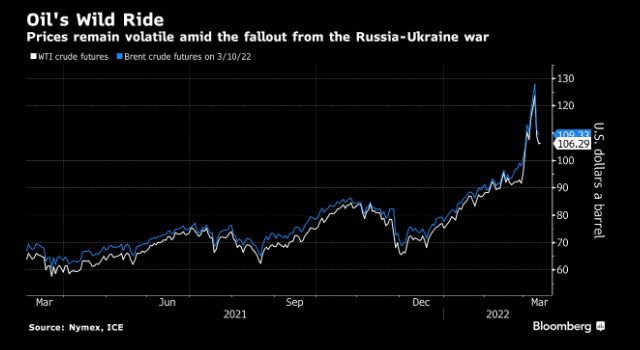

Russia’s invasion of Ukraine has reverberated across global commodities markets, hitting everything from oil and gas to wheat and nickel. Oil prices have gyrated as the market reacts to supply risks, a U.S. ban on Russian imports, and the possibility of the United Arab Emirates calling on its fellow OPEC+ members to boost output.

The front-month contract for Brent crude — the international benchmark — topped $137 a barrel on March 6, while West Texas Intermediate (WTI) came within touching distance of $130 a barrel on the same day, a level last seen in 2008. Oil prices have since retreated.

The International Energy Agency has tried to inject some calm into the volatile oil market, announcing earlier this month that its 31 members would release 60 million barrels of oil from their emergency stockpiles. It said that this would “send a unified and strong message to global oil markets that there will be no shortfall in supplies as a result of Russia’s invasion of Ukraine.” The IEA has since indicated that it will recommend further stockpile releases if needed.

OPEC and its allies have thus far chosen to remain on the sidelines. The 23-nation coalition, known as OPEC+, opted not to boost production beyond its original plan of increasing output by 400,000 barrels a day in March.

Russian oil shunned

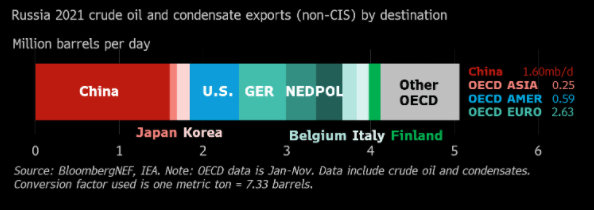

Russia is the world’s third-largest oil producer behind the U.S. and Saudi Arabia, and the largest exporter. Many countries in Europe have been hesitant to directly target Russian energy exports with sanctions given a high degree of dependency on Russia as a supplier. However, the U.S. announced a ban on Russian fossil fuel imports, including oil, on March 8. It was joined by the U.K., which plans to phase in a ban of Russian oil imports over the course of 2022.

Whether the U.S. and U.K.’s measures trigger a domino effect of embargos remains to be seen. In the meantime, refiners, traders and shippers are approaching Russian barrels with caution, or even ‘self-sanctioning’ for fear of backlash. This is despite Russian oil being offered at deep discounts to normal levels.

More than half of Russia’s crude oil exports go to Europe, and this proportion increases to 70% when including other OECD countries, such as the U.S., Japan and South Korea. If oil sanctions step up, Russia will need to find new homes for its crude, and large importers will need to find replacement barrels elsewhere.

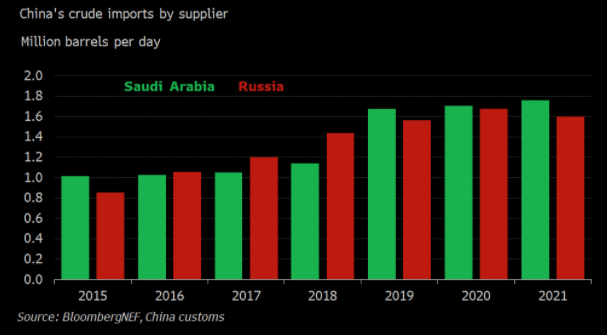

Russian oil exports could pivot to China and India, and the close energy ties between China and Russia, in particular, could be strengthened as a result of the war. Russia is currently China’s second-largest crude oil supplier after Saudi Arabia, accounting for 15% of its total crude imports.

Russia is also an important partner as China looks to gradually move away from dollars and diversify its oil purchase payments. Companies on both sides are discussing the feasibility of using Chinese yuan for crude deals payment, according to a recent interview by the Chinese ambassador to Russia. The exclusion of Russian banks from the SWIFT payment system could accelerate these plans.

A demand shift from the West to the East could also lead to continued disruptions in crude oil shipping, and potentially deter buyers of Russian oil further. Tanker rates have spiked as uncertainty regarding sanctions and payment mechanisms makes shippers wary of handling Russian oil.

No quick fix to replace Russian oil

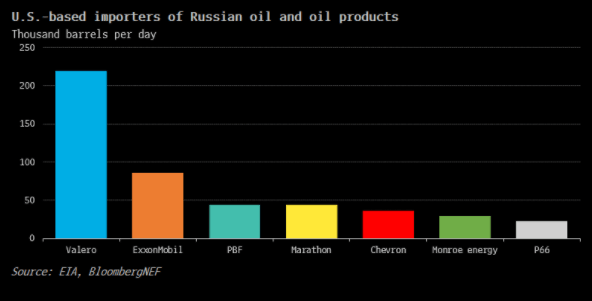

With sanctions now starting to target Russian oil exports, making up the shortfall in global supply will not be an easy task. Of the nearly 700,000 barrels per day of oil and oil products imported into the U.S. from Russia in 2021, Valero and ExxonMobil were the biggest buyers.

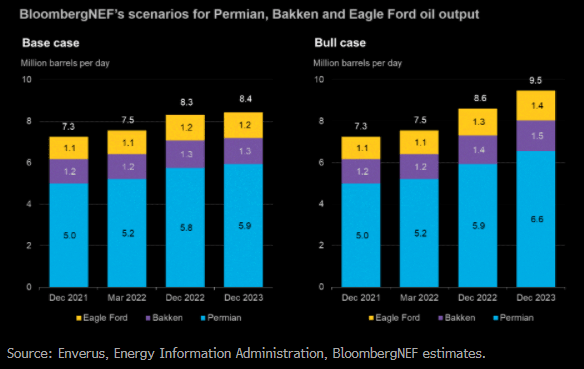

The U.S. ban on Russian oil imports has created an opportunity for its shale producers to increase output faster than their original plans to fill the gap. Under BNEF’s base-case scenario, the combined output from the Permian, Bakken and Eagle Ford — three of the largest U.S. shale plays — could rise by 1.1 million barrels per day between March 2022 and December 2023. If WTI oil prices hold at around $125 a barrel, the increase in production over this period could reach 2 million barrels a day. Permian output is forecast to drive the bulk of the overall increase in U.S. production.

However, it will take time for U.S. producers like Pioneer Natural Resources and Devon Energy to expand their output. On average, there is a six-month lag between the start of drilling and first oil production in the Permian. Moreover, BNEF analysis indicates a one to three month delay between rising prices and an increase in rig count.

The option to lift sanctions on oil exports from Iran is also on the table if a new nuclear accord can be reached. However, this would provide little relief for global oil prices. Iran’s oil production capacity is only a fraction of Russian’s exports volumes and would also take time to ramp up.

Big oil walks away

As the war intensifies, Russia is increasingly being viewed as a market that is too risky to do business or hold assets. Even Big Oil has recognized the jeopardy of continued involvement there, with the likes of BP, Shell and Exxon signaling their retreat.

TotalEnergies is taking a different tack, resisting pressure to pull out of Russia completely. It will hang onto its existing assets and cease to provide capital for any new projects instead. The French major has much more to lose on the liquefied natural gas front than its peers.

With U.S. and European majors looking to exit Russia, this may create opportunities for companies from India and China to sweep up their assets. India and China were among the top 10 investors in Russia’s oil and gas industry over the past two decades, closing 12 and 11 deals, respectively, from 2000 to 2021.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.