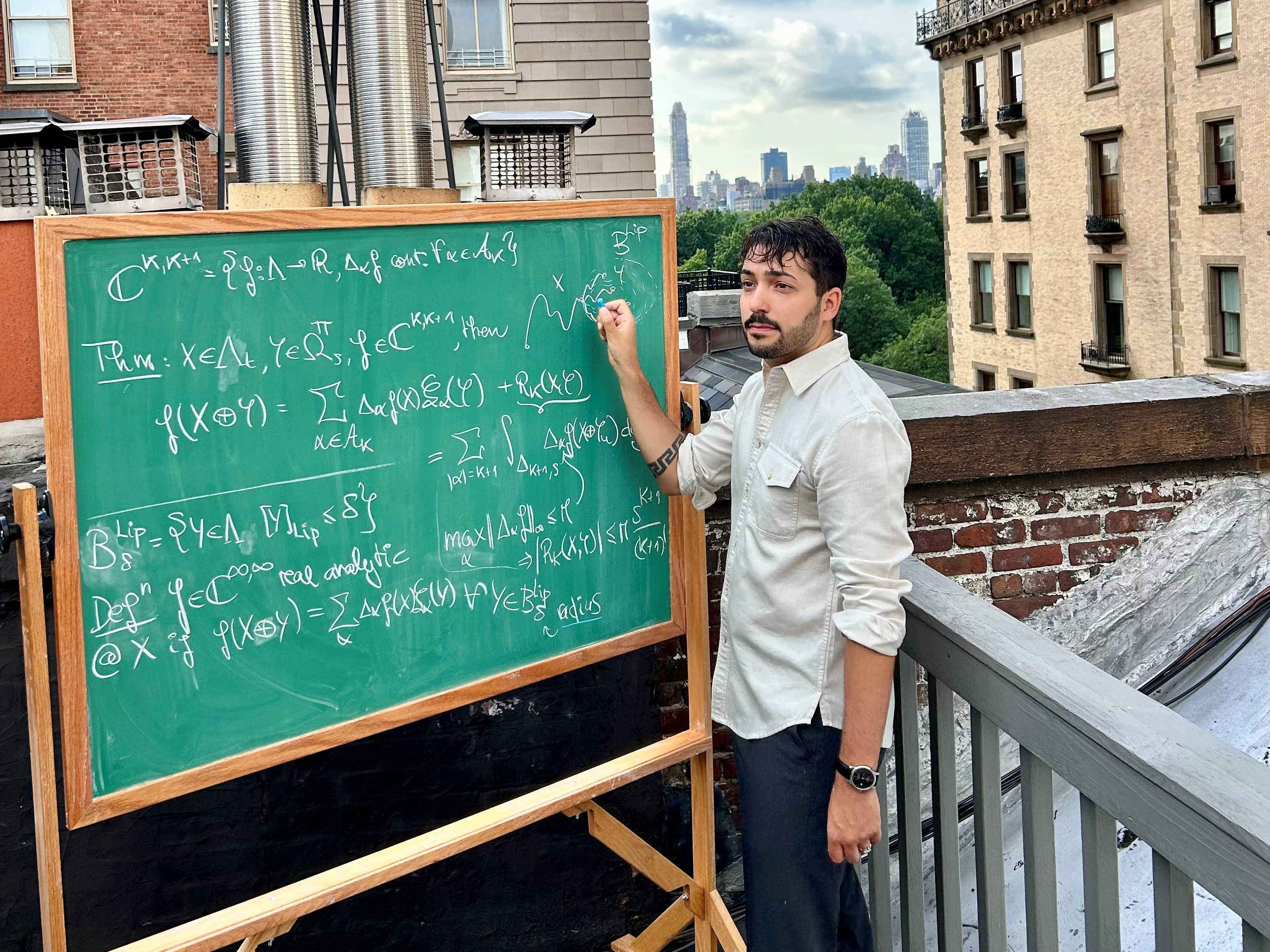

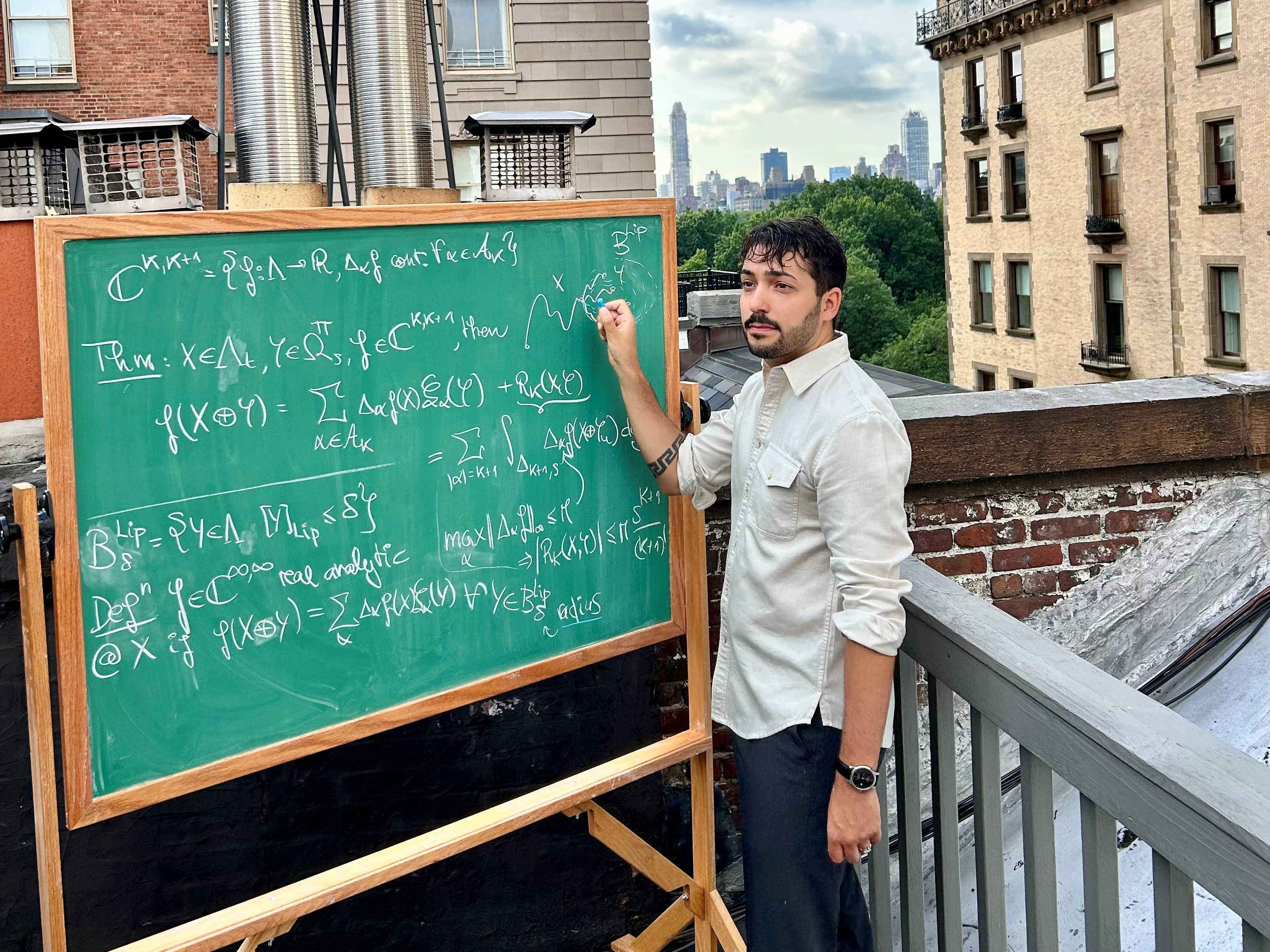

Bridging Academia and Industry: Lessons from Bloomberg’s Award-Winning Quant Finance Researcher Valentin Tissot-Daguette

August 27, 2025

Valentin Tissot-Daguette, a quantitative researcher on the Quant Research team in Bloomberg’s Office of the CTO, was recently awarded the 2024 Nicola Bruti Liberati Prize for the “Best Ph.D. Thesis in Quantitative Finance.” Presented by the Bachelier Finance Society and the QFinLab in the Department of Mathematics of the Politecnico di Milano, this prestigious award highlights the intersection between academia and practice, a theme that is central to the research conducted at Bloomberg.

We recently spoke with Valentin, who joined Bloomberg full-time in June 2024 after earning his Ph.D. in the Operations Research and Financial Engineering (ORFE) department at Princeton University, about his work in Bruno Dupire’s group, his career journey, and the topic of his award-winning thesis: Free Boundaries, Functional Expansions, and Occupied Processes.

This discussion has been edited for length and clarity.

Tell us about your background and career journey.

I’ve been fond of mathematics all my life. My first official step into this field was in 2008, when I started a five-year program in advanced mathematics at EPFL, the Swiss Federal Technology Institute of Lausanne. I also attended math summer camps, where we would hike in the Swiss Alps and dive deep into equations the rest of the time. During my undergraduate years, I studied pure mathematics, and then I got interested in finance, so I decided to pursue master’s and Ph.D. programs in financial mathematics.

You were recently awarded a prestigious award, the Nicola Bruti Liberati Prize. Why is this coveted recognition in the field of quant finance?

The Nicola Bruti Liberati Prize is awarded by the Bachelier Finance Society, which is a leading global organization in mathematical finance, and the Quant Finance Lab in the Math Department at Politecnico di Milano, which is focused on the intersection of the financial industry and academia. The selection is made by top experts in the field and is extremely competitive. In addition, the completion of my Ph.D. thesis was a major transition from being a graduate student to becoming a peer in the research community. Any recognition at this stage is crucial, as it affirms a scholar’s potential in the field going forward.

Could you summarize what your Ph.D. thesis is about?

The first part of my thesis explores the representation of free boundaries, such as the exercise frontier of American-style options. Unlike European options that only can be exercised at the expiration date, with American options, we can assign the contract exercise at any time before maturity, which leads to a dynamic decision problem under uncertainty because you discover the price as you go.

This problem is fairly well-understood when the option is contingent on a single underlying asset. However, in the multi-asset case, it leads to theoretical and numerical challenges. The goal of my research was to develop an efficient method to accurately compute and visualize the exercise boundary, together with a convergence analysis of the algorithm.

The second part of my thesis concerned path dependence, a core concept in finance. One chapter was dedicated to combining the functional Itô calculus – which was invented by my mentor and manager, Bruno Dupire – with the popular path signature. This work culminated in the functional Taylor expansion, which we applied to the pricing and risk management of exotic options. The last chapter introduced a Markovian framework around occupation flows, meaning that the state process, termed “occupied process,” depends only on the present. This Markov, or “memoryless,” property is critical in finance—especially for option pricing —as it opens the door to many tractable numerical methods.

You’ve interned with Bloomberg three times, were one of the first Ph.D. Fellows for the Quant Research team, and then joined the CTO Office full time. What kept drawing you back and what advice would you give to interns about landing a job at Bloomberg?

Throughout my Ph.D. studies at Princeton, I collaborated with Bloomberg’s Quant Research team through a series of internships, and I was also part of the first cohort of its Quant Finance Ph.D. Fellows. This engagement led me to join the team full time just over a year ago.

My first summer internship at Bloomberg took place in 2021, and I felt inspired from day one. In part, I have been attracted to the strong emphasis on the visualization of mathematical objects, complex identities, and structured products. I also like the culture very much and enjoy working in this fast-paced, yet relaxed, environment.

My advice to students in any quantitative discipline would be to continuously visualize what they do to make their work accessible to a wider audience, keeping their management and customers happy. It will also improve their own understanding of these concepts.

What does the Quant Research team do at Bloomberg and what kind of problems does the team try to solve?

There are several missions for this team. One is to assist other groups in their quantitative projects by providing advanced modeling or numerical solutions. We also promote our thought leadership through the publication of research papers and we give talks at various international conferences. The team has strong ties with Columbia University and NYU, among other universities. Some of my colleagues teach classes and we offer mentorship through capstone projects for master’s students. The team also hosts the largest monthly quant event worldwide, the Bloomberg Quant (BBQ) Seminar. All of this helps us to stay connected with the academic research community and to interact with young talent that we may hire eventually. It also enables us to promote Bloomberg’s products, such as BQuant, which is integrated into the teaching (and was originally conceived by our team).

Finally, we endeavor to push the boundaries of quantitative finance, ranging from volatility modeling and machine learning; we keep track of recent advances from academia and the ever-changing business needs of the industry.

Financial derivatives are also a central focus for our team. We continuously monitor the market for new instruments, including recent innovations like zero days to expiration (0DTE) options and “mid-curve” options on VIX futures. These complex products are the perfect challenge, as they require us to create cutting-edge quantitative tools and methods. For quants, every new launch is like a new playground!

What are your current priorities and focus areas for your own research?

My focus has been to deepen my understanding of path dependence in finance and develop numerically tractable frameworks that can model a wide range of financial instruments. I’ve also been working with Bloomberg’s derivatives team and market specialists on zero-day options, where we strive to provide much-needed quantitative and visualization tools to customers, for example.

How does your academic research connect to the work we do at Bloomberg and what were the biggest lessons in your transition from academia to industry?

Due to the numerous internships and interactions with the Quant Research team early on, the transition from academia to industry has been fairly smooth. My current research, while closer to financial markets, is just as challenging and exciting as my academic studies. A key lesson I’ve learned is to always keep practical aspects in mind; there are so many fascinating real-world problems to solve, so there’s no need to get lost in abstract theories.

Are newer AI approaches blending with traditional quant techniques in your work? And if so, how?

My research covers advanced concepts and complex numerical methods, so AI does not blend so well, at least not yet. However, I’ve been using AI to improve my workflow, particularly to code faster and to generate complex visualizations.

What recent trends or challenges in quantitative finance excite you the most these days?

There is quite a bit of discussion on path-dependent volatility, which closely relates to the mathematical objects I’m familiar with and ties into the functional Itô calculus. In addition, I found the rise of zero-day options particularly exciting, as their short-term nature has pushed the development of new quantitative tools to price and hedge these contracts.

What do you like to do outside of work?

I enjoy music composition and have been working on percussion and keyboards. I’ve recently extended my musical horizons by studying jazz and bossa nova harmony. I also love cooking pescatarian cuisine and exploring New York City’s food scene.