ARTICLE

Europe’s $720 billion defense spending wake-up call

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Lead Aerospace & Defense Analyst George Ferguson. It appeared first on the Bloomberg Terminal.

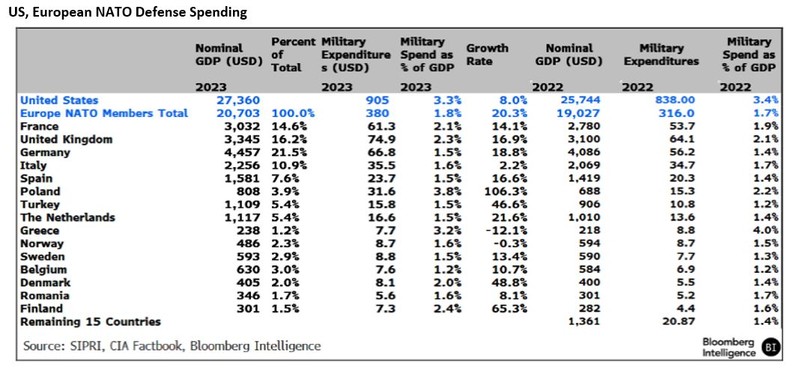

The 15 largest European members of the North Atlantic Treaty Organization might have to ramp up military investment by as much as $340 billion annually to $720 billion as they manage threats on their doorstep and prepare to conduct a divergent foreign policy from the US. The election of Donald Trump may disrupt trans-Atlantic relations as he presses NATO to spend more on defense, even as a Republican-run government turns increasingly isolationist, the focus shifts to threats in the Middle East and Asia, and the federal budget is at records for debt and deficit, which limits military spending. Though European budgets are stretched, we believe core NATO countries could afford significant spending increases, with the impacts on debt and deficits eased by local equipment production. Consolidating Europe’s fractured purchasing of home-built military gear would help. Based on lessons learned from Russian’s invasion of Ukraine, European NATO’s needs include at least $200 billion in armor and aircraft from companies such as BAE Systems, Airbus, Boeing, Saab and General Dynamics.

Key research takeaways

- Production Capacity Depleted: Europe has underinvested in its militaries since the end of the Cold War, requiring an extended period of investment to reconstitute fighting forces. Contractors’ backlogs are swelling, though products will be built over several years since aerospace and defense supply chains are already stretched.

- European Contractors Favored: Regional manufacturers such as BAE and Leonardo will likely receive orders when their technologies are close to state of the art. Other contractors like Rheinmetall will see additional gains as US equipment is partially built in the region. We expect defense products with high costs and large run rates to be built in the region to boost local economies and offset increased government debt.

- Real Risk Will Require US Products: US products, such Lockheed’s F-35 fighter and Precision Strike Missile or Boeing’s Apache attack helicopter, may get the nod in some cases, given they have better capabilities after being developed over decades and tested in battle

Already a customer? Access the full report here.

Not a terminal user? Click here to learn more.