Bloomberg Professional Services

ETF assets have surged to $15 trillion globally, led by rapid European expansion and record inflows. ETFs in Depth event hosted by Bloomberg in London, highlighted new drivers, from thematic strategies and digital adoption to innovations like buffer funds and private-market ETFs, positioning Europe as a catalyst for the next decade of ETF growth.

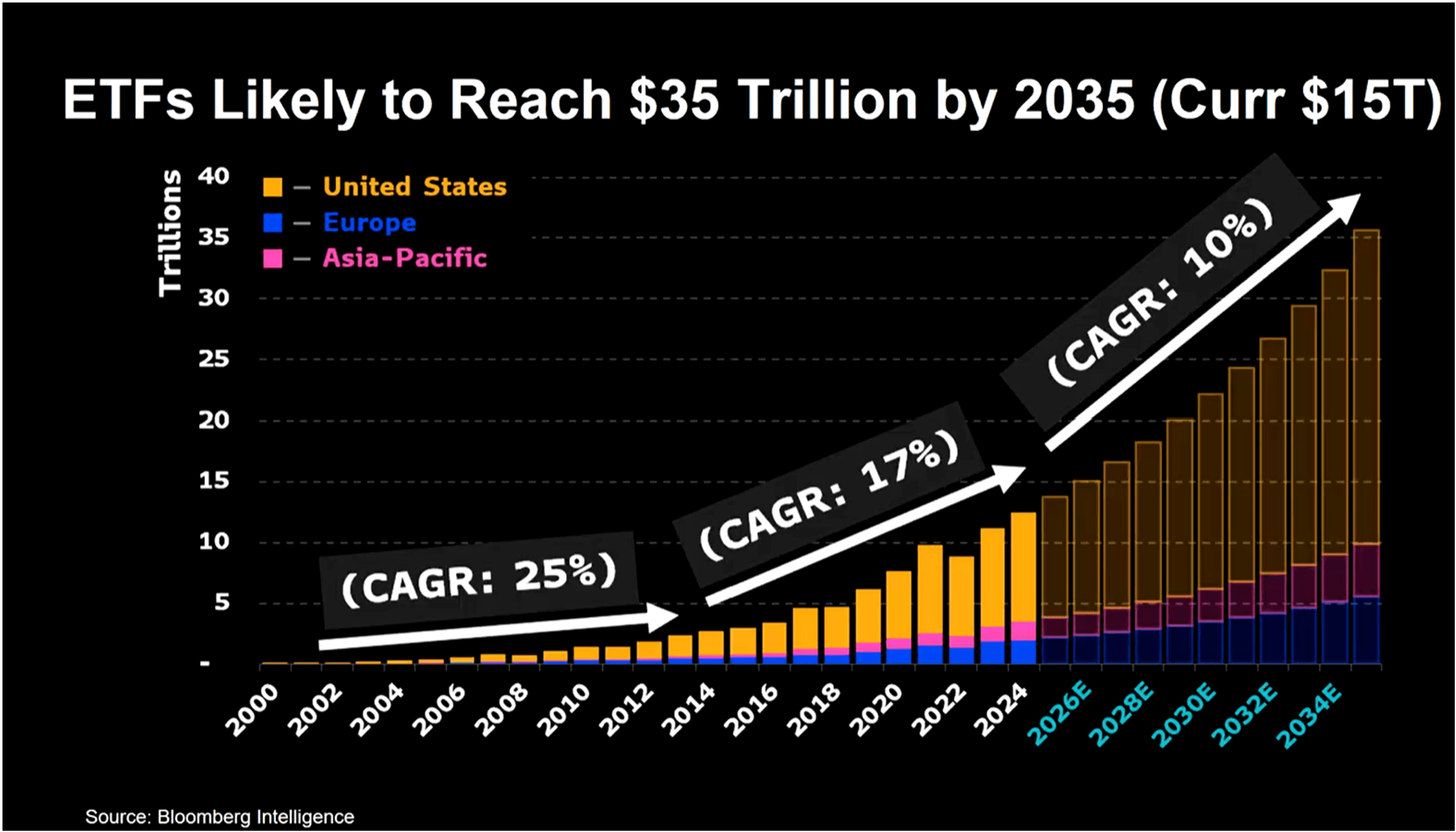

ETF assets globally have surged to $15 trillion in 2024 and are projected to reach $35 trillion by 2035. Europe has been a central driver of this growth, with ETF assets climbing to $2.3 trillion this year. The increasing adoption of ETFs across the continent is reshaping capital markets, portfolio construction, and liquidity provision. As the increasing adoption of ETFs across the continent is reshaping capital markets, portfolio construction, and liquidity provision, what are the trends ahead for European ETFs?

Performing through volatility: the ETF advantage

PRODUCT MENTIONS

The resilience of ETFs in volatile markets has been a defining feature of their rise. In 2024, trading volumes spiked during periods of market stress, with ETFs accounting for nearly half of all equity trading on some days.

This liquidity has provided investors with the ability to reallocate quickly and capture rebounds, often through leveraged vehicles. Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, describes this as “the Vanguard put,” a crucial source of market support.

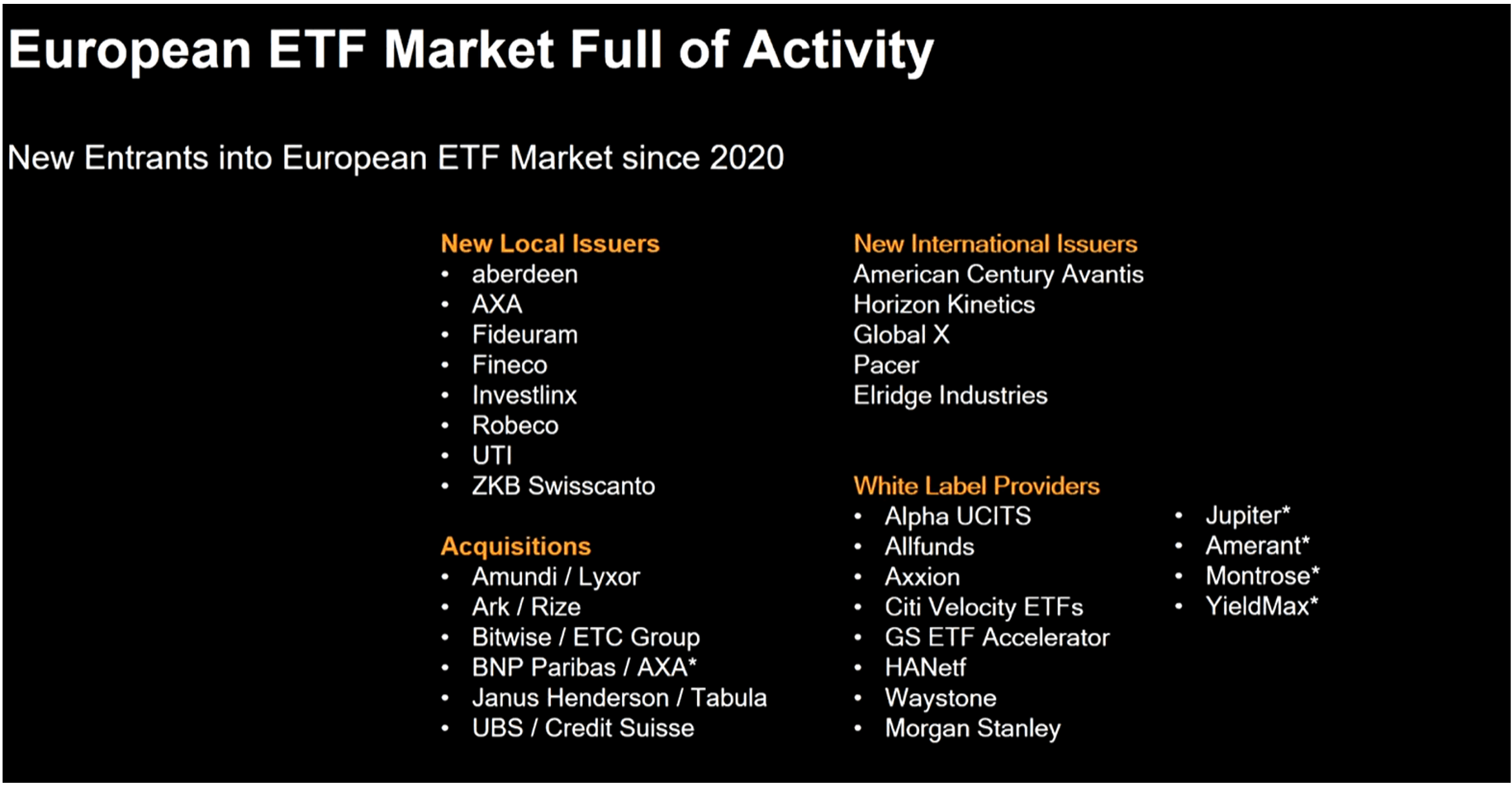

Notably, While the phenomenon is well observed in U.S. markets, Europe has also benefitted, with the iShares Core European Equity Index gaining 23% year-to-date and regional ETF flows setting records in the first half of 2024. This activity is also driving mergers and acquisitions, alongside a wave of innovative new launches.

As ETF launches proliferate, innovative structures are emerging—such as buffer funds that use derivatives to mitigate the impact of market downturns, active ETFs replicating the strategies of star managers like Nouriel Roubini, FundStrat’s Tom Lee, BlackRock’s Rick Rieder, and GMO’s Jeremy Grantham, as well as triple-leveraged ETFs and ETFs investing in alternative assets like cryptocurrency and private markets.

Balchunas notes that growth in the crypto space has been especially explosive. “BlackRock’s iShares Bitcoin Trust ETF attracted $70 billion in assets in 341 days. It’s the fastest-growing ETF ever to exist,” he says. “BlackRock already is the second biggest holder of Bitcoin on planet Earth, but by 2026, they’re going to have more Bitcoin than Satoshi, the founder of Bitcoin.”

Digital distribution and retail adoption

Retail adoption of ETFs remains lower in Europe than in the U.S., but the gap is closing quickly. German savings plans have fueled widespread retail participation, with ownership growing by 33% in the past year and spreading into new markets. The number of savings plan accounts outside Germany more than doubled from 2023 to 2024. Julius Weller, Vice President, Broker at Scalable Capital, explained, “Our strategy is to have any ETF that could be sold to European retail clients under usage on the platform. We will make it savings plan eligible, and savings plans will always be cost-free.”

Investment education is especially crucial for Europe’s largely younger base of new investors. Selina Kirby, Head of Digital and Execution Only, UK Client Group at Vanguard, highlights that “80% of new investors are under 45 and unfamiliar with even basic investment concepts like diversification and risk/reward trade-offs.” She adds, “We’re seeing a huge growth in trusting of social media and AI, whether we like it or not. Everyone’s got advice in their pocket now.”

New trends in thematic investing

Indeed, thematic investing is one of the most dynamic areas of the market, as investors evolve and diversify outside traditional sector or industry categories. As Miriam Breen, Head of Business Development UK and Ireland, ETF and Index at BNP Paribas Asset Management, explains, “They don’t want to just invest in the hot new thing. They’re looking for returns, they’re looking for relevance, and they’re looking for real-world resilience.”

Bloomberg Intelligence, which delivers interactive data, tools and research across industries and global markets, tracks 33 thematic baskets, looking beyond industry classifications to track the themes that drive company revenues. The largest, most diversified companies may belong in more than one basket.

This approach enables Bloomberg to capture themes such as Global Modern Defense. Defense spending in Europe has increased dramatically in recent years, due to Russian aggression and other factors. That makes this a hot category right now, but Dougherty says it was compelling even before the surge in military budgets. “When we built modern defense, we were seeing a big modernization trend within defense budgets, which we really wanted to capture,” says Dougherty.

Trading strategies in a fragmented market

European markets are more fragmented than the U.S. market, spanning multiple countries, exchanges and currencies. “We have something like 13,500 listings in Europe, really dwarfing the number of products in the US with a much smaller asset base,” says Slawomir Rzeszotko, head of institutional sales and trading for Europe and Asia at Jane Street “Why do we have so many listings, and why do we have so many products? Well, because we are dealing with a much more diverse set of customers, right, from retail to institutional, from people based in different currency regimes and expecting income or distributing class share classes,” adds Rzeszotko.

With so many products, many at smaller asset sizes, Gregoire Blanc, Global Head of Capital Markets at Amundi cautions that it’s a mistake to judge ETFs by the same standards as single stocks; even smaller, less frequently traded ETFs can provide liquidity if their underlying assets trade readily. “It’s not necessarily a negative to see no volume traded, small AUM ETF,” he explains. “It doesn’t mean it’s illiquid. It just means no one’s trading it right now.”

The road ahead for European ETFs

Industry leaders emphasize that ETFs are more than just tools for liquidity—they have become central to investment, trading, portfolio construction, and capital formation. “The reason ETFs are such an incredible tool is because they are everything. They’re an investment tool, they’re a trading tool, they’re a portfolio construction tool, they’re a cash equity monetization tool,” Rachel Lord, Head of International at BlackRock, explains.

According to Lord in recent months thinks markets reacted mostly to heated rhetoric, rather than dramatic shifts in U.S. – European relations. “If you just step back and don’t think about the language, the messaging is pretty simple. Europe needs to pay for its own defense. America needs to stop exporting all its manufacturing capabilities and therefore lose control of its supply chain,” she says. “If you can distill it into its simplest parts, it becomes clear that Western Europe’s developed markets and America are actually much more aligned than the media would like us to believe.”

Still, she emphasized that these changes will require new forms of capital, with European markets needing to expand and Capital Markets Union offering a potential catalyst.

ETFs can play an important role in that, providing a low-cost, liquid mechanism for individuals and institutions to invest in Europe’s future. According to Lord, private market ETFs will be critical in moving what she calls “a wall of money” into sectors like infrastructure spending, energy resilience spending, data centers and artificial intelligence.

Interested to see more insights from ETFs in Depth conference. Click here

Insights in this article are based on panels and fireside discussions at the Bloomberg ETFs in Depth event held in London in July 2025.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.