Global perspective on regulation and policy

Bloomberg’s Public Policy and Regulatory team brings you insight and analysis on policy developments to help navigate the complex and fast changing global regulatory landscape.

Monthly regulatory briefs

A monthly newsletter featuring regulatory insights, thought leadership from the Bloomberg Regulatory team, and news about upcoming events.

Get insights delivered straight to your inbox. Sign up now.

Trading and markets

Canada: Canadian regulators propose semi-annual financial reporting

UK: FCA consults on New Short Selling Regime

Australia: ASIC proposes updates to derivatives clearing rules

Singapore: Singapore to announce measures to strengthen equity market

Risk, capital and financial stability

International: IMF calls for stronger oversight of non-banks

Indonesia: OJK issues two new regulations on capital and liquidity structure

Hong Kong: HKMA proposes new capital requirements for cryptoasset exposures

UK and Switzerland: Regulators publish BFSA guidance for firms

Green finance

EU: European Parliament adopts mandate on sustainability omnibus

Singapore: Singapore government launched carbon market initiatives

Hong Kong: HKMA to issue new bank climate risk management guidance

Bahrain: Bahrain proposes new rules for sustainability-linked debt

Digital finance

India: India releases AI Governance guidelines

Singapore: Singapore bolsters national cybersecurity posture

Malaysia: BNM issues discussion paper on Asset Tokenisation

Australia: Australia’s national AI Centre releases practical guidance

Global Regulatory Outlooks 2024

Bloomberg EU Elections Series / Europe Votes 2024

Explore our latest expert-led insights

EU regulatory outlook: Financial services policy agenda 2024-2029

Basel III endgame, finalizing FRTB implementation

Bloomberg Regulation Rundown: Green taxonomies

Industry perspective: Overcoming FRTB data challenges

Market surveillance as a global conversation: Striving for collective responsibility

Compliance technology in an ever-shifting regulatory landscape

In race for market connectivity, UK-India ties offer point of difference

Discover our library of upcoming and on-demand webinars

Regulatory solutions

FRTB

Bloomberg offers a full range of FRTB solutions, including computation engines, repositories for “real price” data, and customised packages to help you meet all of the FRTB standards. Whether you require FRTB-ready data, a dependable risk analytics engine, or an entire end-to-end workflow, Bloomberg can help.

MIFID II

Bloomberg’s comprehensive MiFID II solutions suite is seamlessly integrated with Bloomberg’s Trade Order Management Solutions (TOMS) and Asset and Investment Manager (AIM), providing strategic enterprise workflow across the entire trade life cycle from pre-trade to post-trade and everything in between.

Comprehensive regulatory solutions and expertise

Data is at the heart of everything Bloomberg does – and so it is with regulation. Our regulatory data solutions provide firms with the data sets they need to not only satisfy current regulations but also to help prepare for upcoming regulatory requirements, including:

Basel III, Liquidity Coverage Ratio (LCR), High Quality Liquid Asset (QLA) Qualification, Sanctions, IRFRS 9, IFRS 13 & ASC 820, PTP, Financial Transaction Tax, and more.

Multi-Asset Risk System (MARS)

Bloomberg’s Multi-Asset Risk System (MARS) is a comprehensive suite of risk management tools that delivers consistent, consolidated results across your entire firm. Powered by Bloomberg’s world-class pricing library, market data and mortgage cash flow engine, MARS enables front office, risk and collateral professionals to analyze their trading and investment portfolios, manage and mitigate their exposure and ready themselves for any turn of events.

Insider Look

The Hon. Paul Chan Mo-po, Financial Secretary, Government of Hong Kong SAR addresses the audience of policymakers and market participants at the 2023 GRF.

Julia Leung, CEO at the Hong Kong Securities and Futures Commission and Vicky Cheng, Bloomberg discuss ESG and tech innovation at the 2023 GRF.

Bloomberg European Director Constantin Cotzias convenes financial industry leaders to discuss the Mansion House reforms with the Chancellor in July 2023

UK Prime Minister Rishi Sunak addressed a packed house of CEOs and senior investors at Bloomberg Business Day, at the Conservative Party Conference 2023.

Chancellor Jeremy Hunt addresses industry leaders after the spring statement in March 2023

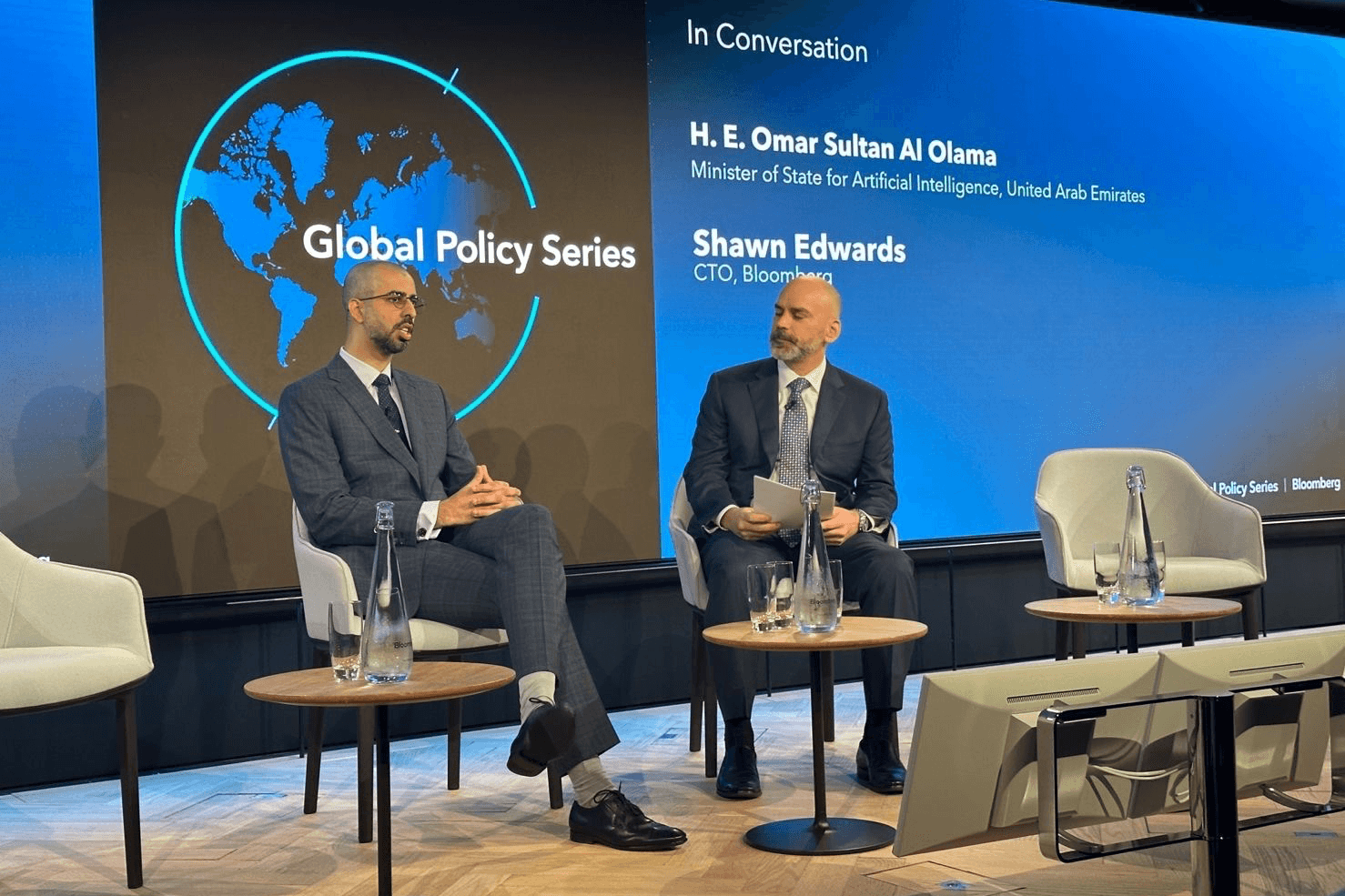

His Excellency Omar Sultan Al Olama, UAE Minister for AI, in conversation with Bloomberg’s Chief Technology Officer Shawn Edwards