Bloomberg Professional Services

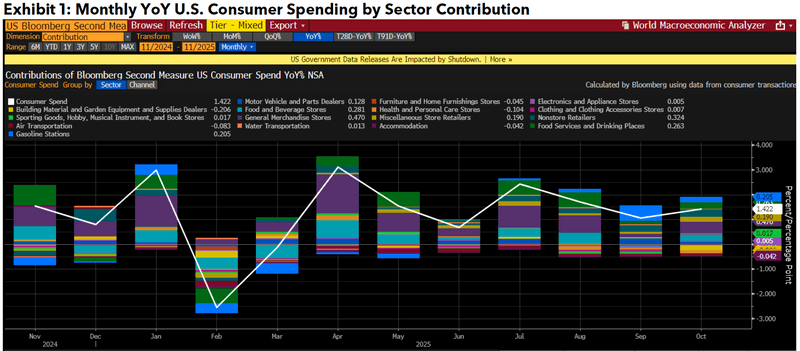

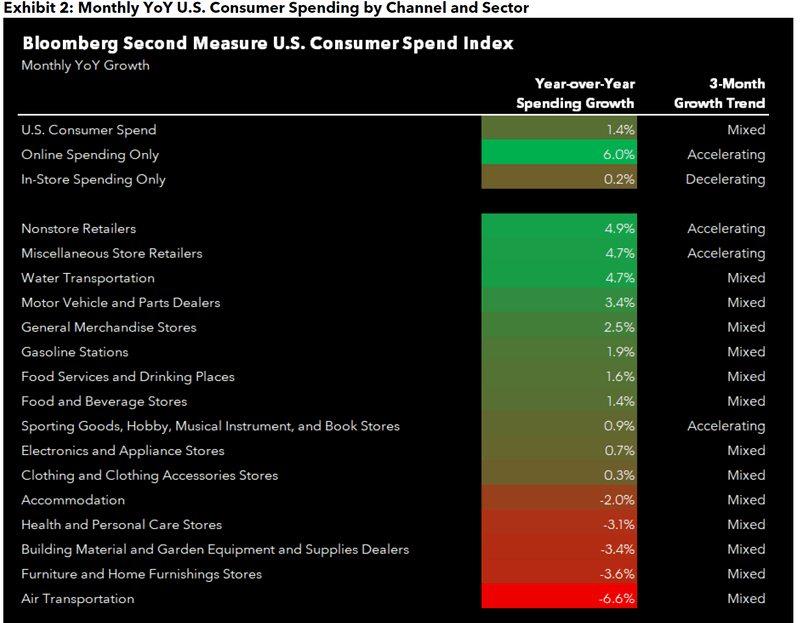

- The Bloomberg Second Measure U.S. Consumer Spend Index shows that observed U.S. consumer spending increased 1.4% year-over-year (YoY) in October 2025, reversing the summer slowdown.

- Nonstore Retailers outperformed other sectors, with early holiday shopping events like Amazon’s Prime Big Deal Days as potential contributors to observed growth. Over the past three months, most sectors in the BSM U.S. Consumer Spend Index experienced “Mixed” YoY growth trends, suggesting uneven momentum heading into the holidays.

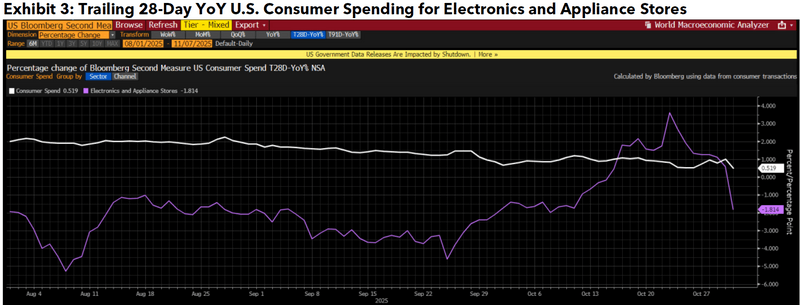

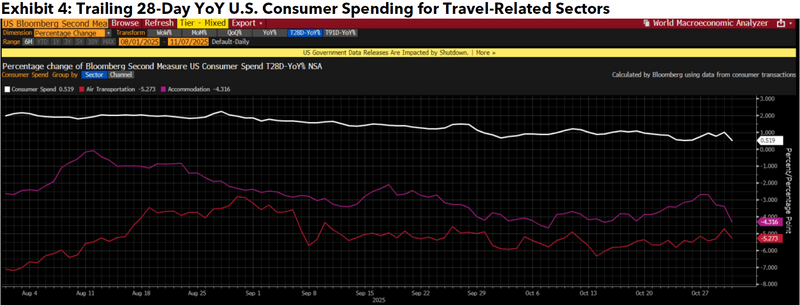

- Observed consumer spending growth in Electronics and Appliance Stores accelerated throughout October amid major product launches, while spending on Air Transportation and Accommodation remained subdued ahead of the holiday travel season.

This article was written by Bloomberg Applied Data Analyst Janine Perri. It appeared first on the Bloomberg Terminal.

PRODUCT MENTIONS

Alternative data sources such as the Bloomberg Second Measure (BSM) U.S. Consumer Spend Index, available via the World Economic Analyzer ECAN<GO> solution on the Bloomberg Terminal, are complementary to government reported macroeconomic indicators. These sources can provide additional ways of tracking consumer spending in the U.S. using consumer transaction data analytics.

Source: Bloomberg Finance LP – ECAN US CONSUMER SPEND

Sector and channel analysis

For many consumers, October represents an unofficial kickoff to the holiday shopping season, with major retailers like Amazon, Walmart, and Target hosting competing sales events early in the month. Sector-level trends for the BSM U.S. Consumer Spend Index show that the highest YoY observed spending growth in October 2025 was from Nonstore Retailers—which includes Amazon.com—while growth in observed spending at General Merchandise Stores also outpaced overall observed U.S. consumer spending. On the other hand, Air Transportation and Furniture and Home Furnishings Stores had the lowest YoY growth. Channel breakouts show that observed in-store spending increased 0.2% YoY, while observed online spending increased 6.0%.

Source: Bloomberg Finance LP – ECAN US CONSUMER SPEND

In terms of three-month trends, three sectors—Nonstore Retailers, Miscellaneous Store Retailers, and Sporting Goods, Hobby, Musical Instrument, and Book Stores—experienced “Accelerating” YoY growth while the rest were “Mixed.” Additionally, YoY growth trends decelerated for observed in-store spending but increased for observed online spending over the past three months. As noted in last month’s BSM U.S. Consumer Spend insight, September trends were likely affected by calendar shifts because September 2025 had 8 weekend days, while September 2024 had 9 weekend days.

Monthly highlight: Electronics gain momentum, travel lags ahead of holidays

Electronics and appliance stores

On a trailing 28-day YoY basis, observed spending growth in the Electronics and Appliance Stores sector inflected in late September. New product launches from Apple may partially account for accelerated growth in the overall sector, specifically the iPhone 17 on September 19 and the MacBook Pro, iPad Pro, and Vision Pro on October 22. Another potential factor is that in early October, Best Buy held a competing sales event around the same time as Amazon’s Prime Big Deal Days. Higher electronics spending may indicate renewed demand for big-ticket discretionary items—such as the new Apple products or the Nintendo Switch 2— leading into the holidays, despite macro headwinds.

Source: Bloomberg Finance LP – ECAN US CONSUMER SPEND

Air transportation and accommodation

Although there were minor upticks in trailing 28-day YoY growth in mid-to-late October for Air Transportation and Accommodation, both sectors continued to underperform relative to overall observed consumer spending. These trends suggest that travel-related spending remains weak heading into the holiday season, especially since the data observed by the BSM U.S. Consumer Spend Index represents the purchase date and often precedes when the consumer’s trip takes place.

Source: Bloomberg Finance LP – ECAN US CONSUMER SPEND

About the data

The Bloomberg Second Measure (BSM) U.S. Consumer Spend Index provides a near real-time comprehensive view of U.S. consumer spending via the World Economic Analyzer ECAN<GO> solution on the Bloomberg Terminal. Bloomberg Second Measure’s transaction data analytics take into account billions of U.S. consumers’ credit card and debit card transactions derived from a panel of 23+ million consumers, starting from January 1, 2017. The index is updated daily on a 7-day lag.

The data included in these materials are for illustrative purposes only. The Bloomberg Second Measure services are made available by Bloomberg Second Measure LLC (“BBSM”). BBSM’s parent company, Bloomberg L.P. (“BLP”), provides BBSM with global marketing and operational support. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BBSM, BLP or their affiliates, or as investment advice or recommendations by BBSM, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. BLOOMBERG, BLOOMBERG SECOND MEASURE, BLOOMBERG TERMINAL, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG TRADEBOOK, BLOOMBERG BONDTRADER, BLOOMBERG TELEVISION, BLOOMBERG RADIO, BLOOMBERG.COM and BLOOMBERG ANYWHERE are trademarks and service marks of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries. Absence of any trademark or service mark from this list does not waive Bloomberg Finance L.P.’s or its affiliates’ intellectual property rights in that name, mark or logo. For each company, the predictive accuracy of Bloomberg Second Measure’s estimates will typically vary over time. BBSM does not guarantee that the accuracy levels, trends or correlations illustrated by the examples in this document will recur for any company in the future. The estimates have been generated by running a standard nonproprietary formula on analytical data about past consumer transactions. BBSM makes available information about this formula to Bloomberg Second Measure clients and the analytical data is also accessible to such clients. All rights reserved. ©2025 Bloomberg.

The Bloomberg Second Measure U.S. Consumer Spend Index is not administered by Bloomberg’s benchmark administration business and is not intended for use as a financial benchmark.