ARTICLE

Indexing the AI theme: From “pure play” to the “show me” narrative

Bloomberg Professional Services

This article was written by Qiao Yu and Frederick Zhang both Index Product Managers at Bloomberg.

The rise of Artificial Intelligence (AI) has reshaped numerous industries, and the investment landscape is no exception. The initial enthusiasm drove significant inflows into tech-centric ETFs like the Nasdaq QQQ. However, as investors delve into the underlying assets, they are encouraged to go beyond traditional tech benchmarks in search of “pure-play” products that are more directly tied to the AI theme, particularly given rising concerns about the dominance and concentration risk of the “Magnificent 7.”

What is a pure AI thematic play?

For investors who want a focused strategy around AI, particularly for those who believe in AI’s long-term growth trajectory, the Bloomberg Artificial Intelligence thematic indices come into play.

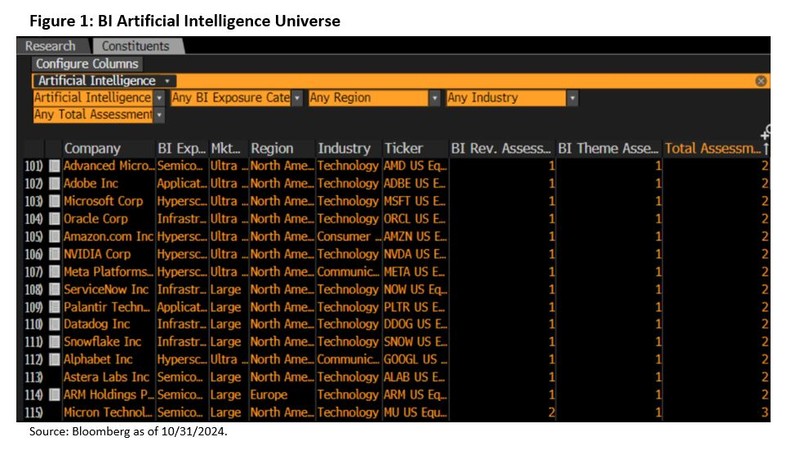

The Bloomberg Artificial Intelligence Index leverages proprietary research from Bloomberg Intelligence (BI). With over 500 BI analysts globally, the team applies company assessments across the revenue and theme exposure to create the final AI theme universe that best articulates the nuances of the AI theme, and conducts a quarterly review of this universe to ensure alignment with market trends. This results in an AI universe consisting of over 120 pure-play companies engaged in various AI activities across six segments including: hardware, hyperscalers, semiconductors, infrastructure software, application software and application accelerators, capturing the upstream and downstream.

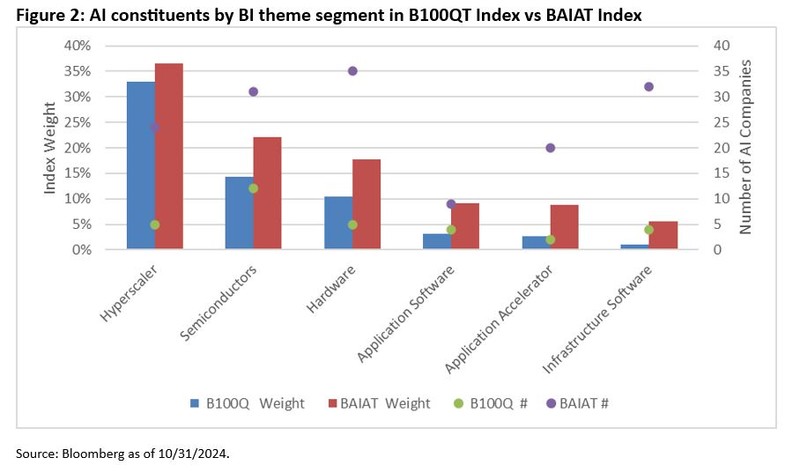

With this theme universe as the basis for index selection, the Bloomberg Artificial Intelligence Index (BAIAT) is both representative and diversified across key segments of the entire AI ecosystem. In contrast, the tech-heavy top 100 US companies (represented by the Bloomberg US 100 Index, B100QT) comprises only 33 AI-related stocks (less than 65% index weight) among its 100 index constituents, resulting in a less thorough and less pure exposure to the AI theme.

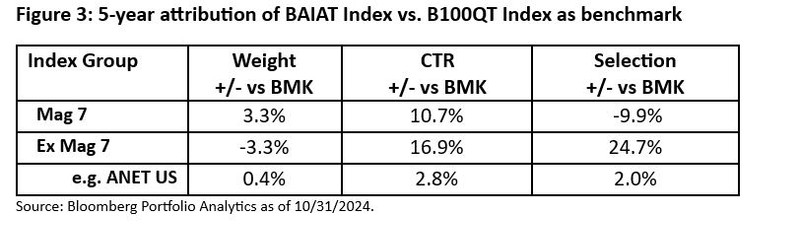

A more focused AI thematic benchmark allows investors to capture the return potential of promising smaller and emerging companies before they gain sufficient scale to significantly impact broader tech benchmarks. Using the Bloomberg PORT attribution analysis, the BAIAT Index has outperformed the B100QT Index by 27.6% over the past five years. To separate the effect of Magnificent 7, which has seen significant investment from both passive and active managers, we also examined the return attribution from the non-Mag 7 group. The analysis reveals that the outperformance is driven by both the overweight of the Mag 7 (with a contribution to return of 10.7%), and more significantly, from the selection effect of non-Mag 7 AI stocks (contributing 24.7% to the return). For instance, Arista Networks, which has thrived amidst the cloud infrastructure surge, delivered a contribution to return of 2.8% with an index weight of just 0.4% during this period.

Entering the “show me” phase

Capital investment among cloud giants has surged, with these tech leaders channeling resources into data center infrastructure, AI chips, servers, and R&D. As AI enters a “show me” phase, indices targeting high-growth companies have become crucial. The year has seen a rotation from early “picks-and-shovels” investments – such as infrastructure and foundational hardware – toward software and applications in the latter half. With concerns about “missing the train” on specific AI segments, investors are now focusing on companies that demonstrate clear growth potential.

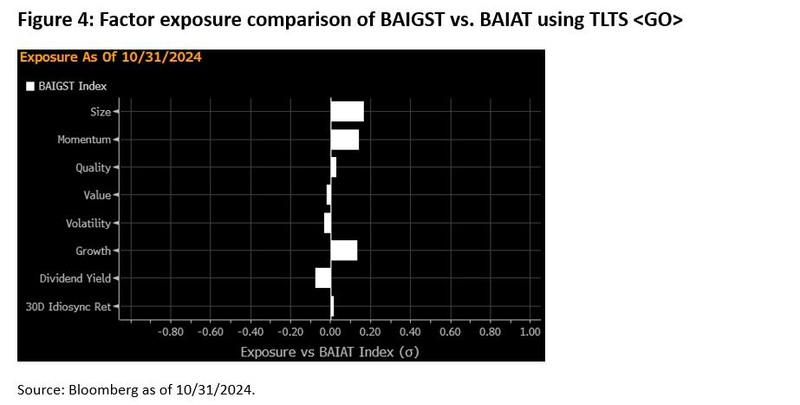

Addressing this demand, Bloomberg has introduced the Bloomberg Artificial Intelligence Growth Select Index (BAIGST). The Index selects the top 50 companies based on size, historical revenue and EBITDA growth metrics from the BAIAT index constituents. It also incorporates a growth factor, factoring in projected revenue growth rates within its weighting methodology. By blending past performance with future revenue projections, this index identifies AI companies with a track record of robust growth and strong future potential.

Compared to the parent BAIAT, higher exposure to factors such as Size, Momentum and Growth allows BAIGST to better capture the AI theme by balancing the exposures to early beneficiaries such as Mag 7, and rapidly growing companies that are often at the forefront of AI innovation. Together, these factors position BAIGST to capitalize on dynamic, fast-growing AI players that drive the theme forward.

With generative AI projected to reach a $1.3 trillion market by 2032, the AI revolution is set to persist and evolve, continually reshaping the economy. Thematic indices focused specifically on AI may offer a more appealing option for investors looking to gain exposure to the long-term growth potential associated with this megatrend. Leveraging BI’s in-depth research and flexible index design, Bloomberg’s Artificial Intelligence thematic indices offer a diversified approach that resonates with various investment strategies—ranging from broad AI exposure to more concentrated investments in high-growth-potential companies.