BloombergNEF

This article was written by Victoria Xu, BloombergNEF analyst. It appeared first on the Bloomberg Terminal.

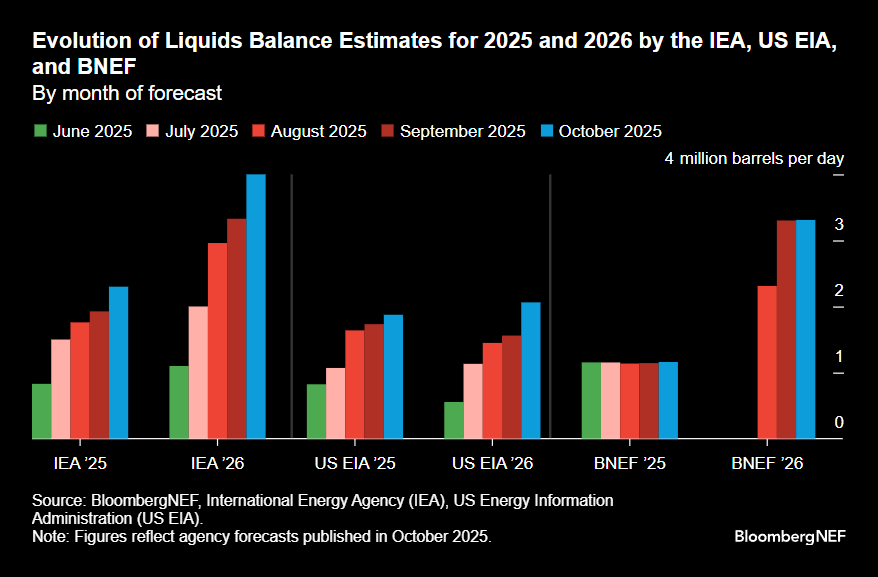

OPEC+ approved another output hike of 137,000 barrels per day (b/d) for November, extending its unwind despite an already oversupplied market. The Organization of the Petroleum Exporting Countries (OPEC), International Energy Agency (IEA), US Energy Information Administration (EIA) and BloombergNEF (BNEF) publish monthly short-term outlooks tracking how global balances are evolving.

By the Numbers

| +2.3m b/d | +1.2m b/d | +2.1m to +4m b/d |

|---|---|---|

| IEA’s global oil balance estimate for 2025 | BNEF’s global oil balance estimate for 2025 | Range of global oil balance estimates by agencies for 2026 |

- Assumptions on OPEC+ supply used by agencies: IEA assumes OPEC+ production targets remain unchanged from November. US EIA’s forecast did not include the OPEC+ output decision for November, and it did not specify its assumption for future OPEC+ production targets. However, the agency expects that some members’ output will reach practical limits while others will aim to prevent inventory builds. OPEC does not directly publish supply forecasts for OPEC+ countries. BNEF derives OPEC balances using imputed OPEC+ crude supply data from the US EIA. BNEF assumes OPEC+ production targets increase by about 137,000 b/d (excluding compensatory cuts) every month until all voluntary cuts are unwound by September 2026.

- For 2025, the IEA trimmed global oil demand by 0.1m b/d to 103.8m b/d and lifted its supply forecast from 105.8m b/d to 106.1m b/d. The agency now expects an annual supply growth of 2.96m b/d, up from 2.7m b/d, as OPEC+ continues to add barrels alongside steady non-OPEC+ production growth. That leaves the surplus widening to 2.3m b/d from 1.9m b/d.

- The US EIA raised its 2025 global demand forecast by 0.2m b/d to 104m b/d. It also revised its supply projection up by 0.3m b/d to 105.9m b/d, mainly from stronger non-OPEC+ output led by the US, Brazil, Guyana and Canada. The surplus widens to 1.9 m b/d from 1.7m b/d.

- OPEC kept its 2025 demand outlook unchanged at 105.1m b/d.

- BNEF’s 2025 demand forecast is largely unchanged at 104.3m b/d and supply at 105.5m b/d, nudging the implied surplus to 1.16 mb/d from 1.14 mb/d.

- For 2026, IEA has cut its 2026 demand outlook by 0.1m b/d to 104.5m b/d. It significantly raised its supply forecast by 0.6m b/d to 105.5m b/d, marking a fourth consecutive monthly upgrade, and now expects supply to grow 2.4m b/d year-on-year. The agency projected a record supply glut of 4m b/d, 670,000 b/d higher than anticipated in September.

- The US EIA left 2026 demand steady at 105.1m b/d and saw its supply forecast climb by 0.5m b/d to 107.2m b/d, loosening the projected surplus to 2.1m b/d from 1.6m b/d.

- OPEC left its 2026 demand forecast steady at 106.5m b/d, the most bullish view among agencies.

- BNEF cut its 2026 demand forecast by 0.2m b/d to 105.0m b/d and lowered its supply forecast by 0.2m b/d to 108.3m b/d, keeping the surplus steady at 3.3m b/d.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.