Bloomberg Professional Services

At the Bloomberg Investment Management Summit 2025 in Singapore, the breakout session ‘Intelligent Automation for Front Office’ explored how data, machine learning, and AI are transforming front-office workflows – from credit research to portfolio management and trade execution.

Opening the session, Cecilia Chan, Credit Analyst at Bloomberg Intelligence (BI), discussed how Asia’s tech leaders are pursuing AI-driven growth amid geopolitical and structural headwinds. She noted that firms such as TSMC, SK Hynix, and Lenovo are diversifying production across regions to mitigate risk while maintaining resilience through strong balance sheets and steady cash flow to fund large-scale investments.

Together, her remarks framed the central question of the session: how can investors harness automation and AI – across credit, portfolio management, and trading – to turn data into faster, more intelligent front-office decisions?

Building the Total Portfolio Platform

Picking up from Chan’s outlook on Asia’s tech landscape, Scott Lewis, from Bloomberg’s global product team in New York, outlined the firm’s progress toward delivering an end-to-end environment for the buyside, one that provides consistent, intraday-aware views of positions and cash, alongside aligned valuations and analytics to support the full investment process.

At the center of this initiative is an open, bidirectional platform that provides clients with a unified picture of all holdings – a Total Portfolio View.

Lewis explained that the Investment Book of Record (IBOR) will serve as the event-based foundation of Bloomberg’s Total Portfolio View. This will allow users to rely on Bloomberg for decision support, order management, trading, and lifecycle events workflows and or contribute and compliment Bloomberg with external data for a more complete representation. A formerly simple reconciliation utility is now evolving into a dynamic ingestion engine. With configurable controls, clients can determine what is best sourced and contributed from external data and incorporate, i.e., flows from transfer agents, collateral details, financing charges can automatically update cash balances, while positions, market values, and P&L remain reconciliation comparison points. Most firms, Lewis noted, still lack a single authoritative IBOR – something Bloomberg’s enhanced platform aims to deliver.

The next frontier is expanded asset coverage, with a focus on private markets. Bloomberg is developing data structures to capture deal-level attributes, book private assets into portfolios, and maintain them in a stateful manner, on par with public securities. Combined with improved derivatives modeling, these enhancements will make the Total Portfolio View truly comprehensive, enabling oversight and workflow on aggregate exposures and analytics across asset classes and sources.

Maintaining an open and interoperable platform is a guiding principle. Bloomberg is working to unify workflows so clients can both contribute and consume data seamlessly. The formerly standalone Research Management Solutions (RMS) platform is now fully integrated: analysts can publish tear sheets via Bloomberg APIs, which feed directly into portfolio management, compliance, and summary views. A new dashboard canvas allows users to aggregate internal and external content, while Launchpad overlays firm-specific research across the entire investment universe. Meanwhile, BQuant empowers users to build custom analytics by accessing normalized Bloomberg, portfolio, and research data, all within the Terminal.

Finally, Bloomberg is extending its platform into post-trade operations, offering service-bureau–style connectivity to custodians, trade repositories, and third-party vendors to help clients scale middle- and back-office workflows with high reliability. A new plug-and-play integration with Clearwater Analytics at the tax-lot level is especially impactful for accounting-heavy sectors like insurance, enabling more seamless reconciliation and automation.

Empowering Traders through Intelligent Automation

Transitioning from portfolio management to trading, Ravi Sawhney, head of Bloomberg’s Buyside execution group, explained how the firm is advancing automation and AI across trading workflows. The goal is simple: to help traders be more productive and performant.

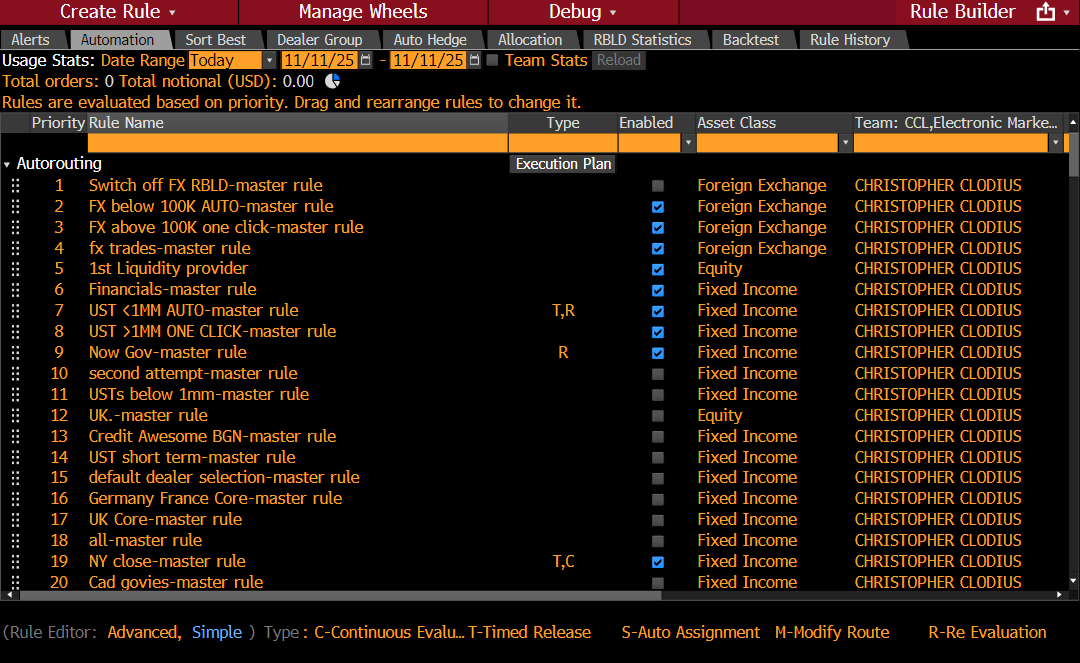

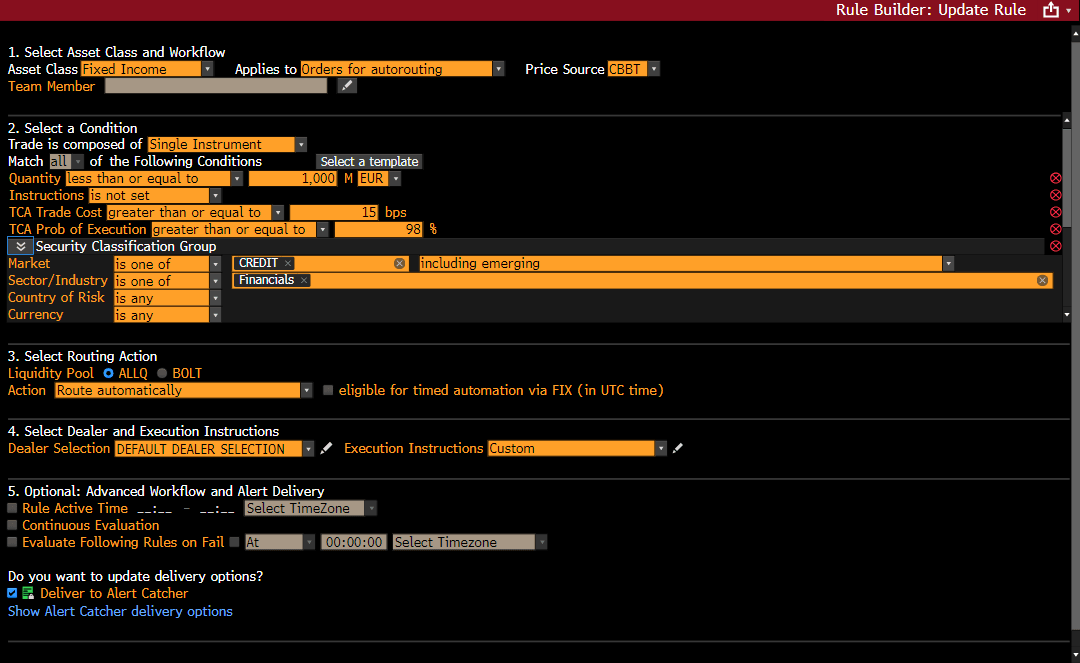

He explained that at its core, a lot of trading workflows can be explained deterministically – a series of rule-based if–then–else statements nested together. Bloomberg’s Rule Builder lets traders configure these rules directly in the Terminal to automate trading across Equities, Fixed Income and FX.

That rule-based framework has recently been enhanced to integrate signals produced through in-house Machine Learning (ML) models that, for example, predict transaction costs, assess automation suitability, and compare dealer responses against Bloomberg’s IBVAL pricing source – all available as criteria for rule definition. He also highlighted capabilities such as Sort Best for optimized dealer selection, and Broker Wheels, which enables equity traders to determine how to allocate orders across brokers based on rules and historical performance.

The next potential step, Ravi said, is folding in Agentic AI – technology that understands trader intent, reason, plan, and act to minimize market impact with the human trader in-the-loop if desired.

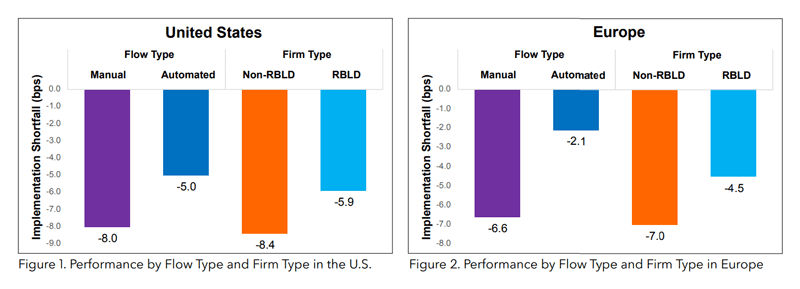

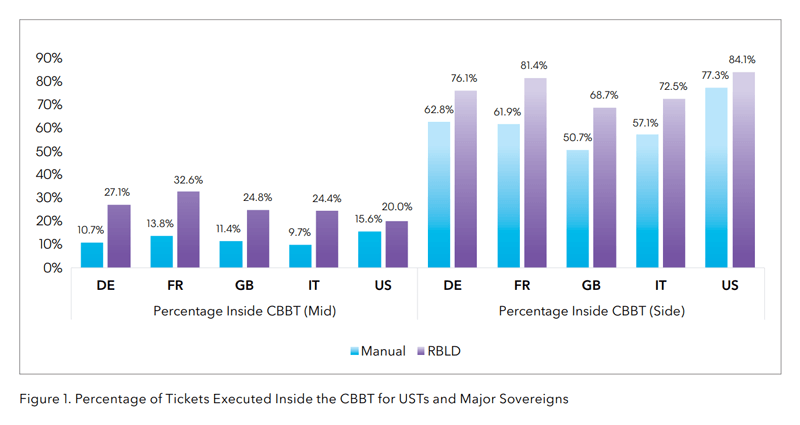

He stressed that automation is not replacing traders, but empowering them to focus on more complex, higher-stake decisions. Performance studies show automation improves not just efficiency but execution quality. In equities, Bloomberg’s analysis of 23 million trades via its BTCA platform found automated orders outperforming manual ones against benchmark implementation shortfall, while firms using Rule Builder saw stronger results as automation freed traders to focus on complex orders. The fixed-income study using CBBT showed similar results, with clients often trading inside the bid–offer spread or even mid-price – evidence that automation strengthens both productivity and performance.

- Download: Equity automation improves performance and strengthens best execution

- Download: Exploring Automated Trading Performance in Sovereign and Credit Markets

How Bloomberg Is Turning Machine Learning into Real-World Trading Tools

Chris Clodius, from Bloomberg’s buy-side execution services team, demonstrated how the firm is using machine learning to improve trade execution across markets.

Bloomberg’s rule-based automation engine, launched in 2019 for equity order routing, now spans fixed income, ETFs, and FX. What began as simple if–then logic has evolved into a system that continuously analyzes market data, optimizes dealer selection, and ingests multiple data sources. Unlike vendors confined to a single asset class, Bloomberg offers a unified toolset spanning equities, fixed income, FX, and ETFs – each using the same underlying technology.

ML, Chris said, has long been embedded in Bloomberg workflows. The firm’s TCA <GO> model has used ML for more than a decade to help traders identify participation rates that minimize market impact. Similar models now support fixed-income and FX trading, estimating execution cost, liquidity probability, and whether to trade algorithmically or via RFQ.

In Asia credit, where liquidity remains thin, Bloomberg has added IBVAL, a pricing source that uses venue data and ML to predict the next trade print. With coverage expanding from 50,000 to 100,000 bonds by year-end, IBVAL feeds directly into Bloomberg’s automation engine, letting traders gauge liquidity and cost before execution.

He also highlighted Bloomberg’s Automation Suitability model, which helps firms identify automation-ready instruments by analyzing order size, liquidity, and peer behavior.

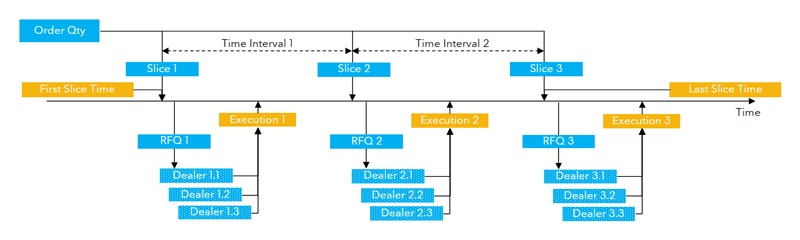

Finally, he showcased the latest order-slicing tools that break large trades into smaller, tradable clips – similar to TWAP execution in equities. When a large order arrives, it’s split into time-based slices: an RFQ goes out, executes, then waits a set (or randomized) period before sending the next slice. Already live for U.S. Treasuries and European benchmarks, the feature is being considered for expansion into ETFs and large FX swaps.