ARTICLE

Asia AI transitions to next-gen communications and computing

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Strategists Shirley Wong and Breanne Dougherty with contributing analysis by Matthew Vitha, Charles Bond, Robert Lea, Jasmine Lyu, Laurent Douillet, and Sufianti Sufianti. It appeared first on the Bloomberg Terminal.

A rising interest in high-innovation themes is driving the tech continuum, with a focus on AI and a transition into next-generation computing and communications. Asia’s not sitting on the sidelines despite geopolitical tensions this year. In APAC, key themes on our radar include the next phase of AI, the digital economy in emerging markets, Japan robotics and multi-theme stocks.

Innovation a core priority at Asian companies

Our frontier tech theme has exposure to nascent themes like space and quantum computing. Now largely made up of US public equities, we expect these themes to advance to involve more global public equities, with Asia being a critical region to watch. While China’s AI firms try to manage US export controls with strategic front-loading, they face other external risks amid geopolitical tensions. Cash-rich AI firms may be able to spend more on R&D as governments support developing AI, semiconductors, quantum computing, and other technologies as national strategic resources.

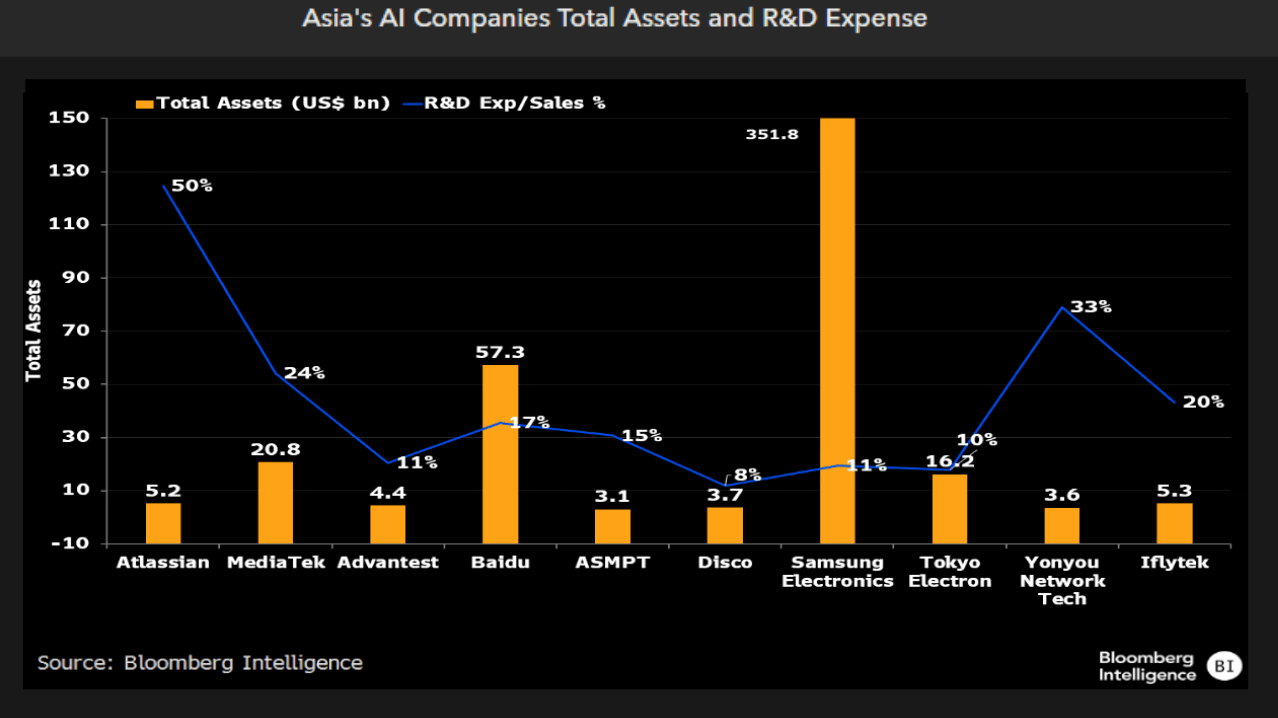

The 31 Asian AI companies in BI’s theme universe have assets with an average total of US$36.5 billion and spend 15% of their revenue on R&D. Nearly half of the Chinese AI firms allocate 10% of sales to R&D, such as Yonyou Network Tech (33%) and Iflytek (20%).

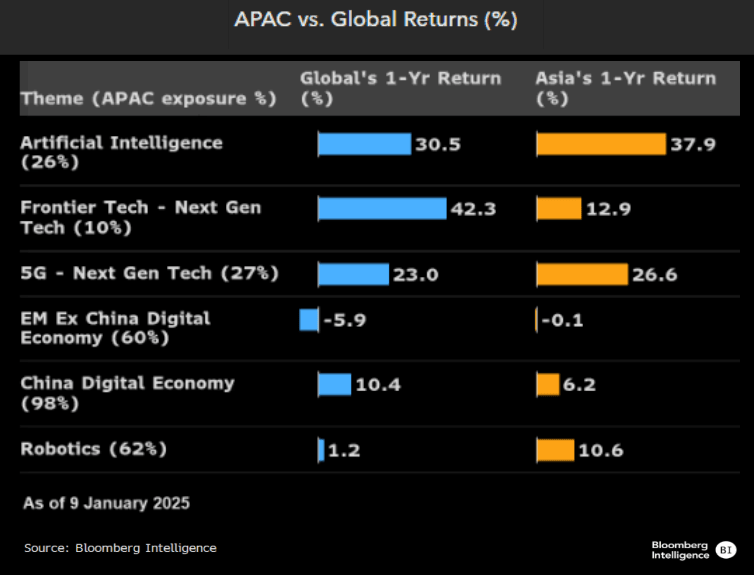

Thematic returns in Asia outpace global peers

Asia is turning out to be a positive contributor to the performance of global BI themes. Out of the 33 BI themes, 18 of them consist of Asian thematic equities with higher returns than the global BI theme indices over a one-year basis. Within the next-gen tech themes, Asia trailed global peers in frontier tech and 5G outperformed by 3.6 pts. Conversely, Asian firms in AI, robotics, and EM ex-China digital economy have outperformed their global BI theme indexes by 7.4 percentage points, 9.4 points and 5.8 points, respectively, over one year.

Asia’s frontier tech one-year performances were mixed with space names SKY Perfect JSAT Holding up 29%, Satrec Initiative up 38% and Ispace Inc. Japan falling 8%. Taiwan’s 5G firm, Mediatek, rose 53% and Hong Kong’s China Unicom was up 59%.

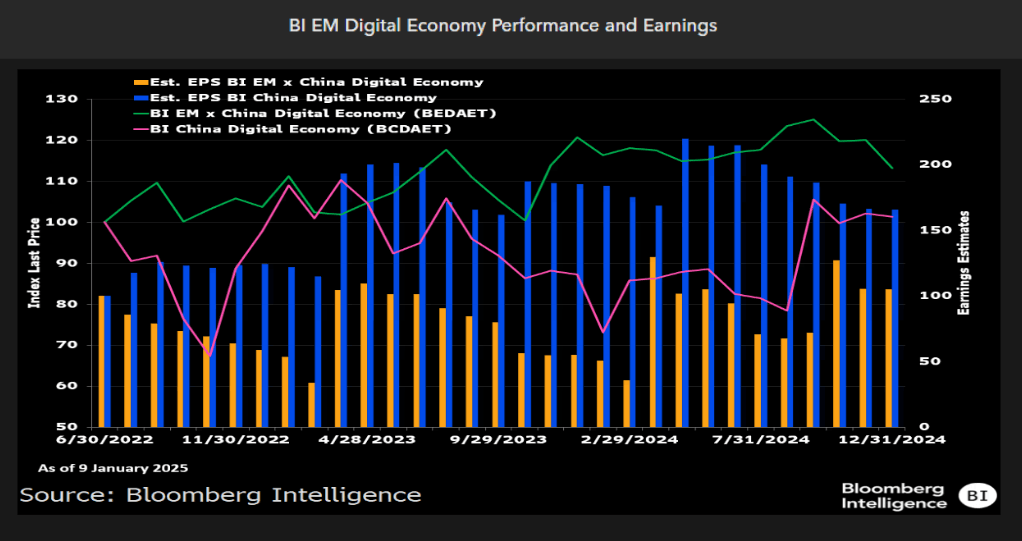

Domestic stimulus, rates support EM digital economy

Domestic support for Asia’s digital economy will likely offset some of the negative impact from external headwinds such as trade tariffs in 2025, with Asia’s growth continuum relying on government stimulus, consumption vouchers, lower central bank rates, and growing middle-income demographics. Over the last two years, consensus earnings estimates for EM ex-China digital economy firms nearly doubled, while Asia ex-Japan governments’ 10-year bond yields fell on average by 42 basis points, along with China’s, dropping 116 bps.

Asian e-commerce firms’ integration of AI agents — applications that can make decisions autonomously — into their platforms seems promising. China’s digital health and media are projected to have 44% and 36% earnings growth, India’s digital commerce at 46% and digital health up 48% over the next year.

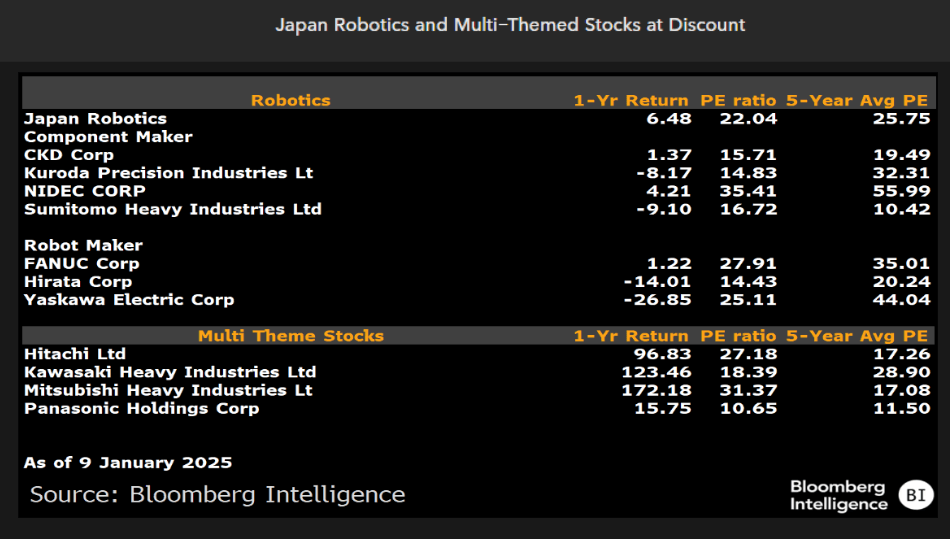

Japan robotics, industrials overshadowed

Japanese companies have broadly been beneficiaries of a weaker yen, a major driver of returns in the past year. In the long term, we find four of our 31 BI multi-theme stocks (those exposed to four or more themes) are Japanese multinationals, interconnected with industrials, frontier technologies and AI segments. Notably, Japanese companies make up over 36% of robotics, a theme that has gained traction as an enabler of AI applications.

On average, Japanese robotics names are trading at a 14.5% discount to its five-year average price-earnings ratio. Component maker Kuroda Precision at 54% below its five-year historical average PE and robot maker Yaskawa Electric at 43% have the widest discount within the theme. Multi-themed stock Kawasaki Heavy is also trading at 36% below its historical average PE.

To boldly go: Dark horse space and quantum themes shine in 2024

A late breakout from frontier tech — with exposure to nascent themes like space and quantum computing — shook up the BI leaderboard and officially made 2024 the year of the dark horse. It had been largely defined by the dominance of modern defense and a flight to AI. This may indicate investors have a renewed proclivity to take on risk, which could bode well for themes in 2025, though shareholders should brace for volatility.

Investors double down on quantum; Korean equities top returns

Defiance Quantum ETF (QTUM US) took top spot for inflows in week ended Jan. 9, with $181 million of new capital. There’s been a surge of enthusiasm related to quantum computing, though that sentiment, and quantum stocks accordingly, did show retreat after Nvidia CEO Jensen Huang’s comments related to the nascency of the innovation. QTUM’s top holdings are D-Wave Quantum (QBTS US), Rigetti Computing (RGTI US) and Onto Innovation (ONTO US) with weekly returns of minus 33%, negative 47% and positive 7%. Their three-month returns are 654%, 1,316% and minus 9%.

Top returns were dominated by Korean equity ETFs, with the Shinhan SOL Secondary Battery Materials & Equipment ETF (455860 KS) taking top spot with an 11% return. Three of the top five were EV and battery ETFs; the KOSPI index advanced 3% in the week.

China emerging as primary contender to US global supremacy in AI

China’s strategic ambitions in AI should continue to pay off over the next 24 months, with the country set to further narrow the development gap with the US despite the semiconductor supply bottleneck. China’s emerging strength in AI is a testament to its inherent strength in software development, positioning the nation as the leading challenger to the US.

Japanese stocks’ 6% upside aided by weak yen, positive checklist

Our health checklist for the MSCI Japan index is in positive territory going into 1Q and our fair value model indicates a 6% upside thanks to a weaker yen and a resilient US economy. Rising earnings drove the index return last year thanks to financials, industrials and technology while buybacks helped offset foreign investors’ large outflows in 2H24.

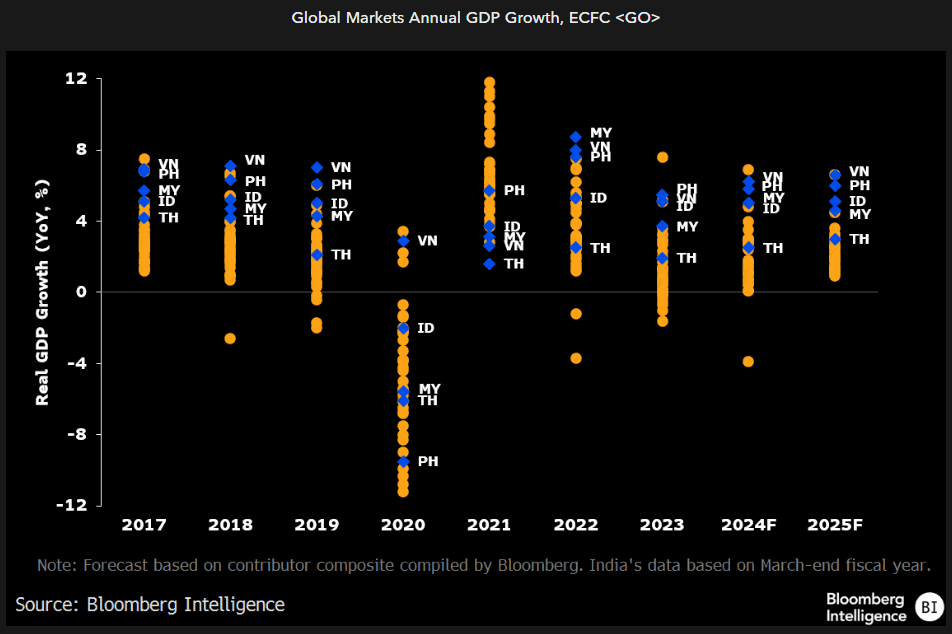

SE Asia among world’s fastest-growing economies

Southeast Asian markets have remained steadfastly resilient, with a credible economic performance track record. Barring the Covid-19 outbreak and its 2020-21 recovery period, GDP growth has consistently exceeded 5% for three of the region’s five markets since 2017. Consensus expects the economies of the Philippines and Vietnam to grow about 6% this year, among the fastest globally, just behind the forecast for India at 7%. Malaysia and Indonesia are expected to achieve 5% growth while the projection for Thailand is the lowest, at 2.5%.

The region’s quarterly economic performance has shown resilience this year. Growth rates for 2Q in almost all markets — excluding Indonesia — were the fastest over the past four quarters. Indonesia’s quarterly GDP growth remains stable at about 5%.

Bloomberg Terminal subscribers can access more Bloomberg Thematic Strategy Research via BI THEME <GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.