Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Omid Vaziri with contributing analysis by Pauline Eschbach. It appeared first on the Bloomberg Terminal.

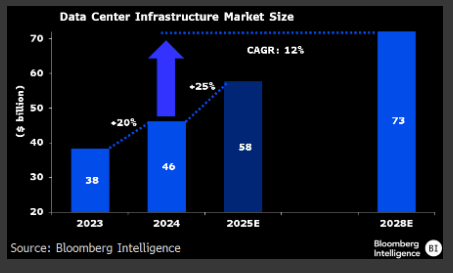

Schneider, Siemens and industrial peers are set for a midterm profit bump as demand for data-center electrical infrastructure surges 25% in 2025, hitting $58 billion in our scenario and reaching a 12% CAGR to 2028. Large OEMs may seize share from smaller rivals as their scale, R&D and capex room helps meet challenges to the rapid rollout of data centers.

Data center sales could grow at 12% CAGR to $73 billion

Growth in the data-center infrastructure market — which we estimate was worth $46.2 billion in 2024 — could reach 25% in 2025 as expansion in manufacturing capacity eases constraints and AI-driven investment starts to lift sales of electrical-equipment providers. Schneider has committed to investing about €2 billion in expanding overall capacity in 2024-27, partly on data centers and electrification. The market could sustain a 12% CAGR until 2028, our BI scenario suggests, with growth normalization likely as bankable land — with power supply, labor and equipment availability –causes bottlenecks and remains a concern.

Data-center build-out is boosting Schneider, Siemens, ABB and Legrand’s sales prospects — alongside Vertiv and Eaton in the US — with the potential for electrification demand to become a supercycle.

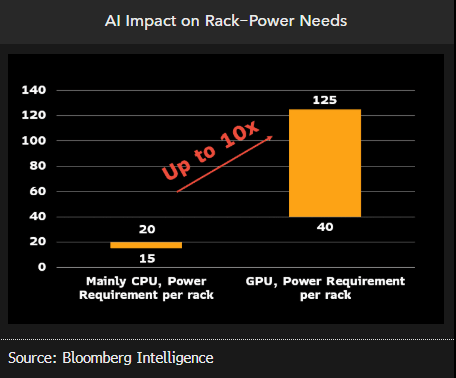

Generative AI boosts electrical-equipment demand, margin

AI adoption could speed up demand for Schneider, Vertiv and Legrand’s thermal management, power distribution and racks. On top of volume demand, AI brings pricing and product-mix benefits to electricals’ margins. New data centers must be built to cater for generative AI, while existing ones need retrofitting. More power-hungry systems that generate more heat and require greater power density are a key driver of demand. Training a large language model may need more than 10x the energy density of centers’ prior use and GPU-based architecture more than 4x at rack level.

AI has begun to boost OEMs’ orders, with the mix in backlogs expanding above all other market segments, and sales should follow. Fulfillment delays have risen as cloud and colocation end users are placing orders further in advance to secure infra capacity.

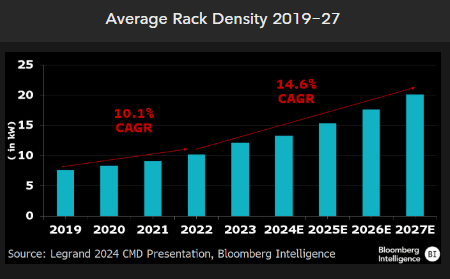

Average rack density may reach 20kW by 2027

AI energy requirements are driving a rise in rack power, but low-capacity racks are likely to remain a key part of the installed rack market. Legrand predicts that 50% will still have less than 20kW capacity by 2027, despite the share of racks of more than 20kW likely doubling over the next three years to 42%. That brings the average density to 20kW by 2027 from 12kW in 2023.

As density increases, cooling capacity becomes essential to maintain data-center operations and is the second-highest energy guzzler, which means efficient cooling can be a key differentiator when customers pick a provider. Schneider (via its Motivair acquisition) and Legrand’s expertise in rear-door heat exchangers (RDHx) that can go up to 200kW, positions them well for market-share gains and they’re also well-suited for retrofits.

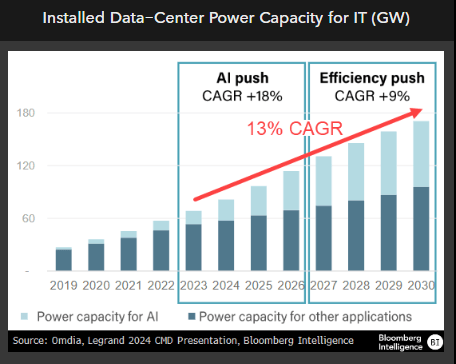

Efficiency push set to follow AI-driven expansion

Though the deployment of AI applications is likely to drive data-center power capacity expansion in the next two years — reaching about 40% of total power capacity by 2026 based on Omdia — capacity growth may extend beyond that due to the push for efficiency, amounting to total capacity expansion of 13% CAGR over 2023-30. Data-center operators that have signed the Climate Neutral Data Centre Pact already commit to a Power Usage Effectiveness of 1.3-1.4 for new builds, compared to the current average of 1.6, and regulation may become more stringent as energy becomes scarcer, following in the footsteps of the EU Energy Efficiency Directive.

AI-dedicated power capacity is expected to grow at a 26% compound annual growth rate over 2023-30, as opposed to 7% for other applications.

Power and labor issues may allow large industrials to grab share

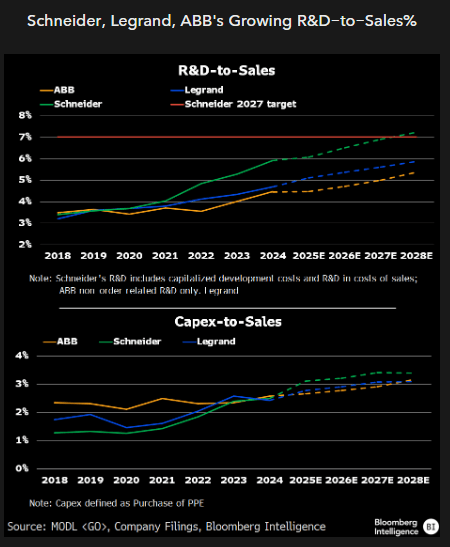

Risks to data-center rollouts could enable large industrials to gain share from smaller players unable to keep up. Strong data-center demand requires large investment from electrical companies to keep expanding capacity and developing new products with enhanced specifications. Schneider, with its 7% R&D-to-sales target, capacity-expansion plans and No.1 market-share position is particularly well positioned. Labor and power shortages may promote monitoring and software capability, and the provision of alternative energy sources to the grid. These are all higher value-added products.

Schneider’s prefabricated units could limit the need for a data-center workforce on location, while Wartsila announced it will provide onsite power generation to support data centers’ high energy needs when power availability is lacking.

Electrical OEM data-center sales exposure to rise

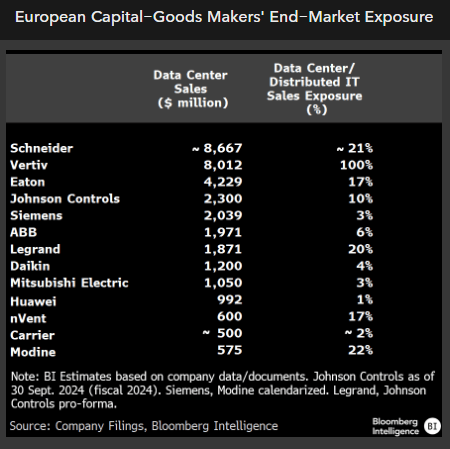

Schneider, Vertiv, Eaton and Siemens are key industrials whose top lines are set to benefit from expanding data-center and AI exposure. Their products are widely used across a data-center’s life cycle — from power supply to cooling systems and rack-power distribution — and represent 43% of data-center capital expenditure. Schneider is the No. 1 provider of physical data-center infrastructure worldwide, with a BI-estimated 19% market share, closely followed by Vertiv at 17%.

Schneider is the most exposed to data centers (about 21% of sales), mainly in its Energy Management division, followed by Legrand (20%) and ABB (about 6%, mainly in Electrification). Data centers represented 3% of sales in Siemens’ 2025 calendarized revenue and are a key growth driver of its Smart Infrastructure unit.

Flexibility, installation speed may expand market share

Data-center infrastructure flexibility and installation speed may be key differentiators for data-center providers and users. In an environment in which new-build growth is limited by the availability of land, labor, energy and water, retrofits may become an expanding part of electrical OEMs’ business, especially in countries with moratoriums on new builds like Ireland.

New-build designs can evolve during a project, giving an edge to solutions that are flexible, rapidly deployable and ensure business continuity. Legrand’s Tap-off technology enables quick connection to busways (prefab electric distribution systems) without the need for specialized staff and allows the rapid removal and replacement of infrastructure without service interruption. Preassembled cabinets may also speed up installations.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.