ARTICLE

Unlocking concealed value in company financials with earnings capture

Bloomberg Professional Services

This article was written by Mike Pruzinsky, Equity Indices Product Manager at Bloomberg.

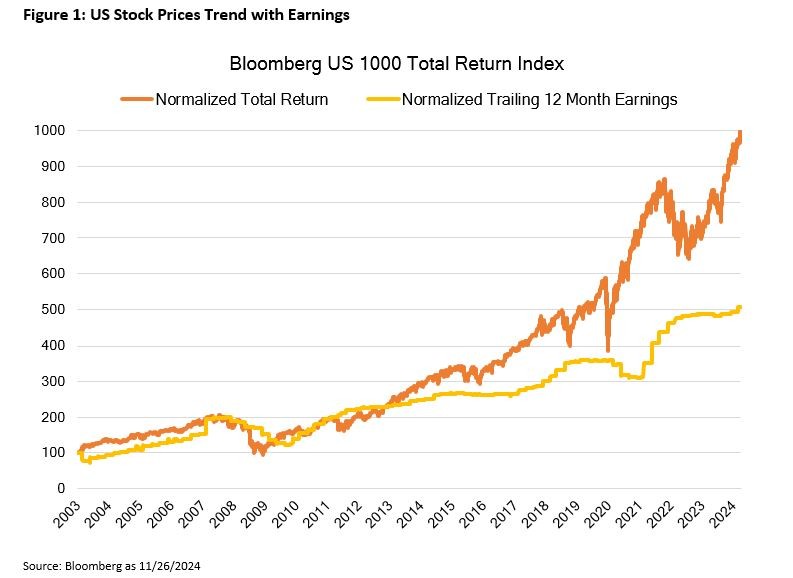

With stock markets at all-time highs, investors may seek to become more selective and consider allocations to alternative strategies from traditional market cap weighted indices. While AUM in passive investing vehicles continues its ascent over active products, gearing one’s portfolio to companies that over-earn may also present benefits. In particular, a strategy that tilts core equity exposure to unrecognized sources of earnings quality by incorporating data hidden in the footnotes has historically shown to outperform broader markets. As legendary portfolio manager Peter Lynch once stated “If you can follow only one bit of data, follow the earnings.”

The challenges nowadays are that “earnings” may not be as reliable as they once were during Peter Lynch’s markets. While the purpose of financial accounting is to provide information about the results of operations, financial position, and earnings of a company, recent history has shown examples of company management engaging in deceptive behavior. Detecting misleading earnings requires best in class data and a robust process to decipher and compare company financials. Current factor-based indices that rely on metrics like profitability, valuation or cash flow to determine security selection may miss these considerations. Until now no comparable index offering targets a company’s “true earnings” by measuring accounting transparency and going beneath the headline numbers and into the footnotes to determine the quality of company as-reported data.

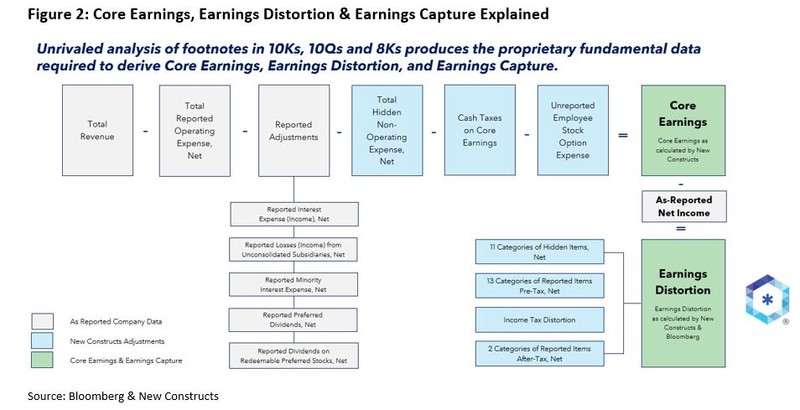

With corporate earnings in focus, Bloomberg Indices is proud to introduce in partnership with independent research technology firm New Constructs the co-branded Bloomberg New Constructs Core Earnings Leaders Index (BCORE Index). While the Bloomberg Index team has access to vast sets of differentiated data and unique insights, the partnership with New Constructs leverages a pioneering AI-based parsing process and machine learning technology to target a company’s Core Earnings by going beyond as-reported fundamentals and into the footnotes, which research shows the market is missing. New Constructs leverages its decades of experience in technology-driven data collection and analysis to provide investors with empirically proven superior, unbiased research to generate novel alpha. For example, Figure 2 below depicts how Core Earnings of a company is calculated by including New Constructs adjustments for hidden items buried in footnotes such as non-operating expenses, cash taxes on core earnings, unreported employee stock option expense, and more.

The Bloomberg New Constructs Core Earnings Index Methodology is designed to be well-diversified and sector neutral by selecting stocks based on companies that have high earnings quality. Specifically, the top companies within each sector that have the highest earnings capture (earnings distortion normalized by total assets) measure are eligible for inclusion for a total of 100 companies in the Index. The earnings capture metric aims to assess the difference between as-reported earnings and Core Earnings, which assesses the normalized operating profitability of a business by removing unusual gains and losses, including those found only in footnotes and the management discussion and analysis section of a company filing. By avoiding hidden risks not explicitly stated in a company’s financials, companies with only the highest quality earnings qualify for index inclusion. This results in a vigorous measure of a company’s profitability and allows for the selection of stocks that may be considered undervalued compared to its intrinsic value.

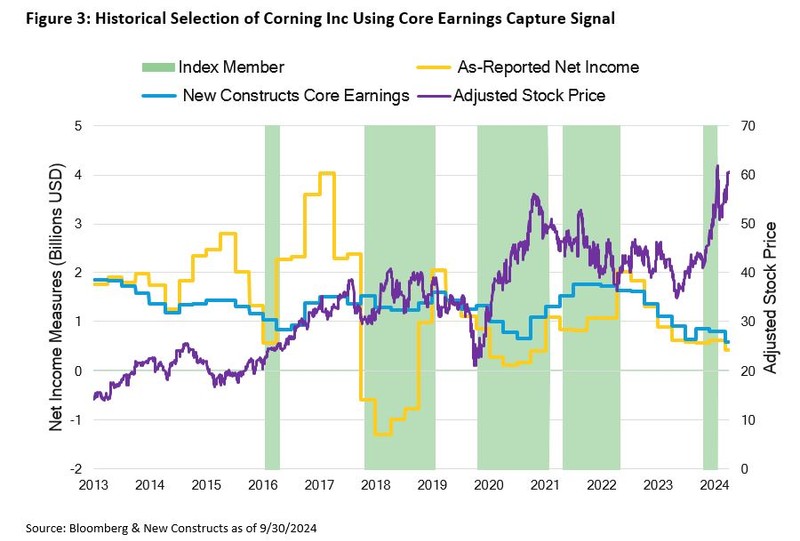

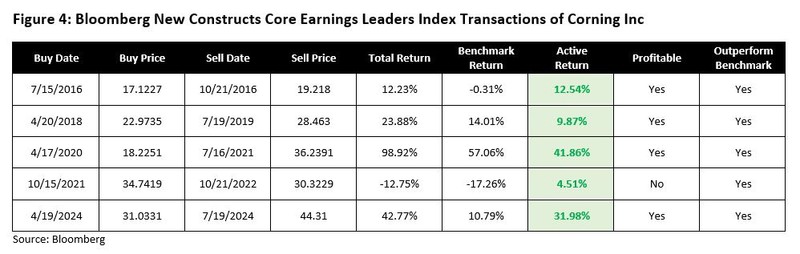

Take Figure 3, which plots Corning Inc’s stock price (purple line), as-reported net income (yellow line) and New Constructs Core Earnings (blue line) with an overlay of when the stock was an index member (green shaded area). When New Constructs Core Earnings exceeds as-reported net income the company’s normalized profitability is understated by its publicly-reported earnings. This difference can be thought of as a leading indicator of company performance as management is reporting more conservative fiscal management with the “over-earning” acting as a source of resilience.

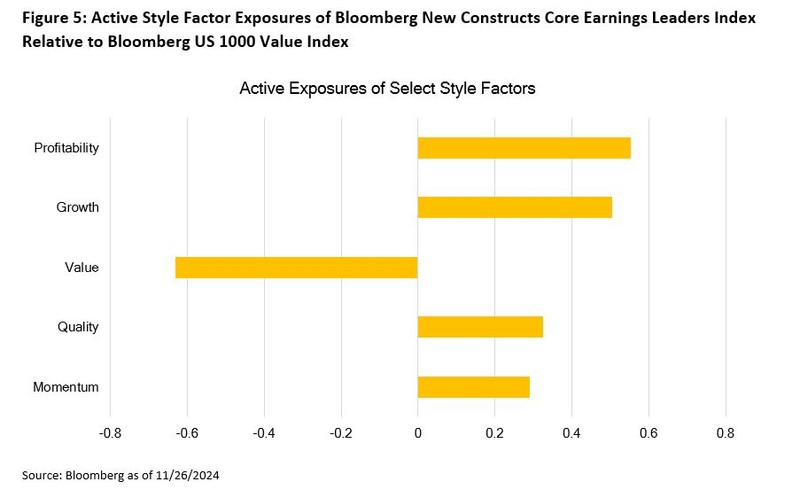

While one may perceive the index methodology outlined as offering an innovative approach to selecting cheap companies in the traditional sense, a look under the hood discloses a different conclusion. This is actually where the hidden magic of the earnings capture signal reveals itself as investing is not just about buying what is perceived to be inexpensive or shunning growth stocks, but rather systematically identifying companies that are undervalued. Figure 5 compares the style factor exposures of the Bloomberg New Constructs Core Earnings Leaders Index relative to the Bloomberg US 1000 Value Index and illustrates active exposure to desirable qualities like growth, profitability, and quality.

The adoption of an index strategy leveraging New Constructs Core Earnings represents a forward-thinking approach to identifying value. By going past the surface-level financial metrics and delving into the nuanced details of accounting adjustments and footnote disclosures, investors can unlock the concealed value not readily apparent to market participants. The Bloomberg New Constructs Core Earnings Leaders Index not only mitigates risk, but can also position investors for potential sustainable returns by offering exposure to the market’s leading corporate earners as determined by index methodology.

- First Trust has launched the First Trust New Constructs Core Earnings ETF based on the Bloomberg New Constructs Core Earnings Leaders Total Return Index (BCORET Index) under the ticker FTCE.

- Bloomberg New Constructs Core Earnings Leaders Index Methodology

- New Constructs – About US Video