Bloomberg Intelligence

Growth in artificial intelligence, which has substantial computing needs, could drive a revitalization in demand for power of all types, including nuclear. Companies such as OpenAI, Amazon.com, Google, and Meta plan to spend billions of dollars on IT infrastructure (servers, storage and networking equipment) to support the development of large language models (LLMs), which are rapidly gaining commercial acceptance.

LLMs use graphic processing units (GPUs) that are more power-intensive than the chips commonly employed in traditional computing. Calculations from BI’s technology team suggest that generative-AI queries require up to 10 times the energy and cost of a traditional internet search. The Nvidia Blackwell GPU requires 1,200 watts of computing power vs. about 150 for a CPU, according to BloombergNEF.

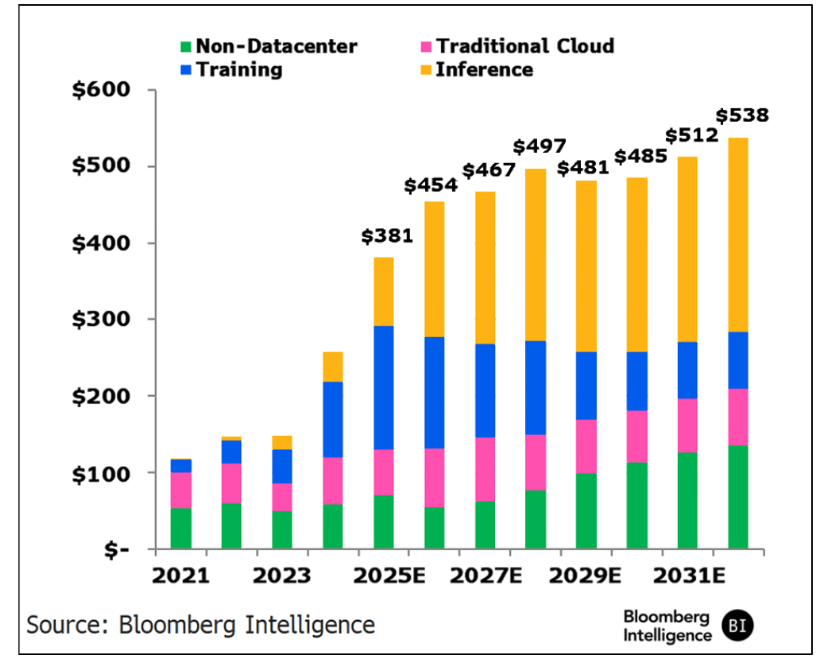

Though capital spending, highlighted in Figure 7, might slow following the initial rollout of LLMs such as ChatGPT, a shift in emphasis to inferencing from training will likely extend the spending cycle. This could be magnified by the introduction of China’s DeepSeek v3 model, which may be less costly to train than other LLMs, making such offerings less expensive and possibly fueling more demand for them. This in turn could prompt model developers to focus on energy efficiency and model profitability sooner than expected.

The BI technology team’s inference scenario assumes that AI capex keeps growing through 2032, including an accelerated 2023-26 growth phase and a more gradual rate from 2026-32. Its training scenario, as shown in Figure 7, sees outlays peaking in 2026 after a more pronounced initial spending phase from 2023-26.

AI Capex Spending Forecast

Renewable energy sources such as wind and solar are emissions-free, like nuclear, but intermittent, which suggests they must be paired with storage or backup capacity. Coal and natural gas-fired power plants have higher capacity factors yet generate greenhouse-gas emissions, making them an unlikely choice for hyperscalers that prioritize environmental stewardship.

Capacity factor, a measure of efficiency, is the ratio of power produced by a source over the total amount it could have produced if running at full strength over a certain period. Nuclear has the highest capacity factor by far of any power source at 90%, followed by coal and combined-cycle gas (60%), wind (35%) and solar (25%). Yet nuclear also costs the most, at $12,500 a kilowatt, well ahead of coal ($5,000), combined-cycle gas ($2,500) and wind and solar ($1,500 each).

New generation capacity of 131-310 GW may be needed to supply the 345-815 terawatt-hours of power required to support US growth in AI computing by 2030. This would equate to an increase of 11-26% from 2023. It assumes a capacity factor of only 30%, in line with wind and solar, since any new baseload capacity may have to be outfitted with costly and unproven carbon-capture technology, according to Environmental Protection Agency regulations, and new nuclear plants may take much longer to build.

Our analysis assumes all AI power needs are met with new generation, rather than increasing output from existing plants. It also excludes the cost of backup, data-center or transmission infrastructure, as well as any fuel efficiencies obtained via advances in chip technology.

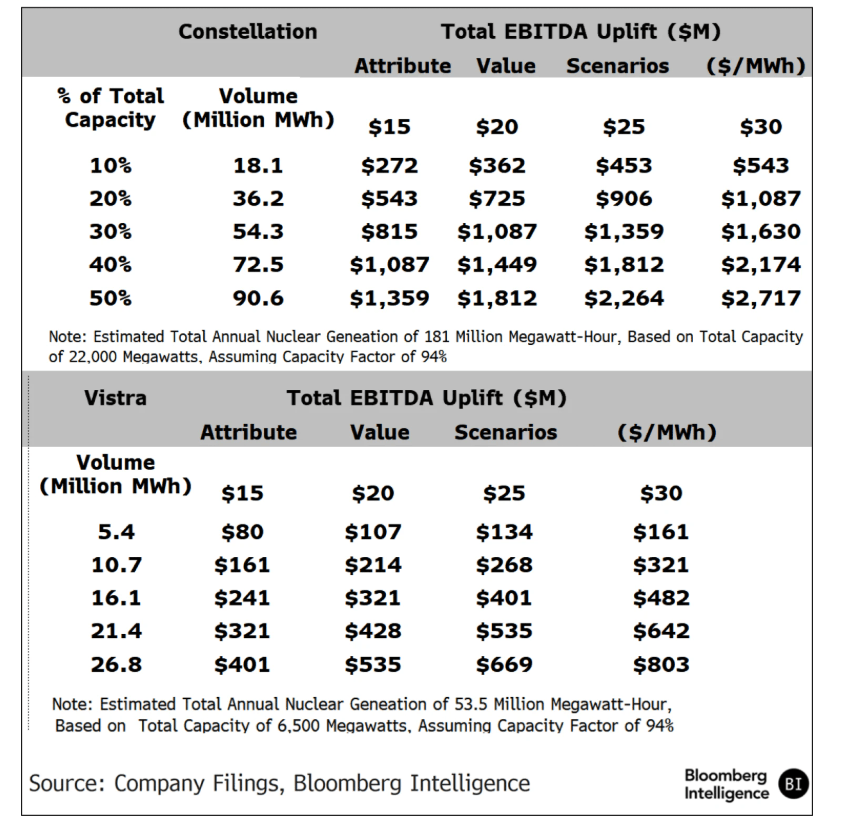

Contract premiums of $15-$25 Per MWh

Data centers are willing to pay a premium for that power, leaving generators such as Constellation Energy and Vistra poised for major Ebitda gains from nuclear power deals set at above-market prices. Constellation’s January VPPA with the US General Services Administration – $840 million for 1 million MWh annually for 10 years – implies a contract price of mid-$80/MWh.

This equates to $15-$25 above market, assuming wholesale power in the low-to-mid $50s and capacity in the low-to-mid $10s. As Figure 8 shows, if each company contracts half of its nuclear capacity at the midpoint $20/MWh premium, Constellation could get a $1.8 billion annual Ebitda boost and Vistra $500 million.

These premiums may prove sustainable, underpinned by data-center demand and limited new nuclear supply. Constellation is by far the largest US merchant nuclear owner, with capacity of more than 22,000 megawatts, followed by Vistra (6,500), Public Service Enterprise Group (3,800), NextEra (2,300), Talen (2,200) and Dominion (2,000).

Ebitda Potential From Nuclear Contracts

Recent nuclear data-center deals have shifted toward front-of-the-meter (FTM) virtual power-purchase agreements (VPPAs) that draw from the grid, avoiding regulatory hurdles tied to off-grid behind-the-meter (BTM) setups that supply power directly. Constellation’s VPPAs with Microsoft (835 MW from the Crane plant restarting in 2027) and Meta (Clinton, after Illinois subsidies expire in 2027) illustrate this trend.

Yet BTM PPAs may offer key advantages to data centers by providing greater load control and operational flexibility. Since the generation is located on-site, electricity can flow directly to the data center, bypassing the network. New nuclear capacity developed under this model could alleviate grid congestion and help prevent cost-shifting to non-data center users. Also, avoiding the interconnection queue may reduce capital costs and deployment timelines compared with front-of-the-meter projects.

PSEG estimates incremental transmission costs can reach $7 a megawatt-hour for FTM solutions, costs that behind-the-meter deployments would largely avoid. Yet BTM connections require FERC approval.

PPA opportunities could emerge for Constellation’s other Illinois-subsidized plants – Quad Cities, Byron, Dresden and Braidwood – totaling 8 GW. In New Jersey, Salem and Hope Creek lost their subsidies in May and may be candidates, with PSEG owning 2.5 GW and Constellation 1 GW. Talen Energy and Amazon Web Services recently expanded their 960-MW Susquehanna agreement in Pennsylvania into a 1.9 GW VPPA, including a 300 MW BTM deal.

This analysis comes from Bloomberg Intelligence’s “Nuclear Power 2026 Outlook”. Terminal subscribers can find the full version of this analysis on BI <GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.