Bloomberg Professional Services

How can market participants gain exposure across the emerging nuclear power ecosystem? This article examines how the Bloomberg Nuclear Power Index considers the full value chain, from uranium mining and fuel enrichment to advanced reactor design, equipment manufacturing, and utilities. A diversified, rules-based approach highlights the companies driving nuclear energy’s revival as a source of clean, reliable power for the digital economy.

This article was written by Sean Murphy, Multi-Asset Index Product Manager at Bloomberg Index Services (BISL).

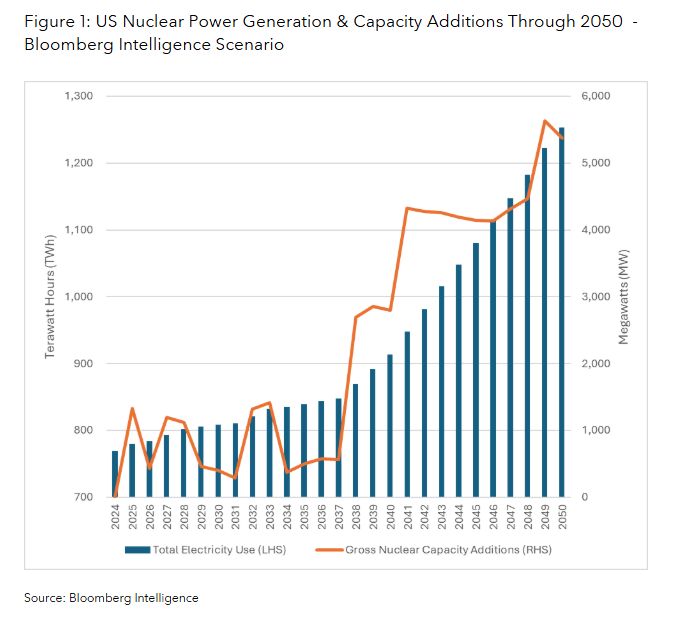

After a decade of stagnation, nuclear power is back in the spotlight. The twin forces of AI-driven electricity demand and net-zero commitments are making nuclear generation attractive. Bloomberg New Energy Finance (BNEF) estimates that data centers could consume 8.6% of U.S. electricity by 2035, up from 3.5% today. That surge in around-the-clock demand is pushing governments and corporations to revisit nuclear’s potential as an energy source.

PRODUCT MENTIONS

For many, nuclear energy still evokes images of glowing rods and Homer Simpson at his control panel. That caricature is giving way to a more modern reality. Countries around the globe are committing to expanding their nuclear capacity. Corporations are also playing a role: technology giants such as Meta and Amazon are signing record clean-energy purchase agreements that increasingly include nuclear generation. Energy-security concerns add further momentum, as nations seek to reduce dependence on volatile fossil-fuel markets. Public sentiment toward nuclear is improving too.

Next-generation reactor designs are reshaping perceptions around safety, cost, and scalability. Small modular reactors (SMRs) promise faster builds, lower costs, and greater siting flexibility. These designs could enable data centers, industrial campuses, and regional grids to add firm zero-carbon capacity without massive infrastructure overhauls.

Think of it as the difference between a bespoke power plant and a factory-built generator: SMRs aim to bring assembly-line efficiency to nuclear energy. Together, these policy, corporate, and societal shifts are laying the groundwork for a resurgence of nuclear power.

Investing in the nuclear revival: Why an index approach works

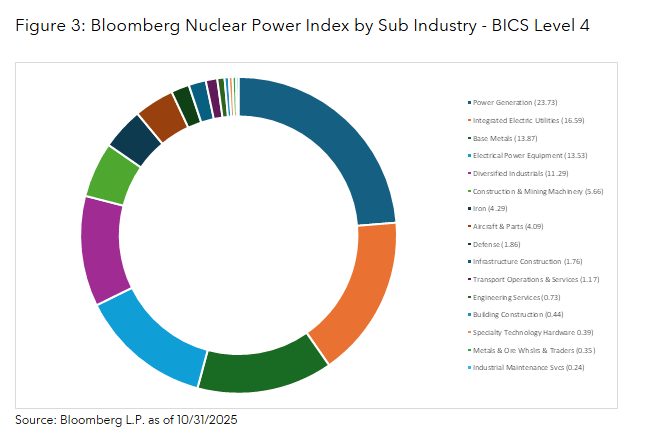

For market participants, gaining targeted exposure to the nuclear theme can be complex. The ecosystem includes miners, reactor designers, manufacturers, engineers, and utilities, each with distinct economics and policy drivers. No single company captures the full opportunity, and risks vary sharply across the chain.

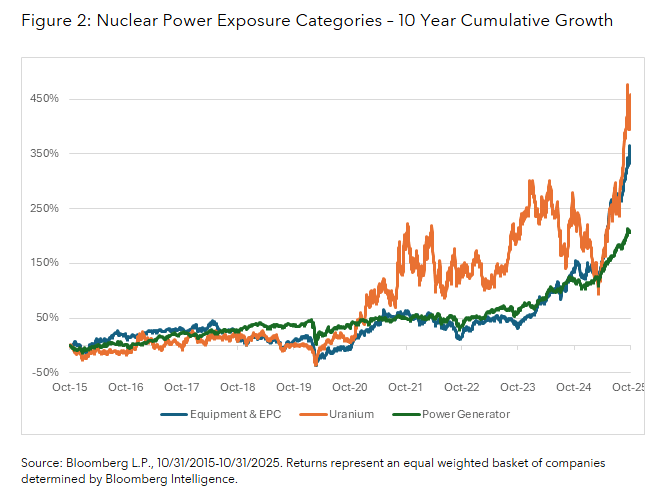

An index approach provides a structured way to gain exposure while improving diversification. Legacy strategies often focus on uranium miners or utilities, leaving market participants under-exposed to the manufacturers and technology firms driving today’s nuclear innovation.

The Bloomberg Nuclear Power Index (BNUKE) takes a holistic view, tracking companies globally with exposure to the nuclear ecosystem. Bloomberg Intelligence uses a rules-based process to identify firms based on near-term revenue alignment with nuclear products and services. Securities are eligible if they fall into predefined “Gold-tier” categories such as uranium, equipment and power control (EPC), or power generation.

This approach aims to reflect on how the market is evolving. Growth in the industry is increasingly driven by engineering innovation, modular reactor deployment, and infrastructure investment rather than by utilities alone. By allocating across the full spectrum, an index can capture gains from both established industry leaders and emerging disruptors behind next-generation reactors.

Policy support, supply-chain shifts, and rising electricity demand are lifting multiple parts of the ecosystem at once. Instead of trying to pick a single winner in a specialized industry, an index strategy offers exposure to the collective momentum of companies contributing to the next wave of reliable nuclear power. In a world where energy reliability and decarbonization are inseparable, a diversified nuclear index provides a practical way to participate in the sector’s re-emergence.

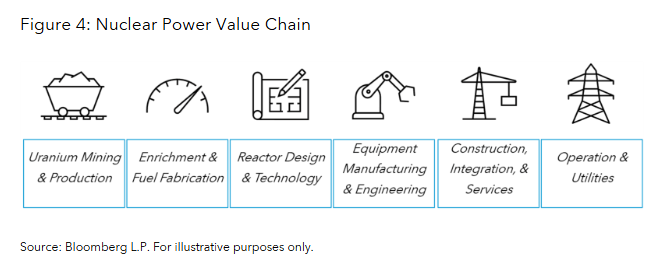

The nuclear value chain in action

The path from uranium to usable electricity is long and intricate. The nuclear ecosystem spans miners, engineers, manufacturers, and utilities. Understanding this progression can help explain where investment opportunities arise and why the nuclear theme is broader than many market participants realize.

Uranium Mining & Production

The journey begins underground. Companies such as BHP Group (+21% YTD through October) and Uranium Energy Corp (+126% YTD through October) extract and process uranium ore, the essential fuel for reactors. Cameco (+99% YTD through October), one of the world’s largest uranium producers, operates across the mining and conversion cycle, supplying feedstock to fuel fabricators worldwide. Their fortunes rise and fall with uranium prices, making them the starting point of nuclear economic chain. Note: source for the data in this section is Bloomberg L.P. between 12/31/2024-10/31/2025.

Enrichment & Fuel Fabrication

Once mined, uranium must be enriched to create reactor-ready fuel. Centrus Energy (+451% YTD through October) plays a key role here, developing advanced enrichment technologies that will power next-generation small modular reactors. This step ensures a steady, secure fuel supply for both existing and future systems.

Reactor Design & Technology

At the heart of innovation are the firms designing the reactors themselves. GE Vernova (+78% YTD through October), is advancing the small modular reactor design aimed at making nuclear deployment faster and more economical. Rolls-Royce Holdings (+117% YTD through October) is developing its own SMR program, applying aerospace-grade engineering to create compact, modular power plants.

Equipment Manufacturing & Engineering

Translating design into hardware requires precision manufacturing. Doosan Enerbility (+422% YTD through October) and Mitsubishi Heavy Industries (+115% YTD through October1) produce reactor vessels, turbines, and control systems that form the backbone of plant construction. BWX Technologies (+93% YTD through October1), with decades of experience in reactor modules and nuclear propulsion, adds fabrication expertise that extends from defense to civil applications. These companies are an integral part of the nuclear buildout.

Construction, Integration & Services

Building and maintaining a nuclear facility demands deep technical integration. Huntington Ingalls Industries (+73% YTD through October), best known for naval shipbuilding, has expanded its nuclear expertise into environmental services and Department of Energy projects, including site remediation and decommissioning. Its work demonstrates how technical knowledge in one nuclear domain can be applied across the energy landscape.

Operation & Utilities

The chain ends with the utilities that deliver reliable power to homes and industries. Entergy Corporation (+29% YTD through October) operates several U.S. nuclear plants that provide carbon-free baseload electricity across southern states. In Japan, Kansai Electric Power Company (+44% YTD through October) is among the utilities restarting the nation’s nuclear fleet, underscoring the importance of nuclear power to energy security and grid stability.

Looking ahead

After years of dormancy, nuclear power is emerging as the quiet backbone of the digital economy, providing the reliable, carbon-free electricity that modern infrastructure demands. Yet the opportunity extends well into the coming decades. From uranium miners to modular-reactor engineers, the sector is being rebuilt by global companies, modernizing one of the world’s most complex energy systems.

The Bloomberg Nuclear Power Index (BNUKE) captures this transformation by tracking the performance of firms across the entire value chain, including those designing, manufacturing, and operating the reactors of tomorrow. For market participants, it offers a diversified way to participate in nuclear’s resurgence. If nuclear energy is to power the next industrial age, BNUKE can serve as a benchmark for how that revival unfolds, measured not only in megawatts but in the innovation driving them.

To learn more about Bloomberg Indices, click here.

First Trust has licensed the Bloomberg Nuclear Power Index for their ETF, ticker RCTR.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator. © 2025 Bloomberg. All rights reserved.