ARTICLE

AI power hunger drives record private equity deals

Functions for the Market

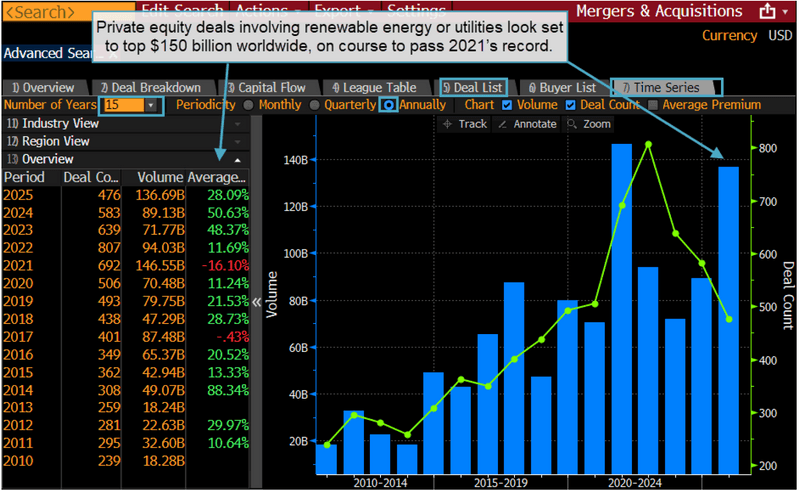

- The surging electricity demand from AI is leading to record private equity investments in utilities and renewable energy, with deals on track to exceed $150 billion.

- Data center operators are moving towards clean energy due to net-zero commitments and new regulations.

- The Bloomberg Clean Energy Index has returned 31% this year, while the Bloomberg 500 and the Bloomberg Magnificent indices have seen returns of 15% and 20% respectively.

Background

In September, US President Donald Trump staged yet another attack on green energy in a speech given to world leaders at the United Nations General Assembly, calling renewable energy a “joke” and climate change a “hoax” and “the greatest con job ever perpetrated on the world.”

PRODUCT MENTIONS

Since returning to office in January, his administration has sought to end projects on federal lands, stop work on wind farms, revoke permits, and make it more difficult for new renewable energy developments to gain approval. He’s also pushed for legislation that phases out key tax breaks and limits access to these incentives.

President Trump has criticized solar and wind as being unreliable and expensive and called for more power to be generated from fossil fuels, namely natural gas and coal. The attacks on green energy projects come as energy demand is on the rise, driven by data centers needed to support AI initiatives. Data centers are set to quadruple their power demand in the next decade as the US maintains its status as the world’s largest data center market.

The issue

Despite the Trump administration’s efforts to undermine green energy projects, investors haven’t been swayed. Private equity funds are investing in electricity at a record pace and the returns look promising.

Private equity deals involving utilities or renewable energy are on track to top $150 billion this year, surpassing record year 2021. KKR’s $950 million September acquisition of TotalEnergies’ solar assets helped keep the momentum going, following Blackstone’s $11.8 billion purchase of TXNM Energy in May.

A look into private equity fundraising activities suggests strong Q1 launches of funds with renewable energy among their targets. Brookfield Asset Management Ltd, KKR & Co Inc, and Stonepeak Partners LP are all raising cash for $20 billion funds that include renewable energy investment. Brookfield’s chief financial officer, Hadley Peer Marshall, says a $7 trillion investment is needed to finance the rapid growth of artificial intelligence.

So far this year, clean energy investment has offered the potential for substantial returns. The Bloomberg Clean Energy Index has soared 31%, while the Bloomberg 500 Index rose 15% and the Bloomberg Magnificent Seven Index rose 20%.

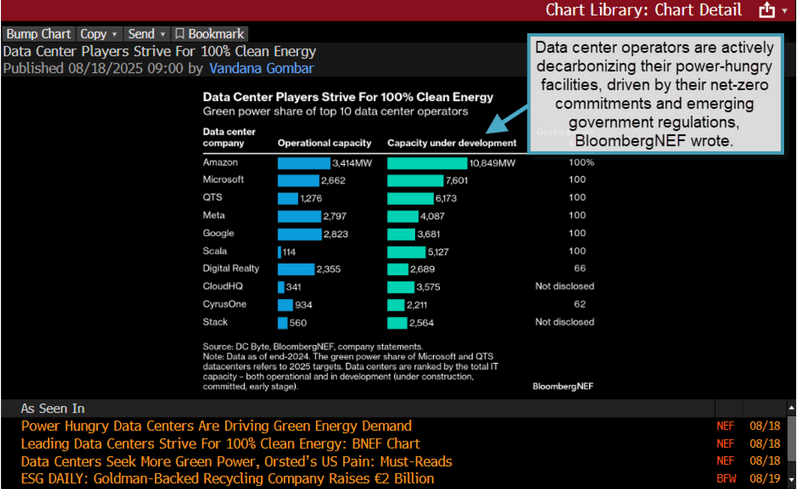

While the growth in power demand from data centers ramps up, data center operators are decarbonizing. This is being driven by net-zero commitments and new regulations. With tech giants accounting for 43% of clean power purchase agreements signed in 2024, the data centers supplying the infrastructure for their AI projects are likely to continue moving toward green energy.

Tracking

Track data center’s moves towards green energy with the Bloomberg Chart Library:

- Type “chart library” in the command line and select CHRT.

- Type “data center” in the amber filter box and select Match This Phrase.

- Select Data Center Players Strive For 100% Clean Energy on Aug. 18.

For more information on this or other functionality, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.