Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Economics Editor Niraj Shah. It appeared first on the Bloomberg Terminal.

US job revisions flag we’re in recession, or new cycle

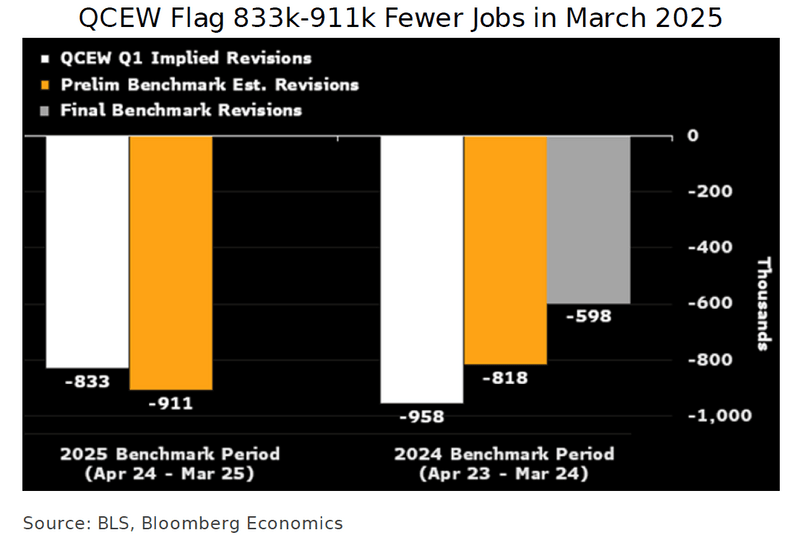

Massive preliminary benchmark revisions to Bureau of Labor Statistics data show net hiring slowed rapidly starting in late-spring 2024 – and even contracted in two months last year. Throughout 2024, payrolls were growing at less than half the pace needed to keep the unemployment rate stable.

When all the revisions for 2024 and 2025 are complete – we won’t get the final revisions until early in 2026 and 2027 – we expect they’ll show the business cycle peaked around April 2024. It’s possible the economy is either still in recession or is in the early phase of a new business cycle.

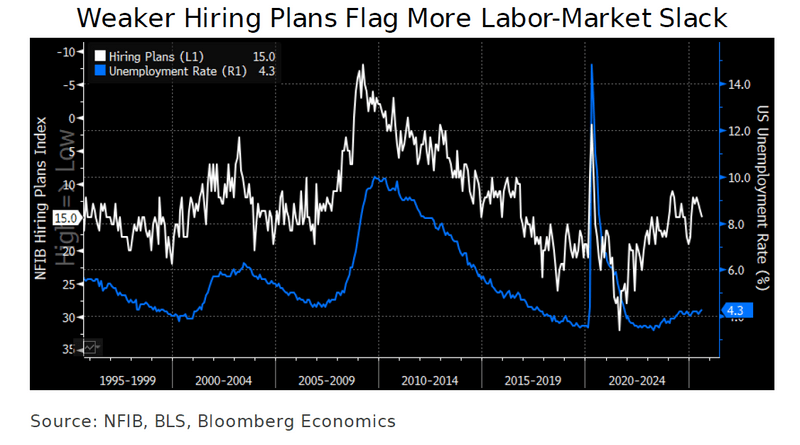

US hiring, capex plans cool despite upside NFIB surprise

A better sales outlook drove the improvement in August’s NFIB’s small-business optimism index – but details of the report reflect less dynamism. Demand for labor and investment plans are cooling amid elevated uncertainty. Even as the NFIB reported “tariffs may be starting to impact pricing,” the share of firms raising prices fell in August. We think the potential for demand to retrench in the face of higher prices could limit the pass-through from tariffs.

Small-business sentiment improved modestly in August, boosting the NFIB’s index to 100.8 from100.3 in July – above the consensus of 100.5.

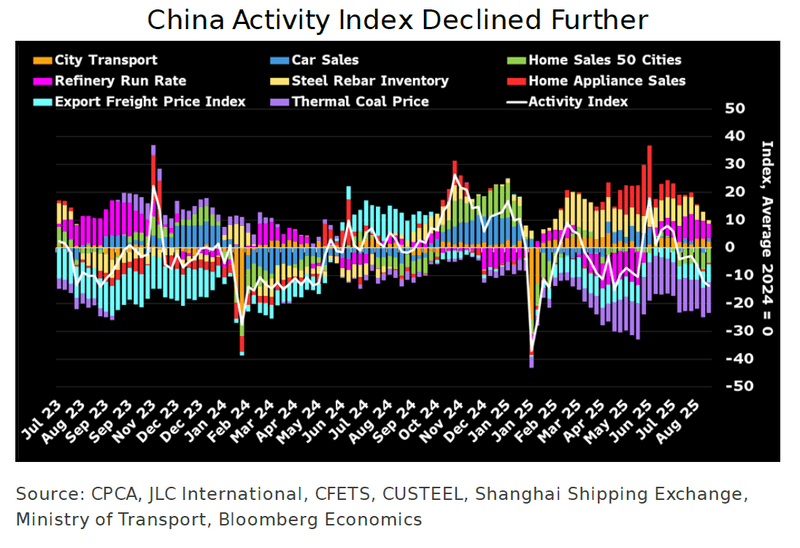

China exports, car and home sales dragged demand

China’s economy lost more steam in the second half of August, according to Bloomberg Economics’ high-frequency index based on data through the week of Aug. 29. The slowdown was sharper on the demand side. Production indicators were mixed, with a slight tilt to the downside.

The index registered -13.5 for the week ended Aug. 29, compared with -6 at mid-August and -3.5 at the end of July. A negative reading means momentum is weaker than the 2024 average.

Is the AI-fueled capex boom in the US over? Probably not

Nvidia’s disappointing second-quarter earnings raised a question on every investor’s mind: Is the AI-fueled investment boom losing steam? The answer has important implications for US economic growth. We still see a substantial runway for the AI-driven capex boom.

Even as Silicon Valley’s sentiment toward artificial general intelligence (AGI) capabilities seems to have eased lately, the growing adoption of AI in real-world tasks will generate immense demand for advanced chips and data centers. We expect AI-related investment will continue to play a major role in driving real GDP growth in the near term.

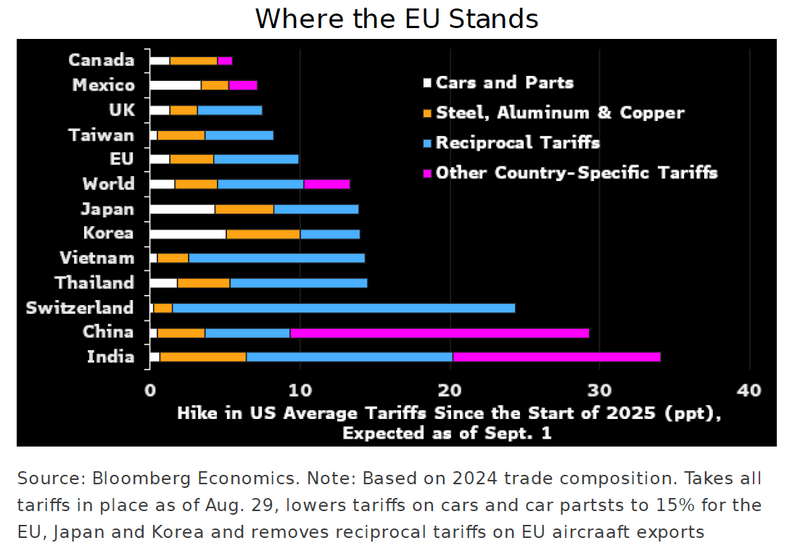

How tariffs are chipping away at euro-area’s economic resilience

Early signs of strain from US tariffs are beginning to show in the economic data, challenging the euro-area’s resilience narrative. Brussels’ deal with Washington is more favorable than that obtained by most US trade partners and has averted the threat of higher reciprocal tariffs on European goods. Yet, it is still unlikely to provide much relief to the bloc in the months ahead.

We think most of the tariff impact has yet to be felt. Our latest projections show the euro-area economy expanding by 1.2% in 2025 before slowing to 0.8% in 2026. The euro-area economy has so far held up against headwinds from US trade policy, but much of the resilience in the first half of the year was due to exporters front-running tariffs. Recent data suggest those anticipation effects have faded.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.