This article was written by David Tung, Keith Gerstein and Kelly Lai. It appeared first on the Bloomberg Terminal.

Background

With the runup in U.S. equity markets stretching valuations, private equity shops are catering to retail investors who turn to alternatives to diversify by providing products with low minimum investments, including publicly traded giants Blackstone and KKR. For them, fee-related earnings are forecast to increase as much as 38% a year through 2023, according to best estimates and the Company Financials (MODL) function. Fee-related-earnings margins are also projected to expand. Moreover, inflows into assets under management (AUM) are reaching record highs.

The issue

For Blackstone Inc. with an AUM of $618 billion at the end of 2020, analysts estimate inflows will total $196 billion in 2021. Consider, for example, the Blackstone Real Estate Income Trust Inc. The non-publicly traded real estate investment trust allows investments of as little as $2,500. Started in 2017, BREIT is already one of the world’s largest real estate funds, with assets of $66.3 billion as of Sept. 30. This serves as a golden opportunity for retail investors to enter the playground. With the barrier to entry lowered, the next question would be, what are the important factors to consider and how can we visualize them to grasp an overview of the private equity giants’ performance?

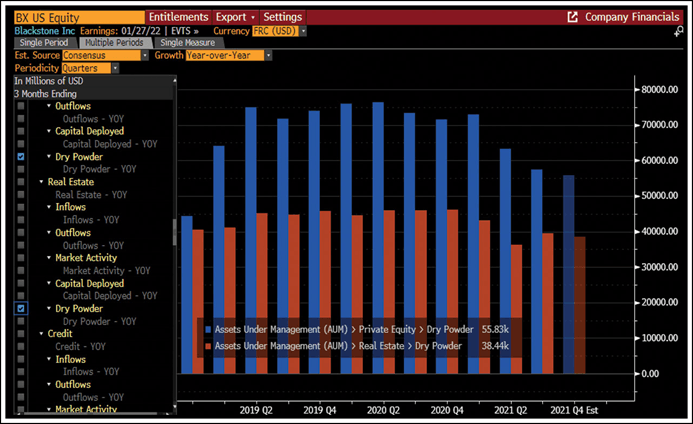

Dry powder, i.e. the committed capital that’s not yet invested, is one of the principal factors which can fuel private equity deal making. Blackstone has multiple segments with ample dry powder. For two of them—private equity and real estate—dry powder largely held steady for two years before starting to drop in 2021. Private equity dry powder decreased in 2021 after largely holding steady in the previous two years. The value of Blackstone’s private equity dry powder dropped to $57 billion in the third quarter, the lowest since 2018, and was projected to decline further in the fourth quarter. Real estate dry powder rebounded to $39.5 billion in the third quarter, up from $36 billion in the second quarter. So where has Blackstone’s dry powder been going? In a word: deals. As of early November, Blackstone had in 2021 already done its largest volume of acquisitions in a calendar year since 2006, according to data compiled by Bloomberg.

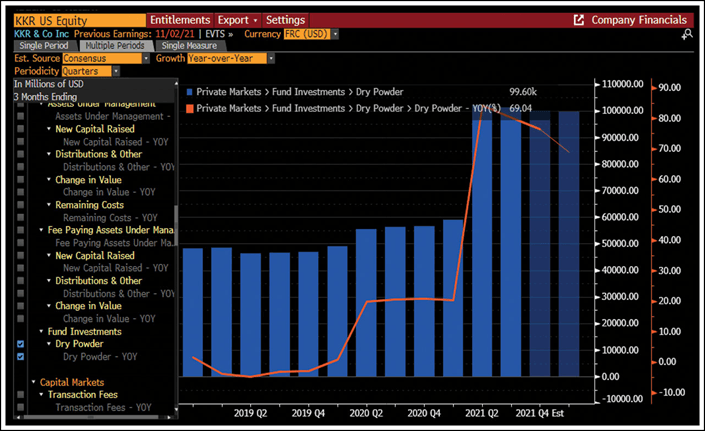

Not all private equity firms are approaching the market in the same way as Blackstone. KKR & Co., which has focused on integrating its purchase of insurer Global Atlantic Financial Group, had done a lower volume of acquisitions in 2021 as of early November than it had in 2020 or 2019. (In late November, KKR made a €10.8 billion [$12.2 billion] bid for Telecom Italia SpA in what could be Europe’s largest buyout.) In addition, New York-based KKR piled up dry powder thanks to a fundraising push. In the third quarter, KKR’s private market dry powder, at $101 billion, was 80% higher than it had been a year earlier. This increase in dry powder is part of a trend that, according to estimates, is expected to result in KKR’s largest annual accumulation of such capital. While other companies have been stockpiling dry powder in 2021, KKR’s massive growth stands out.

Tracking

To chart dry powder for Blackstone’s segments in MODL, type BX US <Equity> MODL <GO>, scroll down to the Assets Under Management (AUM) heading in the Business Breakdown section. Under Private Equity, click on the chart icon to the left of Dry Powder. Then tick the box to the left of Dry Powder under Real Estate.

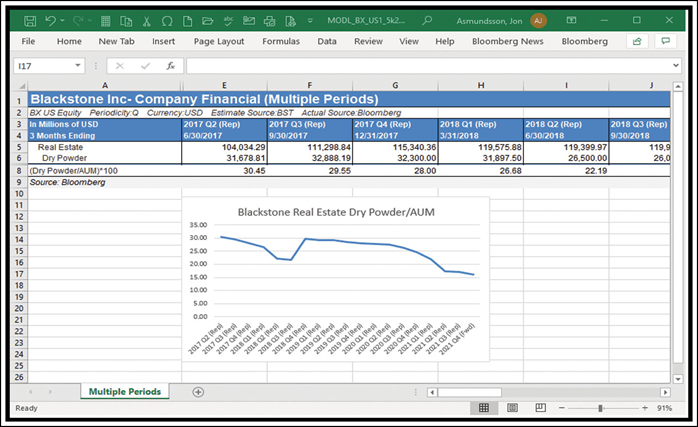

The ratio of dry powder to AUM can be derived in Excel. Click on the Export button on the red toolbar in MODL and select Export (Row by Row). Tick the items you want to export (real estate dry powder and AUM) and then hit the Export button again. A spreadsheet with the selected items will open. In it, you can add a formula in the form of “= (dry powder/AUM) *100”.

MODL now also enables you to drag and drop a data point into Excel. Click on an estimate in MODL and drag and drop it into a spreadsheet. That will paste in the Bloomberg Query Language (BQL) formula so that it will update whenever the estimate changes.

To dig into this, run KKR US <Equity> MODL SOURCE <GO>. Use the Growth drop-down to select Year-over-Year and the Periodicity field to select quarters if they aren’t already selected.

Scroll down to the Private Markets heading in the Business Breakdown section, click the chart icon to the left of Dry Powder, and tick the box for Dry Powder.