ARTICLE

SEC’s broker-dealer regulation for AI will probably be scrapped

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Government Analyst Nathan R Dean. It appeared first on the Bloomberg Terminal.

President-elect Donald Trump’s victory — along with his decision to nominate former SEC Commissioner Paul Atkins as Chair of the SEC — likely means the proposal to enhance transparency and guardrails for new technologies within broker-dealers has likely been scrapped. The rule was already facing an overhaul, and with other priorities likely, we think this proposal could be set aside for years, if not indefinitely.

Our Thesis: A 2023 SEC proposal requiring firms to “eliminate or neutralize the effect of conflicts of interest,” as well as have written policies to prevent violations, probably won’t have a material effect on revenue or business operations. We believe, however, that compliance costs for the largest brokers and advisers in the US will run just above $1 billion over five years.

What’s at stake

More than $1 Billion in New Costs.

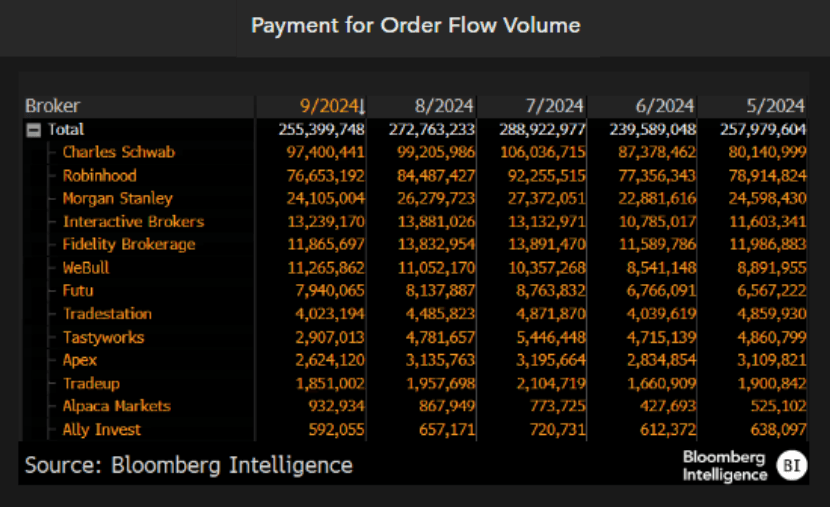

Compliance costs for the largest brokers will likely increase in response to the SEC proposal on preventing conflicts of interest when using technology including predictive analytics and artificial intelligence. Firms will be required to both ensure their technology usage meets US financial rules and maintain policies that prevent such conflicts. Though the proposal shouldn’t have much impact on revenue, BI estimates costs for the largest brokers and advisers could run just north of $1 billion over five years. Some firms may try to pass such costs on to clients via higher commissions or fees.

And…

Third-party technology firms.

Third-party firms that provide and sell predictive analytics and artificial intelligence technology may also fall under heightened scrutiny due to the rule. The SEC estimates that many brokers and advisers outsource complex technological needs to third parties and questions whether those firms should also be scrutinized. At a minimum, those third-party firms probably will face greater scrutiny by their clients to ensure that the product doesn’t push conflicts of interest. Such firms may also see compliance costs rise.

What’s the outlook?

20% chance of proposal in 2025.

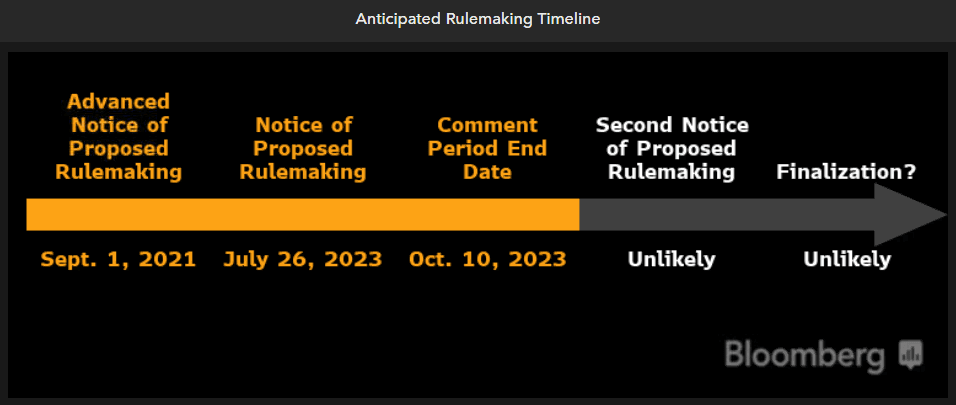

President-elect Donald Trump’s victory in November essentially puts the SEC’s proposal on predictive analytics on ice and likely delays it for years, if not indefinitely. The proposal would already have been slated for an overhaul had President Biden won re-election, and SEC Chair nominee Paul Atkins, if confirmed by the Senate, probably has other priorities on his to-do list. We think this rule will instead be deferred and subject to recall if a future Democrat-named SEC chair opts to revisit the idea.

What’s the timeline?

What’s the issue?

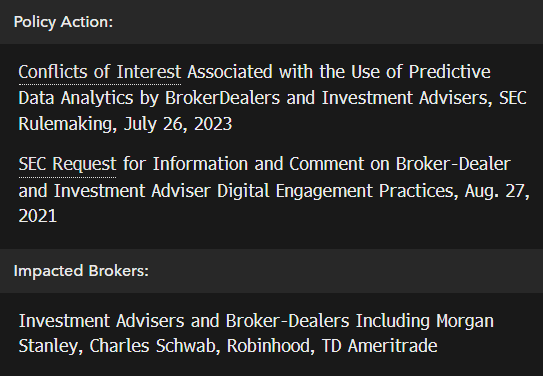

Technology use by brokers.

In response to high volatility in some equities trading in January 2021, the SEC conducted a review of “gamification” and whether it hurts retail investors. Initially, the agency requested market participants’ comments to learn more about so-called digital engagement practices. Then, with increased use of artificial intelligence, the SEC broadened the review. The proposal released in July 2023 is a result of that effort, with the SEC focused on preventing conflicts of interests when offering investment advice. Technologies that don’t offer advice — like customer balance information or web sites — are not impacted.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.