Private Credit Could Replace 15% of Traditional Fixed Income as Asset Class Rides Tailwinds, According to Bloomberg Intelligence Survey

October 15, 2025

Survey shows growing optimism for private credit expansion, with potential 2-5% penetration of $12 trillion US defined-contribution plan assets

NEW YORK, OCTOBER 15, 2025 — A new survey from Bloomberg Intelligence (BI) finds that private credit could replace 15% of traditional fixed-income investment of BI’s current addressable fixed income market, up five percentage points from BI’s April 2025 survey conducted amid post-tariff volatility. The growth could be focused on replacement moving from public markets.

As part of BI’s semi-annual survey, the Fall 2025 Private Credit Survey — which polled 140 financial professionals across North America, Europe and Asia from September 8-22 — demonstrates the market’s cautious optimism as participants expect modest annual core asset growth of 5-10%. This trajectory, while below the sector’s five-year average of 10%, signals demand for private credit remains robust, yet deployment still needs to accelerate and a number of recently troubled investments could seed caution.

Following the US presidential executive order on retirement plans, private credit could capture 2-5% of the $12 trillion defined-contribution plan market over time, as most survey participants see net positive regulation impact. Despite the excitement around the emerging retail channel, the survey respondents still view asset managers (29%) and insurers (19%) as the biggest contributors to private credit.

Paul Gulberg, Americas Director of Equity Research and Senior Financials Analyst at Bloomberg Intelligence and lead author of the survey, said: “We’re seeing a fundamental shift in how institutional investors view private credit. The 15% replacement rate for traditional fixed income represents real momentum, but the consensus on 5-10% annual growth suggests the core asset class has entered a new phase.”

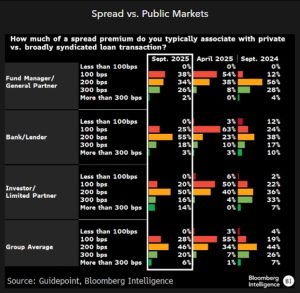

The overwhelming majority of industry participants — 75% of lenders and 64% of fund managers — expect more deployment of private credit in the next 12 months. As credit spreads recently compressed across the public markets, it’s notable that respondents think privates can offer more spread premium than six months ago — 46% pointing to 200 bps and 28% to 100 bps.

These premiums support returns, despite potentially lower interest rates and credit risks, making the asset class attractive and maintaining or improving management fees. 59% of respondents expected private credit fee rates to rise modestly and 21% projected a significant increase.

Although the tailwinds for growth in private credit are strong, the survey identifies key risks. Economic and rate uncertainty top concerns at 34%, followed by stricter regulations at 29%. Credit quality deterioration ranks third at 24%. Notably, 42% of respondents report tighter underwriting standards, though this represents an easing from previous surveys conducted during periods of market volatility.

The full BI Private Credit Survey is available to Bloomberg Terminal subscribers who can access the report via {BI<GO>}.

Contact

Alaina Hay

Bloomberg Intelligence

ahay38@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of over 400 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and more than 600 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.