ARTICLE

Tariffs & trade policy remain a key source of uncertainty for corporations

Bloomberg Professional Services

Potential changes to US trade policy have dominated the landscape in recent months, with proposed tariff increases on goods imported into the United States from China, Mexico and Canada. While the ultimate direction and implementation of government policy remain in flux, companies, financial institutions, and investors alike have been preparing for an increasingly dynamic landscape in 2025 and beyond, with implications across trade, currencies, consumer spending and supply chains. At this point, many market participants agree on the certainty of incremental tariffs, but there is much debate around the magnitude, timing and ultimate impact. With the US law giving the President significant scope and legal justifications, Bloomberg Intelligence expects an 80% chance that tariffs will be imposed, with a likelihood for increasing tariff rates in the coming years.

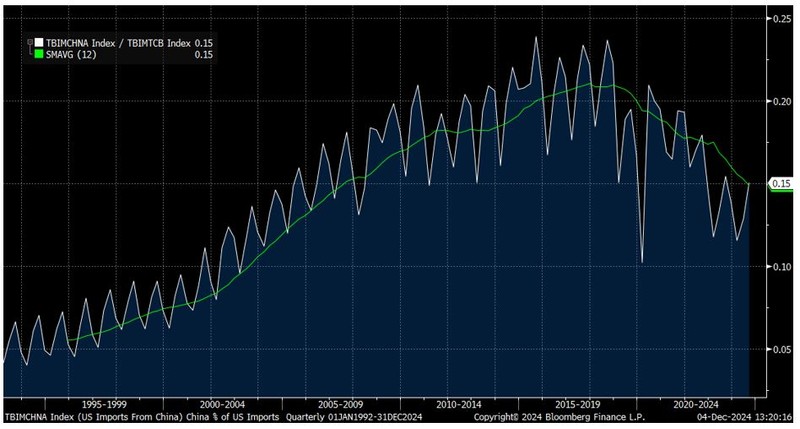

China is expected to be one of the largest losers in an era of escalating protectionist trade policies. In the past few decades, the US had become increasingly dependent on China-sourced goods – the percentage of US imports from China has increased from ~7% in 2000 to a peak of ~21% in 2018. Since then, the percentage of share of imports has fallen to ~15%. Unrelated to tariffs, the supply chain delays in the immediate years after the pandemic also forced companies to focus on supply chain resiliency, including diversifying their sourcing base, ports of entry and methods of transportation.

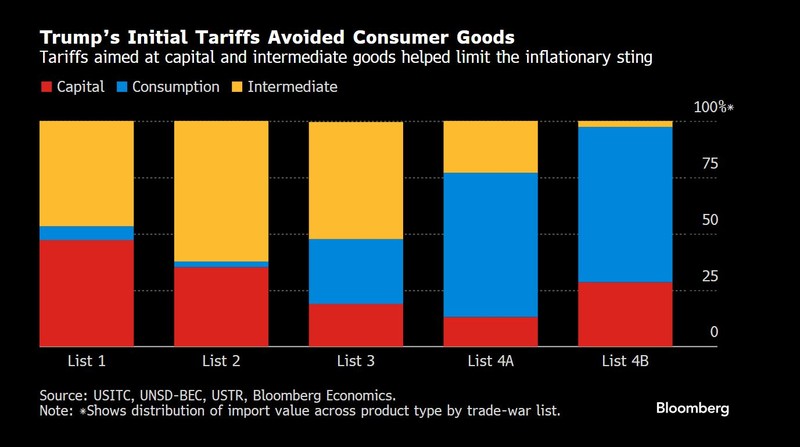

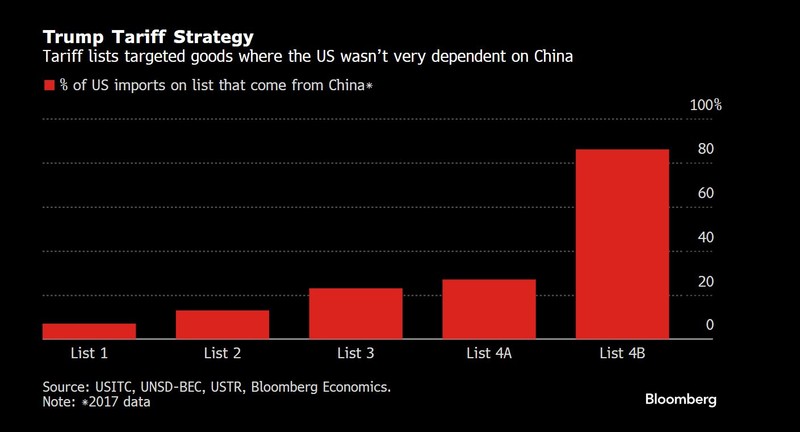

The 2017/2018 tariff headlines were a shock to trading partners and supply chain stakeholders, creating significant uncertainty with limited time to respond and mitigate negative impacts. Despite what appeared to be a fairly disordered situation at the time, one less-discussed aspect of the 2017/2018 experience relates to the strategic and thoughtful implementation of tariffs. Trade policy was carefully implemented to reduce disruption and pricing impacts to the end-consumer. Bloomberg Economics analysis shows that the initial phasing of tariffs was targeted on capital and intermediate goods, and on those categories that were less dependent on China. Only the List 4 tariffs included a larger portion of consumption goods.

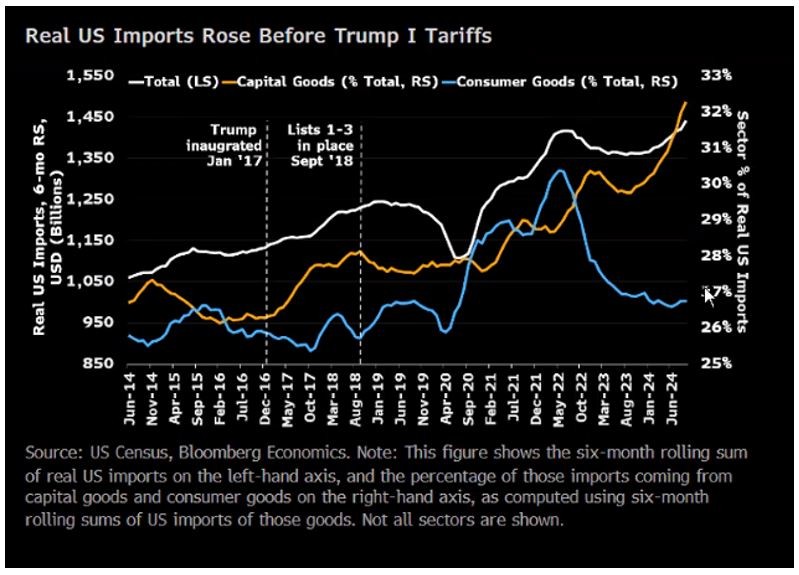

With the potential for escalating tariff rates, US companies will now likely be forced to consider the benefits of front-loading import volumes with the associated risk of carrying excess inventories should demand trends change materially. Given the dynamic situation around both policy & consumer spending, this will always be a decision that has to be carefully managed to minimize future financial risks. In 2017/2018, real imports of capital goods showed a marked increase in capital goods imports, with a smaller increase in consumer goods imports.

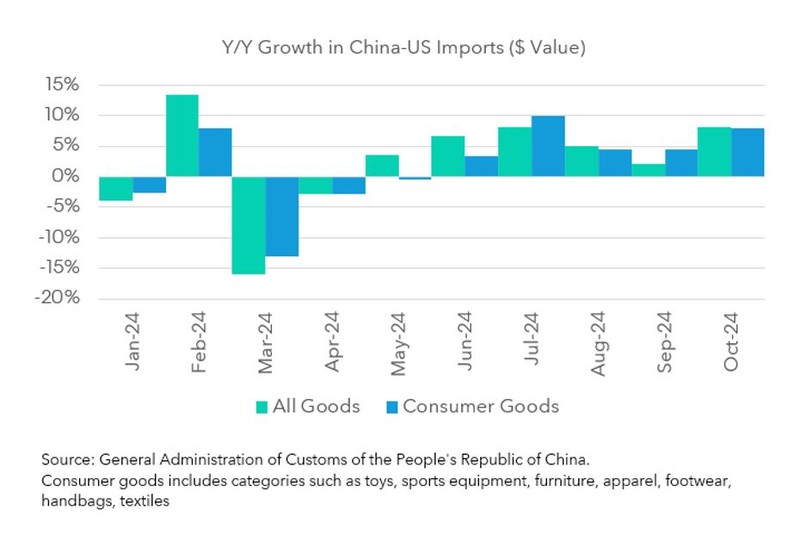

Turning to the present situation, data from China’s General Administration of Customs shows a modest uptick in China-US imports, with September and October import values increasing 5% YTD, compared to an average increase of 1% in 2024YTD. Perhaps more telling is the conclusions drawn when examining traditional consumer goods only (such as toys, sports equipment, furniture, apparel, footwear, handbags, textiles). Import values in these categories for September and October are up 3% Y/Y compared to a decrease of 4% in 2024 YTD.

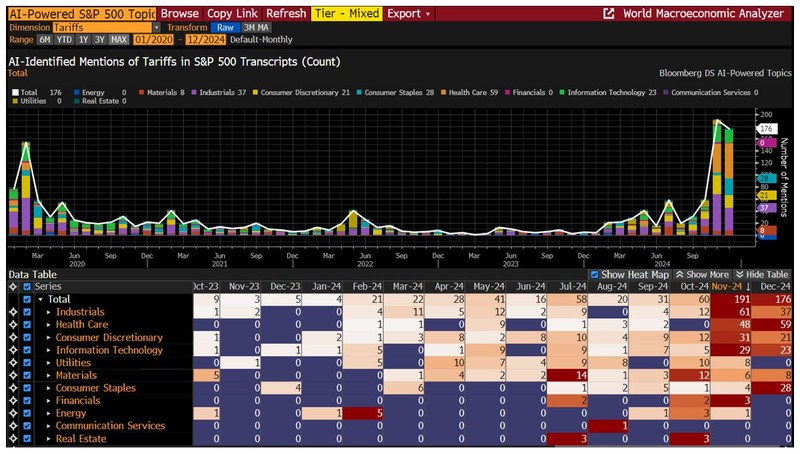

Unsurprisingly, tariffs are an increasing topic of interest during earnings calls and conference presentations. According to an analysis from DS <GO> of S&P 500 transcripts, tariffs have been mentioned more times in November & December alone than they were from the 10 months of January to October. Predictably, the industrials, consumer and healthcare sectors have seen the largest number of mentions.

Commentary suggests that companies are actively using the 2017/2018 experience as a reference point to adjust supply chains and alter sourcing patterns. Companies must consider many variables, such as pricing power, sentiment, tax policy, supply chain constraints and currency volatility, as they continue to navigate the uncertainty on the horizon.