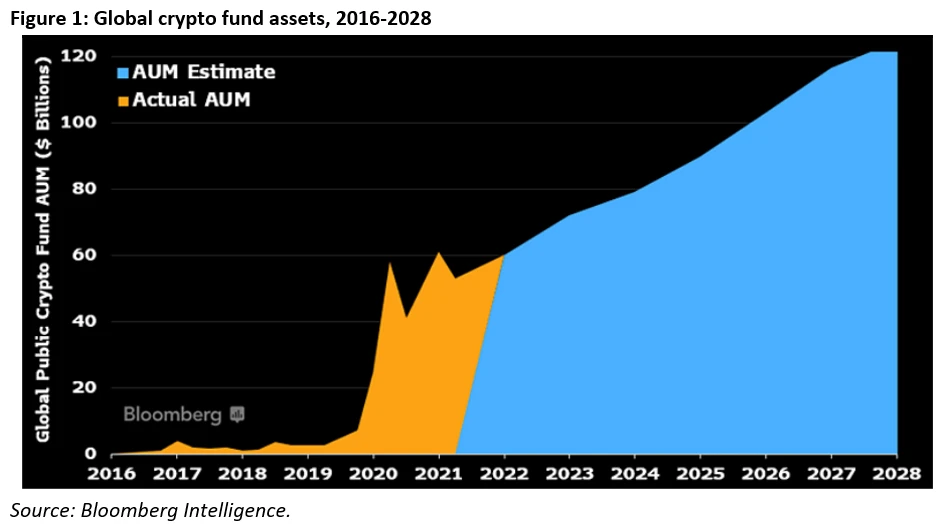

Crypto Exchange Traded Products Likely to Surpass $120 Billion in Assets Under Management by 2028, According to Bloomberg Intelligence

April 05, 2022

BI 2022 Crypto Outlook sees institutions with crypto positions rising to 52% last year, from 33% in 2019, bring more liquidity and, possibly, less volatility

New York, April 05, 2022 – Assets under management in crypto Exchange Traded Products (ETPs) are likely to grow beyond $120 billion by 2028, even absent large crypto price increases, fueled by increasing institutional demand and changes in U.S. policy, according to a new report by research provider Bloomberg Intelligence (BI).

Bloomberg Intelligence’s latest 2022 Crypto Outlook – a comprehensive analysis of the global crypto sector and the key trends driving its growth and evolution – finds that regulatory approval is a key catalyst for a spot Bitcoin ETF by the end of 2023. If this happens, there is likely to be tens of billions in assets added to crypto funds given such a move would signal regulatory clarity and approval of the digital assets space. Currently U.S. advisors control about $26 trillion, with only a small minority of those advisors having exposure to crypto and the majority who do, allocate only 1% or less of their clients’ portfolios.

With the industry moving from a niche offering to a more established investment product, BI forecasts that exchanges such as Coinbase and FTX will see strong volume and revenue grow, while the potential for the U.S. to launch a central bank digital currency in the coming years remains a distinct possibility.

According to BI’s report, institutions taking crypto positions rose to 52% last year, up from 33% in 2019, bringing further liquidity to the sector. Furthermore, growth in the number of broker-dealers in the U.S. offering crypto products continues to support retail investor involvement in the sector, with convenience and simplicity creating a compelling incentive for entry-level investors.

Julie Chariell, Senior Fintech Industry Analyst at Bloomberg Intelligence said: “Bitcoin turns 13 years old in 2022, barreling into its teenage years marked by greater independence in the form of decentralization, some rebelliousness, as seen in its volatility, and formation of identity as in its store of value or medium of exchange. With some discipline, through regulation, crypto has the potential to achieve acceptance by peers in the shape of mainstream adoption.”

BI estimates there are at least 107 cryptocurrency funds with 119 share classes listed on public exchanges globally, including ETFs, CEFs, mutual funds and trusts. These launches and this fund growth show that fund issuers see massive potential for asset growth in the crypto space, believes BI. However, with no spot option in the U.S., investors seeking crypto exposure are left with futures ETFs that incur roll costs and trusts that trade away from their underlying value.

There are 15 blockchain- or crypto-themed equity ETFs currently trading on U.S. exchanges, up from just four in March 2021, while sector assets have levelled off at $1.9 billion. BI expects the number of funds to increase slightly alongside assets in 2022 as the SEC withholds approval of spot Bitcoin ETFs.

James Seyffart, ETF Strategist at Bloomberg Intelligence said: “The number of publicly listed cryptocurrency funds – mostly tracking Bitcoin and Ethereum – should sustain the rapid growth of the past two years through 2022 and into 2023 as more countries allow the launch of spot products and regulators get more comfortable with digital assets.

“In the U.S., regulatory concern is the top reason advisors haven’t invested in crypto assets. We believe a Bitcoin ETF approval would alleviate these concerns. The SEC has regulated the crypto industry with enforcement rather than offering regulatory clarity thus far but the industry is likely to get significantly increased clarity over the coming years from Biden’s crypto executive order and from SEC rule proposal expansions. All of which will cause the growth of crypto fund assets.”

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence said: “There’s little doubt Bitcoin is the most fluid, 24/7 global trading vehicle in history and well on its way to becoming digital collateral in a world going that way.”

The full 2022 Crypto Outlook report is available to Bloomberg Terminal subscribers who can access the report via {BI<GO>}.

Contact

Veronika Henze

Bloomberg Intelligence

+1-646-324-1596

vhenze@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of 400 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and 500 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.

Disclaimer

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2022 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.