Functions for the Market

- Uncertainty and confusion over newly imposed US import tariffs and threats of steep new tariffs are driving up fear and volatility.

- Imports from China fell by $10 billion in February, and March consumer data shows a pivot toward essential goods over discretionary spending—early signs of economic stress.

- New levies on raw materials and agriculture are fueling inflation concerns, while slashed oil demand forecasts and multi-year price lows suggest broader recessionary pressures may be building.

Background

In the wake of tariff announcements and takebacks, markets are experiencing wild swings as businesses, investors and consumers alike struggle to manage uncertainty. The S&P 500 Index swung more than 10% in a single day as volatility reached levels not seen since the beginning of the pandemic. Following two weeks of market chaos, investors remain wary.

PRODUCT MENTIONS

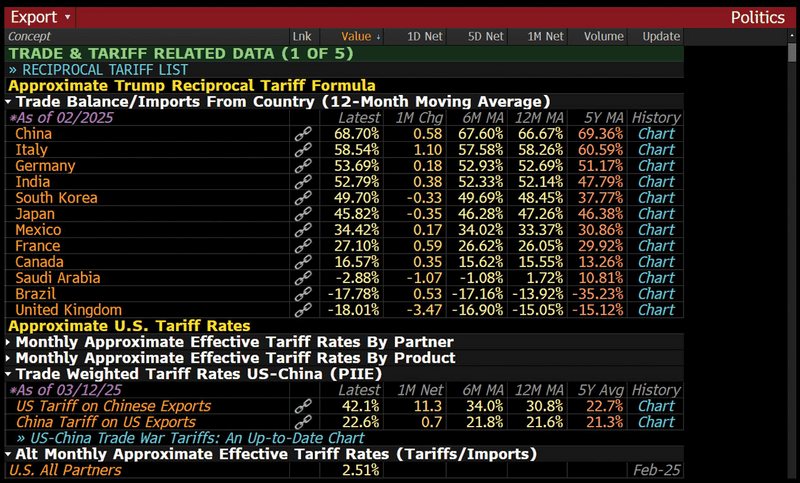

Before President Donald Trump’s April 2 announcement that the US would impose what he calls “reciprocal” tariffs of at least 10% on all its trading partners, data suggested the US economy could be resilient. Inflation had been trending down, with the consumer price index rising 2.8% in February, below forecasts.

The issue

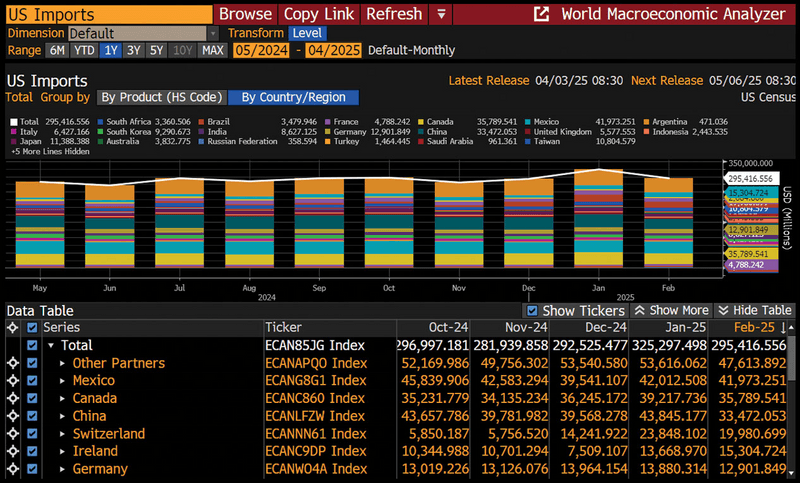

Tariffs pose a threat to the US economy’s resilience with disruptions to trade flows and consumer spending—two key indicators of economic health. The need for timely data and advanced analytical capabilities to assess these impacts accurately is critical in navigating the volatility inflicted on markets. In a recent analysis of US import dynamics, Bloomberg’s ECAN tool, which allows users to see the key economic indicators that contribute most to headline numbers, revealed that in February imports from China declined by about $10 billion from January. Drilling down on shifting trade patterns can help forecast broader economic implications.

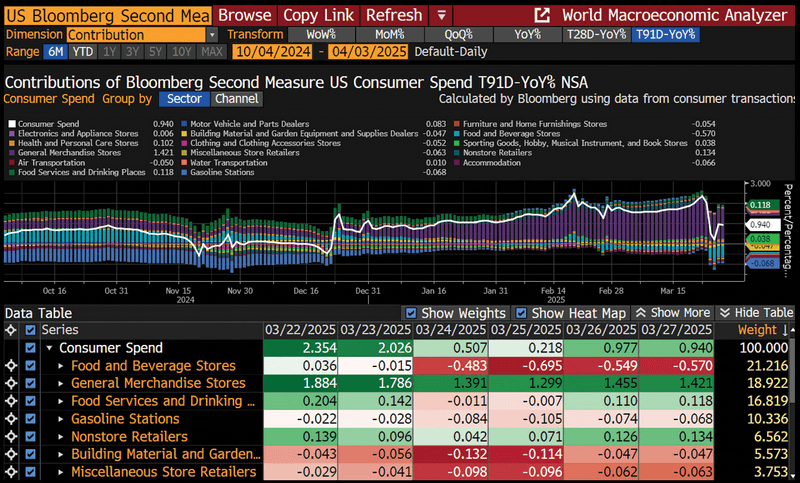

Additionally, consumer spending behaviors can rapidly shift in response to economic uncertainty from tariffs. Consumer spending is crucial for the health of the US economy, and consumer demand and supply levels can act as a leading indicator of inflation. The ECAN tool can leverage real-time credit and debit card transaction data from millions of consumers. In March, analytics showed a noticeable year-over-year dip in consumer spending with purchases appearing to be directed more towards essential goods than discretionary items.

Tariffs on raw materials and agricultural products threaten to drive up inflation and spark fears of recession. Meanwhile, expectations for oil consumption this year have already been slashed by 320,000 barrels a day, while prices approach a four-year low.

“Oil is already starting to price in a recession,” Energy Aspects analysts wrote in a note. “The question now concerns how long the front can hold out while the world’s two largest economies butt heads — which historically has not been the best news for demand and the global economy as a whole.”

Tracking

Run WSL POLITICS <GO> for real-time tracking of the US Trade Commission tariff data by partner and relevant US political decisions.

- Type “worksheet sample” and click the WSL match.

- Type “politics” in the amber field, press <GO>.

- Click on the Politics worksheet.

For more information on this or other functionality, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.