Bloomberg Intelligence

This article was written by Bloomberg Intelligence Senior Industry Analyst Edmond Christou. It appeared first on the Bloomberg Terminal.

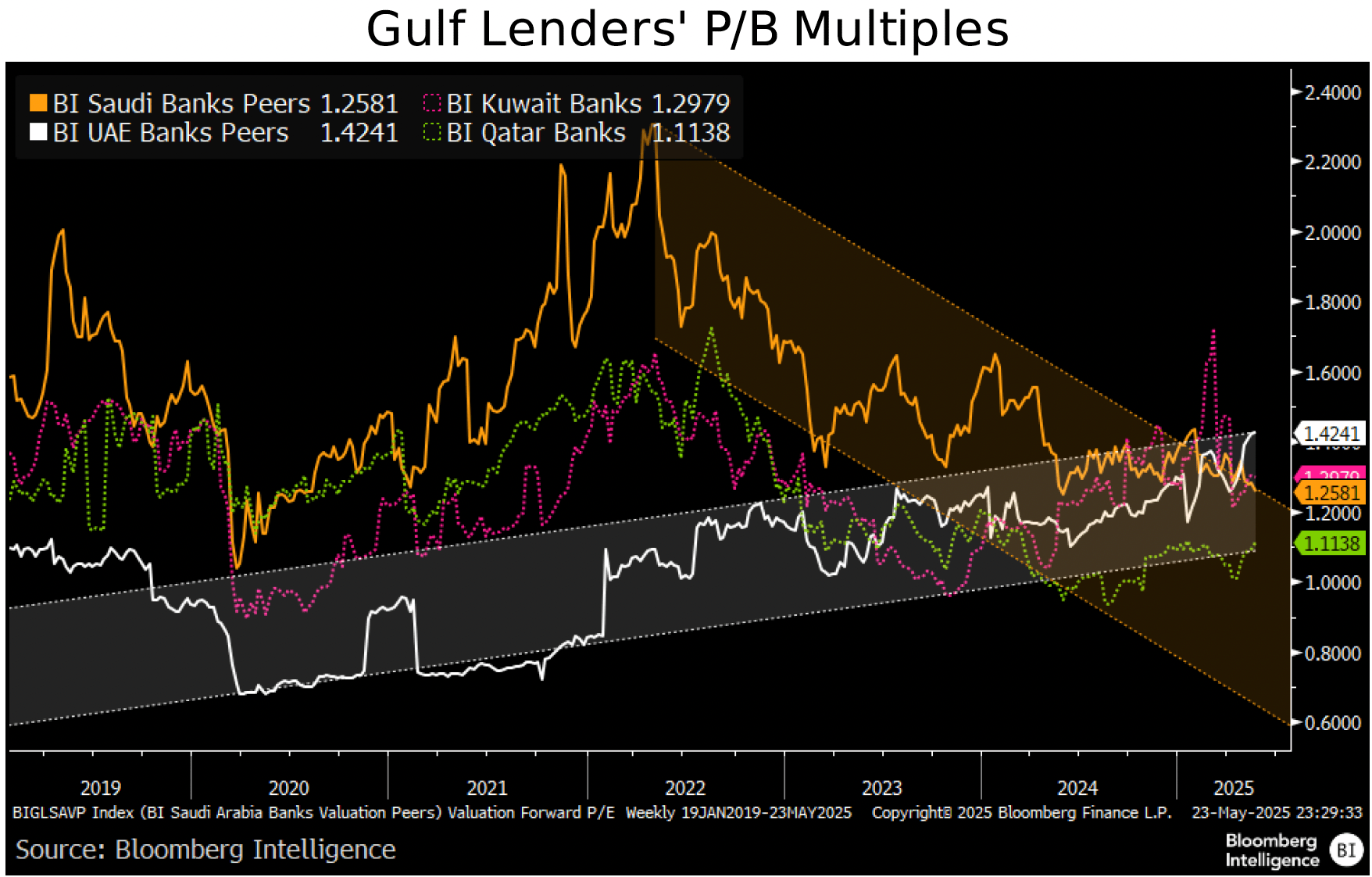

UAE lenders’ forward price-to-book ratio of 1.4x vs. Saudi banks’ 1.3x is supported by the formers’ ability to capture strong domestic and Saudi growth and healthy balance sheets, despite rate-cut sensitivity. Saudi lenders’ P/B reflects concern that oil prices will hurt profitability and an uncertain outlook for its “giga” construction pipeline.

Investors price more risk for Saudi banks than UAE peers

Saudi banks have traded at a 1.3x forward price-to-book vs. 1.4x for UAE peers since May amid concern that oil prices will hurt Saudi profitability. UAE lenders’ stocks have been supported by fewer-than-expected rate cuts and healthier balance sheets that are capturing credit growth inSaudi Arabia, despite their earnings sensitivity to lower interest rates. The Saudi pipeline is double the size of the UAE’s yet has similar value, excluding the uncertainty around “giga” — or large-scale — projects. Saudi banks’ P/B ratio was 1.6x in early 2024 and hit a 2.3x peak in May2022 on higher funding costs and lower returns. Catalysts for a rerating include better market liquidity and pricing to improve tight lending spreads.

UAE banks’ P/B has trended up since late 2020 due to robust property-market and private-sector activity.

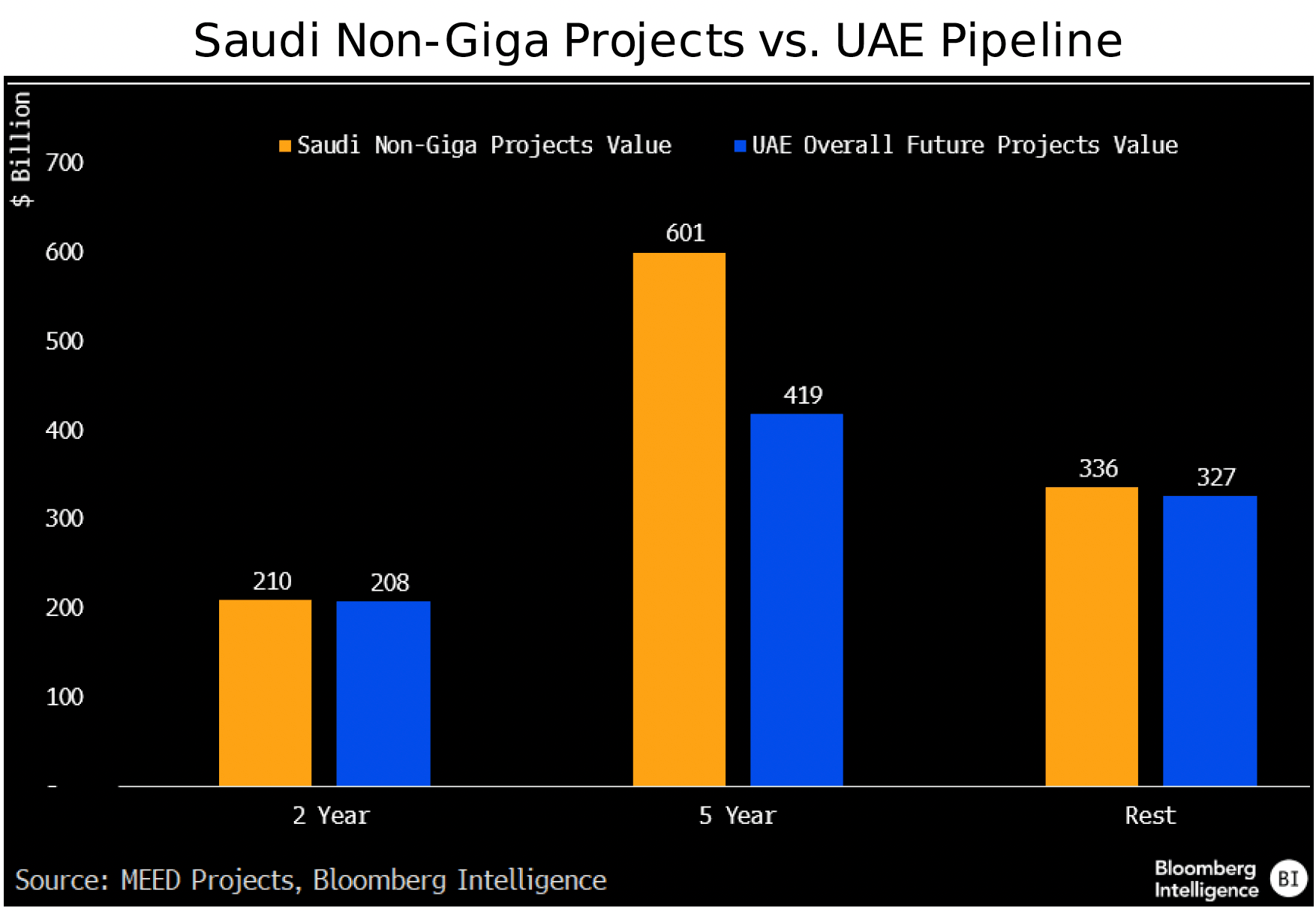

UAE pipeline similar to Saudi’s excluding giga deals

Saudi Arabia’s construction pipeline is valued close to the UAE’s of about $210 billion over the next two years and $420 billion over five years excluding giga projects, which face execution uncertainty. The value of projects in both pipelines that are either beyond five years or on hold is about $330 billion. The UAE pipeline offers local banks a similar growth trajectory to Saudi banks(if giga projects are excluded), yet the UAE market has been flushed with liquidity compared withSaudi Arabia, which has led to corporate and public-sector entities repaying loans earlier, dampening the new-loan origination rate in the UAE. The Saudi market’s tight liquidity means demand for credit from corporate and government-related entities is strong, giving UAE banks an opportunity to offer cross-border lending.

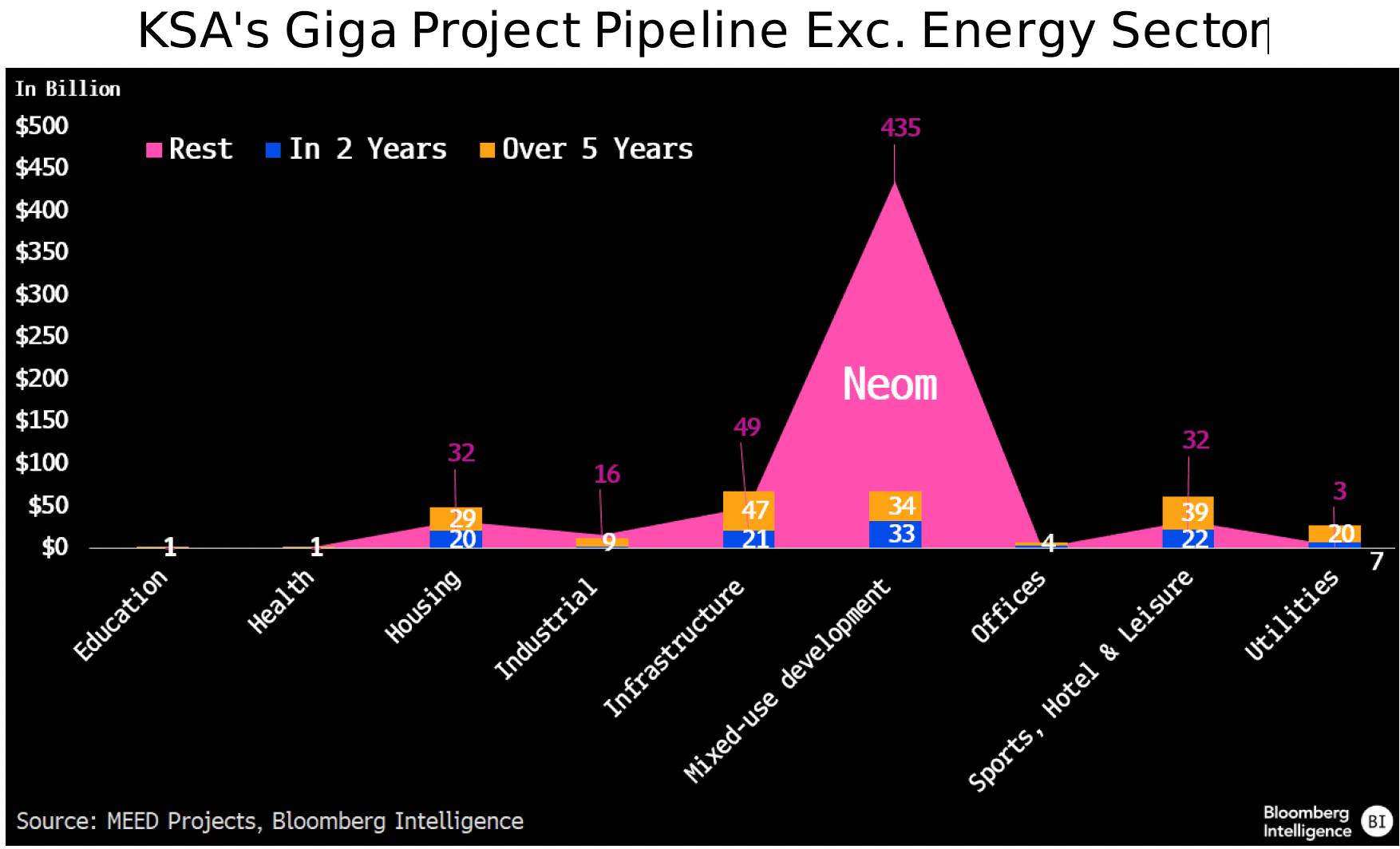

$567 billion of Saudi giga projects at risk

Neom’s mixed-use developments make up a large part of the $753 billion giga-project pipeline, of which $186 billion is likely to be executed over the next five years, based on MEED data. The remaining $567 billion faces uncertainty and could be put on hold or subject to cancellations as the government reprioritizes its spending amid low oil prices. Projects in housing, infrastructure and retail account for the majority of the five-year pipeline.

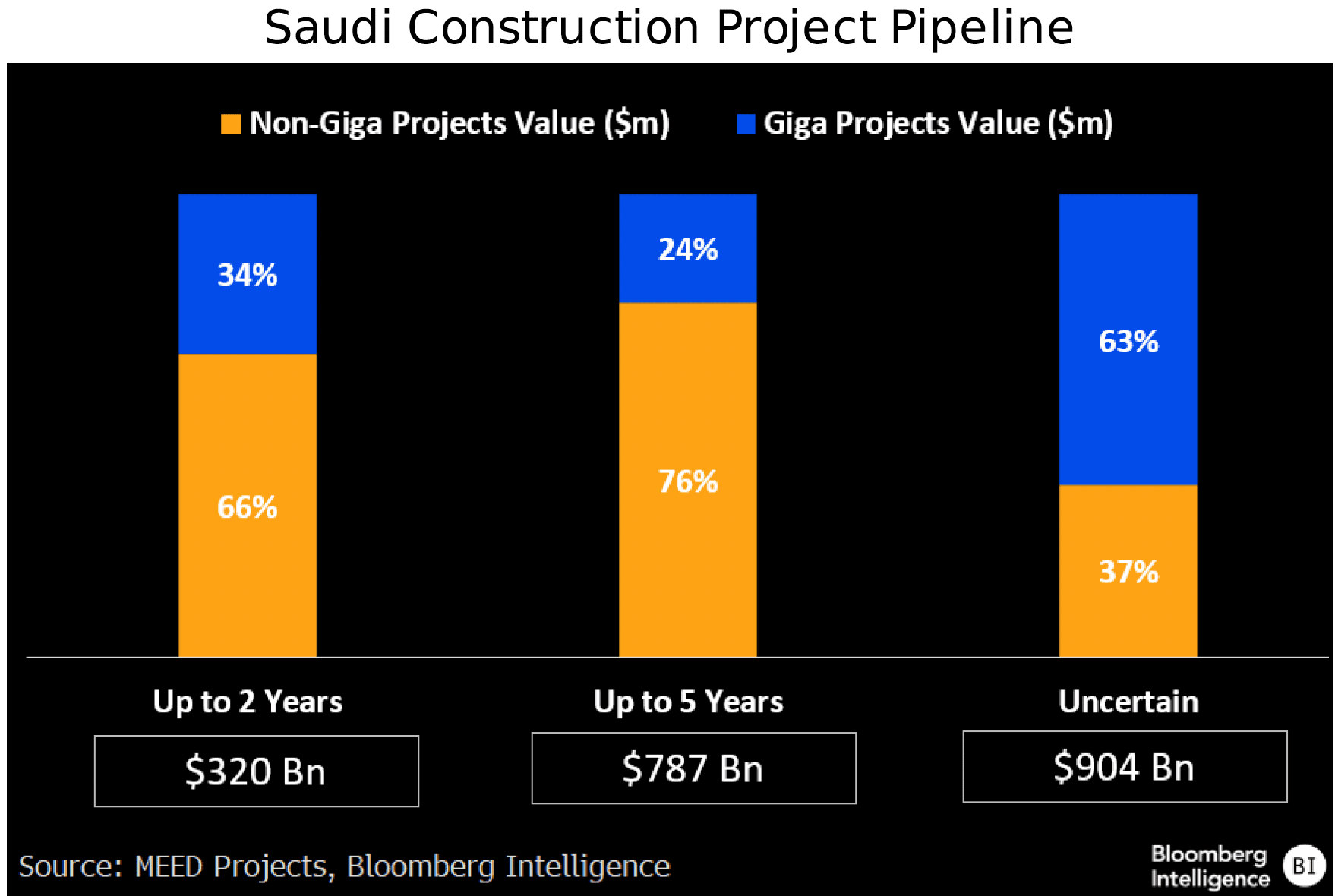

Future of $904 billion pipeline projects uncertain

Giga projects make up 34% of Saudi Arabia’s two-year construction pipeline and up to 24% over the next five years, with smaller-sized projects accounting for the largest share near term.Projects on hold or which have no time line have been valued at $904 billion, of which 63% are giga projects. About $107 billion worth of projects was put on hold between August 2024 andMarch this year, equivalent to almost half of awarded project value in the last two years, according to MEED data.

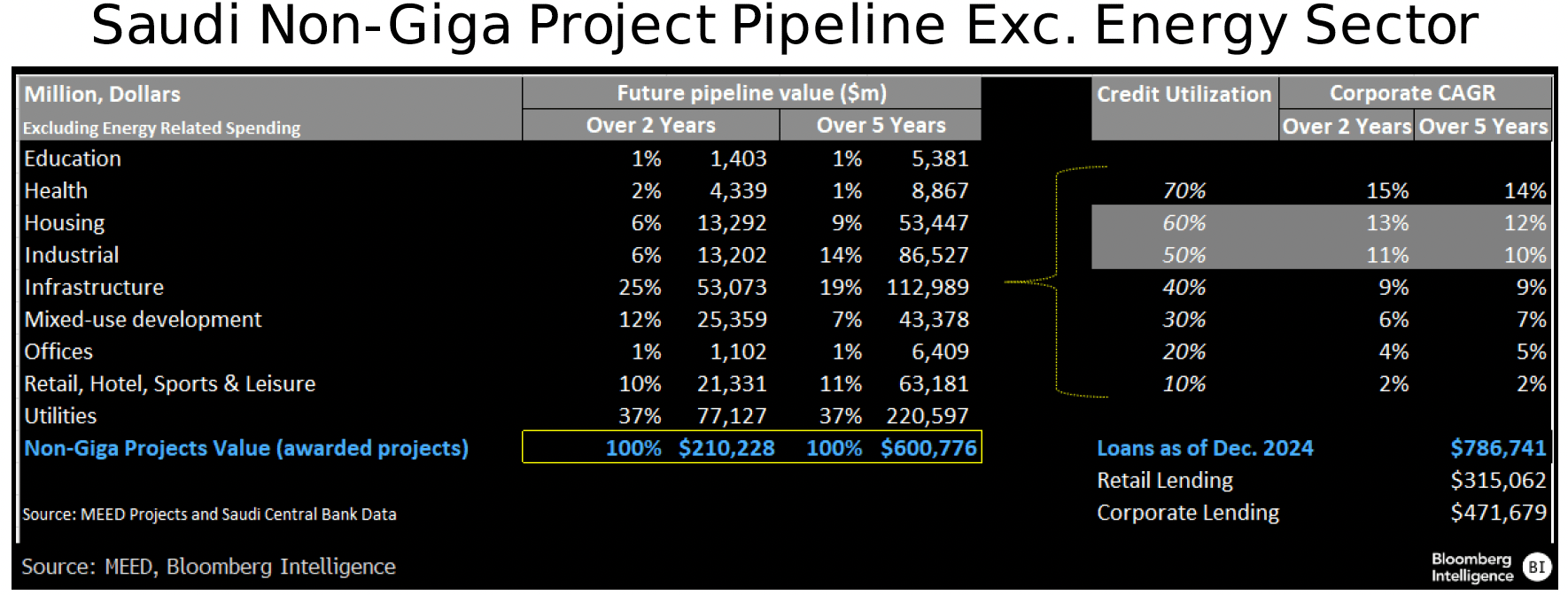

10-12% loan growth, $10-$13 billion debt on non-giga

Saudi Arabia’s construction pipeline remains strong at $210 billion over the next two years and $600 billion over the next five years, even after excluding giga projects. That implies a potential corporate loan-growth rate for banks of 10-12% annually over the period, based on 50-60% local credit utilization for these projects. Saudi lenders would need to issue at least $10-$13 billion of new debt annually to support their balance-sheet expansion, we calculate, assuming the wholesale funding mix remains at an 18/82 loan-to-deposit ratio.

Still, excluding giga projects, Saudi Arabia’s construction pipeline looks close to the UAE’s total future pipeline of $201 billion over the next two years and $420 billion up to five years.

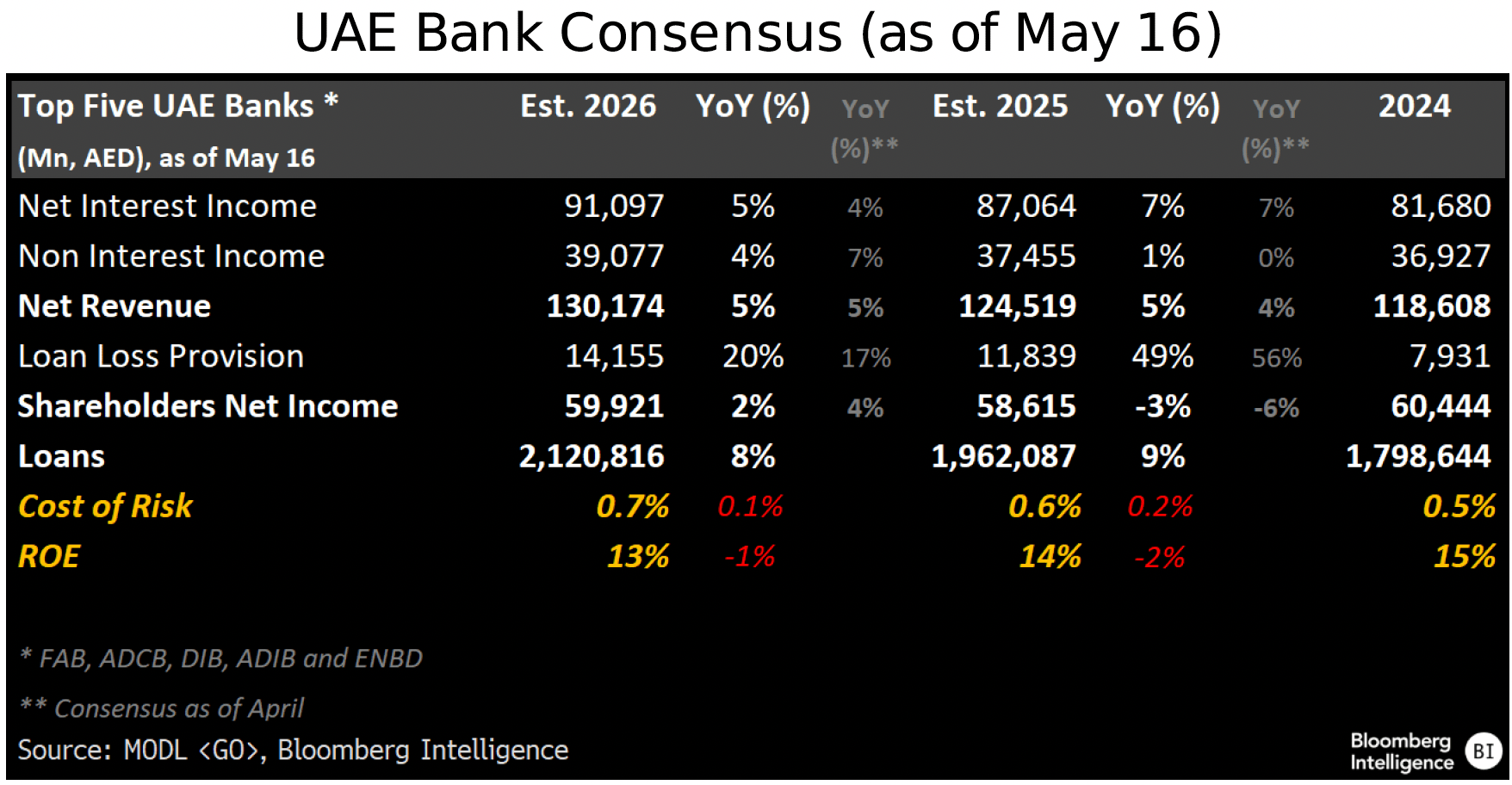

Revenue growth at 4-5% unless more other income or less cut

The top five UAE banks’ revenue prospects may improve if fewer than two rate cuts are fully priced in, pushing 2025 revenue growth beyond 4-5%, given lesser than a 10-15-bp margin drag this year. Competitive pricing may ease, given lenders could take action to improve lending spreads to mitigate rate-cut pressure. Also, ample liquidity may allow lenders to partially navigate the pressure. Nonfunded income share of topline is expected to be 30% in 2025-26 slightly below 31% a year earlier, but any gain in the contribution of other income to top line may offset the expected EPS 3% decline this year (6% drag previously).

Cost of risk may normalize up by as much as 15-17 bps in 2025 to more than 60 bps. This, together with an increased corporate-tax rate to 15% (9% last year) may trim ROE close to13.8% (15.4% in 2024).

Revenue, EPS have room to run if margin dynamics change

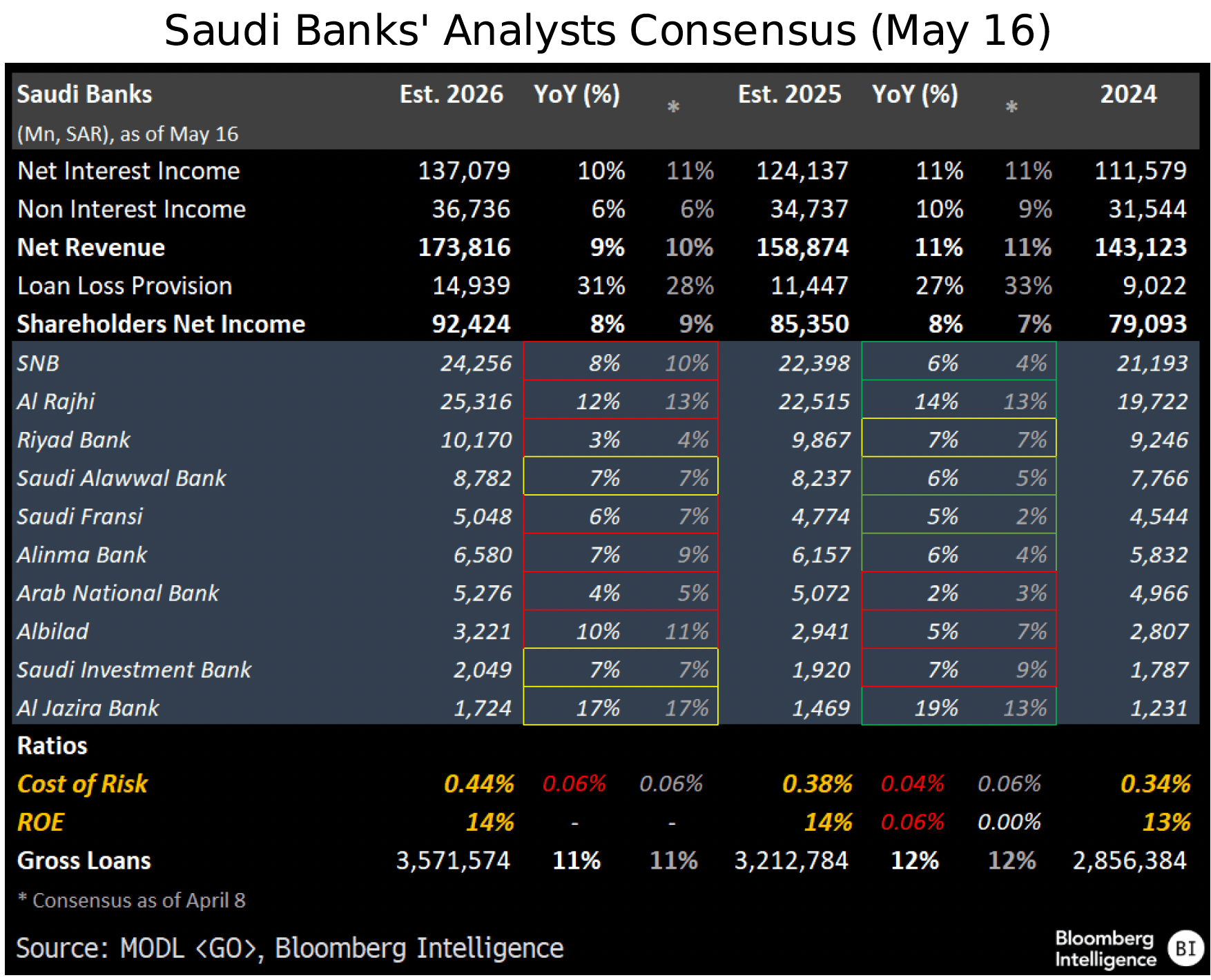

If Saudi banks’ loan pricing and cost of funding are supportive of margin in the coming quarters, there’s scope for consensus upgrades to revenue and EPS in 2025, with the possibility of top-line estimates being raised by two percentage points (based on our calculations). Expectations currently point to an 11% revenue gain, 12% loan growth and a margin trim of 5-6 bps. Consensus calls for 2026 net interest income to rise 10% on anticipated industry lending growth of 11% and 4-5-bp margin setback. There’s upside from fewer rate cuts and a falling oil price. EPS is seen up 8% in 2025, with this rate sustained in 2026 with a return on equity (ROE) of 14% in2025-26 (13% in 2024).

Analysts see cost of risk (COR) rising to 38 bps in 2025 (34 bps in 2024), but COR above 45 bps in 2026 threatens ROE.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.