Russia-Ukraine, peak commodity inflation may dictate 2022

This analysis is by Bloomberg Intelligence analyst Mike McGlone. It appeared first on the Bloomberg Terminal.

The sell-high mantra may play out this year in commodities, buoyed at the start of 2022 by major crude oil exporter Russia amassing troops along the border of top grain exporter Ukraine. An easing of tensions should cure higher prices, with severe detriments to Russia vs. potential benefits to North America — the global epicenter of energy and agriculture production — a good reason for commodity hedges and making an invasion unlikely.

Crude oil has had a bad decade, and the next may be worse, as elevated prices are likely to aggravate unfavorable demand vs. supply trends. Industrial metals’ prospects are better, but facing China in decline and an inflation-fighting Federal Reserve elevates reversion risks.

Commodity risks tilt to higher-price cure vs. Russia-Ukraine

The past decade of poor commodity performance followed a record Bloomberg Commodity Index (BCOM) high in 2011 and is likely to endure. Primary differences are China in decline, North America as a net liquid-fuel exporter, and markets buoyed at the start of 2022 by strife between top exporters Russia (crude oil) and Ukraine (grains).

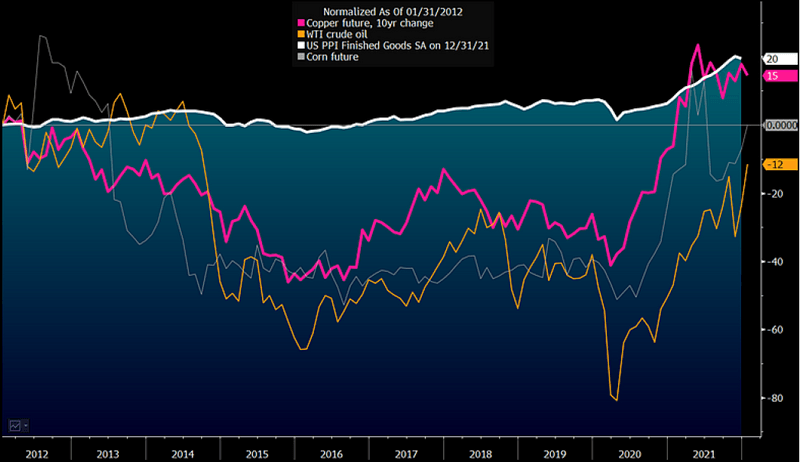

Crude oil and corn vs. Copper in coming decade

In a future of accelerating decarbonization and electrification, we believe metals are likelier commodities than energy and agriculture to appreciate in price. Our graphic supports this, showing the past 10 years of poor performance for crude oil and corn vs. copper. Up around 20%, the top macroeconomic indicator among metals is at about the same as the producer price index. Corn is flat, while the world’s most significant commodity — crude oil — is down about 10%. Easier to store, copper is favored.

PPI is a top metric facing mean reversion, due to the base effect. Crude oil is being replaced by technology, and the cost of production in the U.S. — a primary price-pressure factor — is well below a decade ago. Corn yields have risen about 20%.

What’s stops reversion with PPI in 2022?

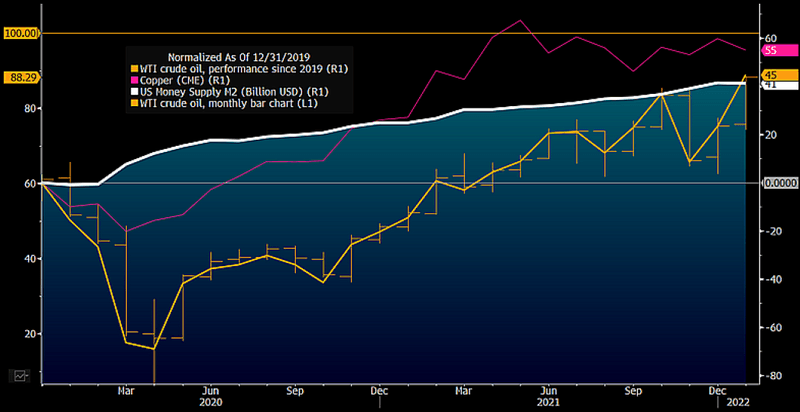

Significance of $60 vs. $100 crude? Money supply vs. Geopolitics

Crude oil may have entered a lose-lose period. Sustained higher prices should embolden the inflation-fighting Federal Reserve, enhance Republican prospects in the mid-terms and intensify supply vs. demand elasticity, which has pressured the market since 2008. Reversion-lower risks are elevated, if Russia-Ukraine tensions subside.

How strong is crude oil? About flat with money supply

West Texas Intermediate crude oil approaching $90 a barrel at the end of January is on track with rising U.S. money supply since 2019 and may harken back to about a decade ago, when a top concern was peak supply. What did find an apex was North American demand (formerly the largest net importer), in 2018. For crude to sustain gains in 2022, the predominant bearish force of the past decade — North American oversupply — will likely need to reverse. We expect more supply due to the higher price cure.

Our graphic shows WTI, which ended 2019 around $60 a barrel, up about the same 40% as money supply. If crude reaches $100, it would roughly match the 2021 copper peak. The metal is a key part of decarbonization and electrification. We see more copper upside potential than crude oil, which is being replaced by technology.

Crude oil has caught up to U.S. moneysupply

Buy low worked in 2020, but it’s 2022 and commodities are high

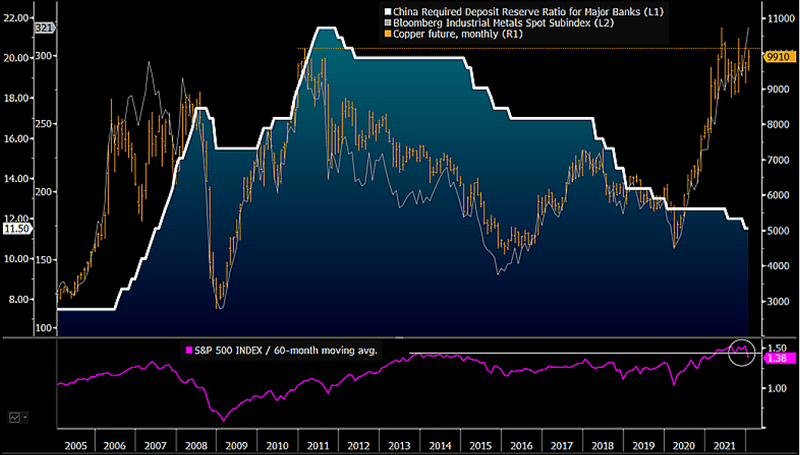

Commodities and inflation measures in 2022 may run into the downside of the base effect of 2021, while industrial metals near records face the higher-price cure, a weakening China and a Federal Reserve emboldened to fight inflation. Gold appears well supported and its top competitor — rising equity prices — may be waning.

Buy when they cry, sell when they yell

The Bloomberg Industrial Metals Spot Subindex at a record high in January vs. China in decline, an inflation-fighting Federal Reserve and a wobbly stock market combine to leave us cautious for 2022. The 2020 swoon favored buyers of base metals when concerns were elevated, but the lagging nature of inflation measures and of human nature to chase rallies may favor the sell-high mantra. Our graphic depicts the juxtaposition of rising copper and industrial metals vs. the declining China reserve requirement ratio (RRR) and extended S&P 500.

When copper peaked around the same level in 2011, the RRR was rising and the S&P 500 only stood about 10% above its 60-month moving average. The index’s recent stretch to over 50% shows elevated reversion risks and, absent lower commodities, a central bank more apt to raise interest rates.

A little metals reversion may feel like a crash

100,000 Russian troops vs. the Ukraine and a U.S. grain boom

It may not get much better for commodities than the roughly 90% advance in agriculture prices since the 2020 bottom, which is part of the greatest inflation in 40 years and an emboldened Federal Reserve. Seasonal buoyancy and 100,000 Russian troops on the border of Ukraine may prove temporary and incentivize North American production.

Buy high, sell higher? Not for commodities this year

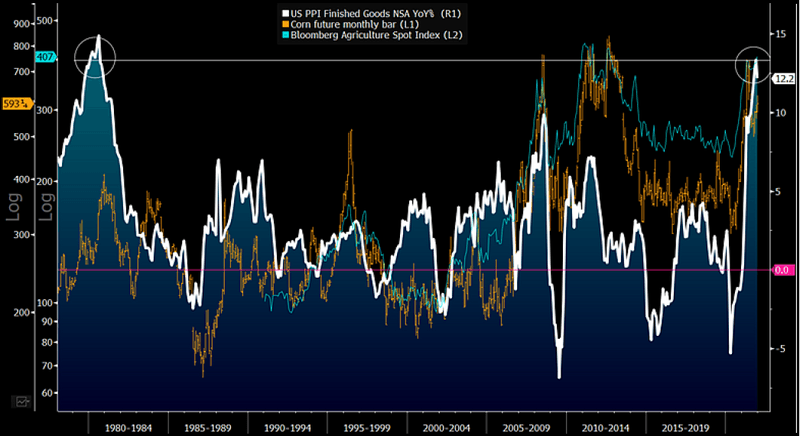

The first part of the “buy low, sell high” mantra in commodities has worked well since 2020, but has a high probability of transitioning toward the latter in 2022 if history is a guide. A top indication of how extended markets and prices are — and the risk of extreme mean reversion — is the Producer Price Index: It may be peaking from the highest since 1980. About 40 years ago, South America was a small part of global grain supply and the average U.S. corn yield was about 100 bushels per acre — and it’s about 180 now. Our graphic depicts the last time the PPI topped from similar extremes. It took about a 70% drop in the price of corn before bottoming.

We see little to stop human ingenuity and profits from pressuring grain prices. A poor U.S. growing season should be necessary to maintain prices near current levels.

Elevated reversion risks — inflation, agriculture