Explore how analysts model growth at China’s tech disruptors

Bloomberg Market Specialists David Tung, Keith Gerstein and Kelly Lai contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

While major U.S. companies tap the country for its supply chain, workforce advantages and vast market, China is also generating massive growth in its homegrown tech businesses.

From developing its own electric vehicles and building out a massive 5G network to creating new digital devices and supporting a whole new generation of startups, China is not just another link in the global supply chain — it’s a major player in its own right.

The issue

Here is an overview of several Chinese companies making their mark, including what you need to know now and about their prospects.

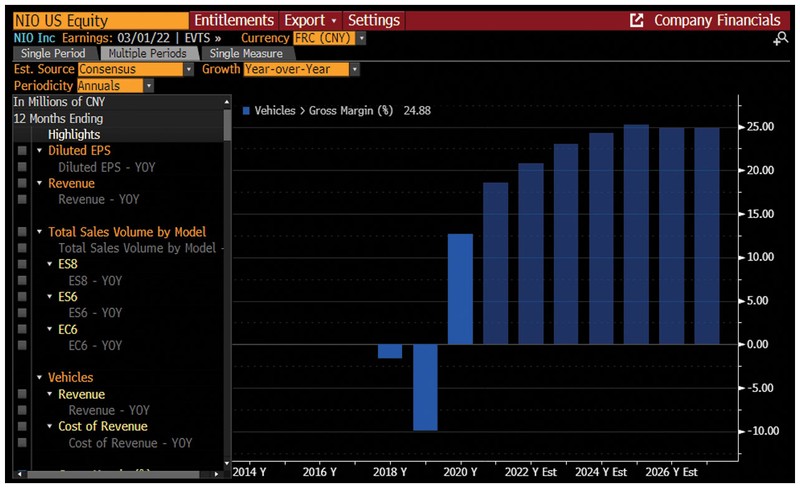

Nio

Shanghai-based electric vehicle maker Nio Inc., valued at $38 billion as of Jan. 26, is the most extensive Chinese pure-play EV stock by market capitalization. Shares skyrocketed 2,551% from their March 2020 low to their February 2021 high. Then they plunged 63% through Jan. 26, 2022.

Increasing EV demand drove the stock’s runup as countries move to reduce emissions, including China. Nio’s revenue is expected to increase 121% in its fiscal 2021, and analysts anticipate the company will become profitable in 2023.

CATL

Contemporary Amperex Technology Co. — one of Nio’s suppliers — is showing similar growth surges. A leader in the renewable energy equipment sector, the Ningde, Fujian-based company’s shares rose 452% from Dec. 31, 2019, through Jan. 26, 2022.

CATL provides batteries for domestic EV makers and foreign producers such as Tesla. When CATL introduced its cell-to-pack technology in 2019, its revenue increased 55%, to 46 billion yuan ($6.6 billion). Analysts anticipate that momentum will continue in fiscal 2021 and 2022.

China Tower

Beijing-based China Tower Corp. builds cell towers and provides tower maintenance throughout the country.

As the number of 5G-capable towers worldwide has increased over the past couple of years, global competitors have seen stock price gains while China Tower shares plunged 45% from the end of 2019 through Jan. 20, 2022.

However, China Tower’s total revenue for fiscal 2021 is forecast to increase by 7%. For fiscal 2022, revenue is expected to rise 6.5%, in line with North American peer company American Tower.

Xiaomi

Xiaomi Corp. sells smartphones and related products — devices capable of using 5G networks. The Beijing-based company shipped 146 million smartphones in 2020 and an estimated 191 million in 2021. Xiaomi is anticipated to ship approximately 222 million smartphones in 2022.

The average selling price of a Xiaomi phone has increased to 1,087 yuan in 2021 and is projected to rise an additional 5% in 2022, to 1,149 yuan.

As smartphone prices continue to rise, Xiaomi’s revenue is expected to increase 37% in 2021. As 5G needs increase in other parts of the world, analysts forecast that other countries will account for more of Xiaomi’s revenue than China by 2022

Tencent

Shenzhen-based Tencent Holdings Ltd., now one of China’s leading tech giants, is best known for its signature product for instant messaging — WeChat. The app reported 1.225 billion average monthly users in 2020. For context, China’s total population is 1.4 billion.

Its substantial social media user base is a natural traffic source for Tencent’s businesses, including animation, e-books, gaming and media. Gaming accounted for 40% of the company’s revenue in 2020.

While Tencent’s smartphone games revenue jumped 71% in 2020, stimulated by the mobile version of League of Legends, PC gaming revenue dropped 10%. PC gaming is expected to stay flat in 2021 and 2022, but the outlook for mobile gaming growth is positive.

Tracking

Bloomberg functions allow investors to use the Company Financials (MODL) function to get insights into these companies.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.