This analysis is by Bloomberg Intelligence ETF Analyst Rebecca Sin and Senior Industry Analyst Matthew Kanterman. It appeared first on the Bloomberg Terminal.

Metaverse-related exchange-traded funds could balloon to $80 billion in assets under management by 2024 with annual fees of $600 million, as ETFs capture a slice of the $800 billion market for 3D virtual social worlds. Investors are flocking to the metaverse bandwagon worldwide, with ETFs dropping fees as assets pour in.

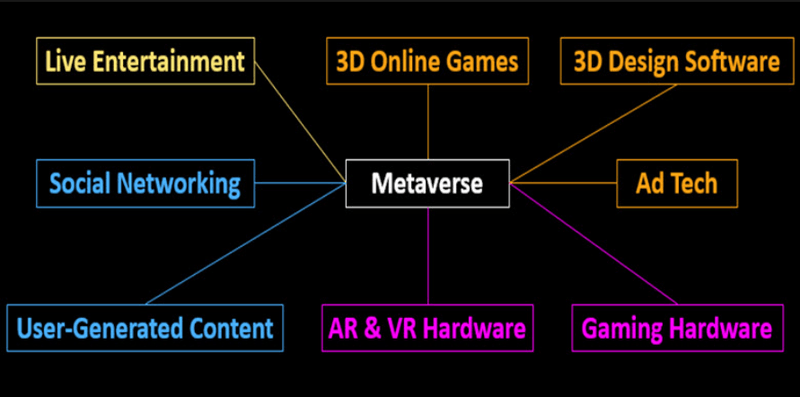

What is the metaverse? A shared virtual space

From online gaming to live entertainment, the metaverse is more than just virtual reality goggle-wearing and playing video games online. It has expanded to include live entertainment, social networks, hardware, user-generated content and technology infrastructure. It’s a shared virtual space where megatrends converge — such as online games with social networks and live entertainment with pop stars, with the user experience augmented via the help of technology — whether it be through avatars, shared screens/space or remote education and meetings. As technology converges, more synergies and mergers may take place. This could help companies such as Nvidia, Roblox and Sea continue to outperform peer valuations. The metaverse’s definition is likely to continue to expand and include more sectors and potential growth areas.

Convergence of trends into the metaverse

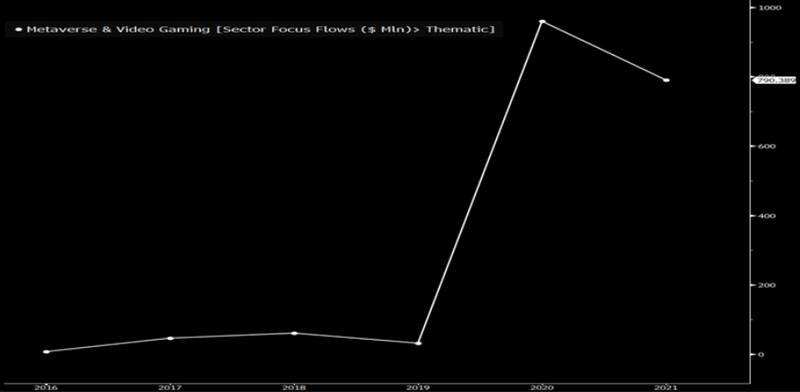

Metaverse inflows continue despite poor performance

Metaverse ETFs could reach $80 billion in assets by 2024, based on historical growth of other thematic funds. Pure Metaverse ETFs gathered $247 million of inflows in the year-to-Feb. 7, 24% higher from last year, despite a median year-to-date return of minus 15% across all ETFs with “metaverse” in the description. The metaverse is here to stay and more issuers and investors are hopping on the bandwagon across online games and e-sports to live entertainment. The gaming industry can be split into chip manufacturers, virtual spaces and gaming platforms/publishers. Metaverse ETFs will grow as the definition expands to incorporate more sectors among thematic funds, resulting in more assets under management.

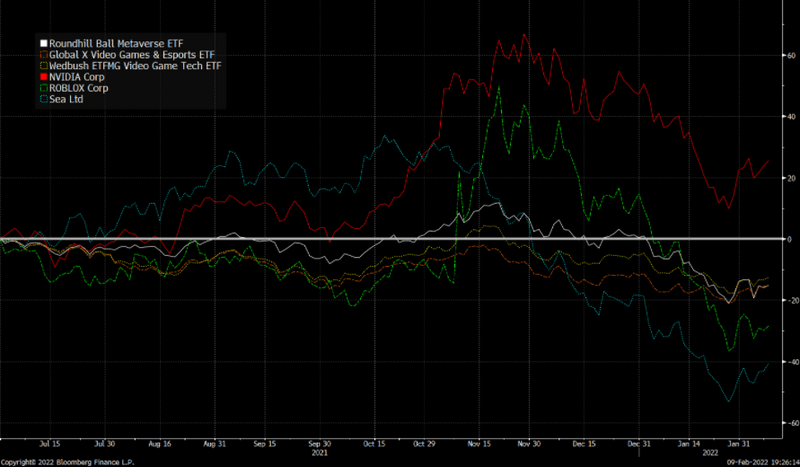

Metaverse ETF performance (year-to-date)

Rounhill Ball leads the pack by assets, fee discount

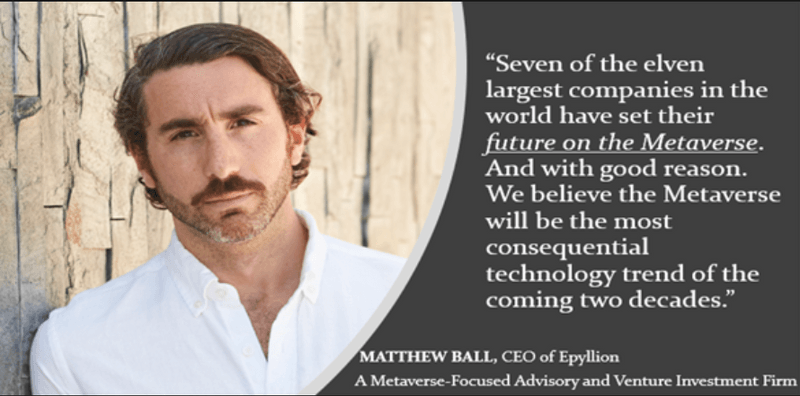

The metaverse may reach $800 billion by 2024 with ETFs accounting for $80 billion, according to our calculations. On Jan. 31 Rounhill Ball Metaverse (METV US), changed its ticker to METV from META as Facebook took over the latter. As one of the first metaverse ETFs, launched on June 30, 2021 METV leads by assets at $858 million, with a recently- reduced fee of 59 bps. Its unique feature is Ball Metaverse index, led by an expert council which maps and weights companies into seven categories: compute (the power to support metaverse), virtual platforms, payments, networking, interchange standards (tools, protocols, services to operating metaverse), hardware, and content, assets and identity services. Assets may continue to rise as investors seek exposure to the metaverse.

Quote about the metaverse potential

ETFs set to capture metaverse’s growing synergies

The metaverse’s growth is diversifying beyond video games to live entertainment — including films, music and sports — a market that may exceed $200 billion by 2024. Some ETFs are set to capture the momentum and may include Roundhill Ball Metaverse ETF (METV), Global X Video Game & Esports (HERO) and Wedbush ETFMG Video Game Tech (GAMR). The gaming industry can be split into chip manufacturers, virtual spaces and gaming platforms/publishers. Share-price performance of Nvidia, one of the largest chip manufacturers, Roblox, which creates virtual spaces, and gaming platform Sea are all negative year-to-date amid easing metaverse hype. Overly bullish retail buying last year affected some names by pushing prices higher than fair value and impacting ETF performance. Yet we expect more synergies and potential mergers to come.

Roblox’s growth driven by younger players

Entertainment ETFs almost $5 billion

Online entertainment has surged as spending more time at home during the pandemic has led to more online games, sports betting, and increases in spending on home entertainment systems, tech hardware and social-networking use and advertisements. ETFs in this space have seen 30 new launches globally since the start of the pandemic in early 2020; in 2021, new ETFs launched in the space attracted more than $2 billion, a 58% increase from 2020. The overall market in entertainment ETFs is now almost $5 billion in assets, with the top three countries being the U.S., South Korea and Britain with more than $1 billion in assets each. Asia has 21 ETFs in the space and Korea leads with 14, including an anime ETF by Global X Japan Games & Animation ETF (2640 JP). In Hong Kong, there is Nikko AM E-Games Active (3091 HK).

U.S. metaverse’s ETF asset growth